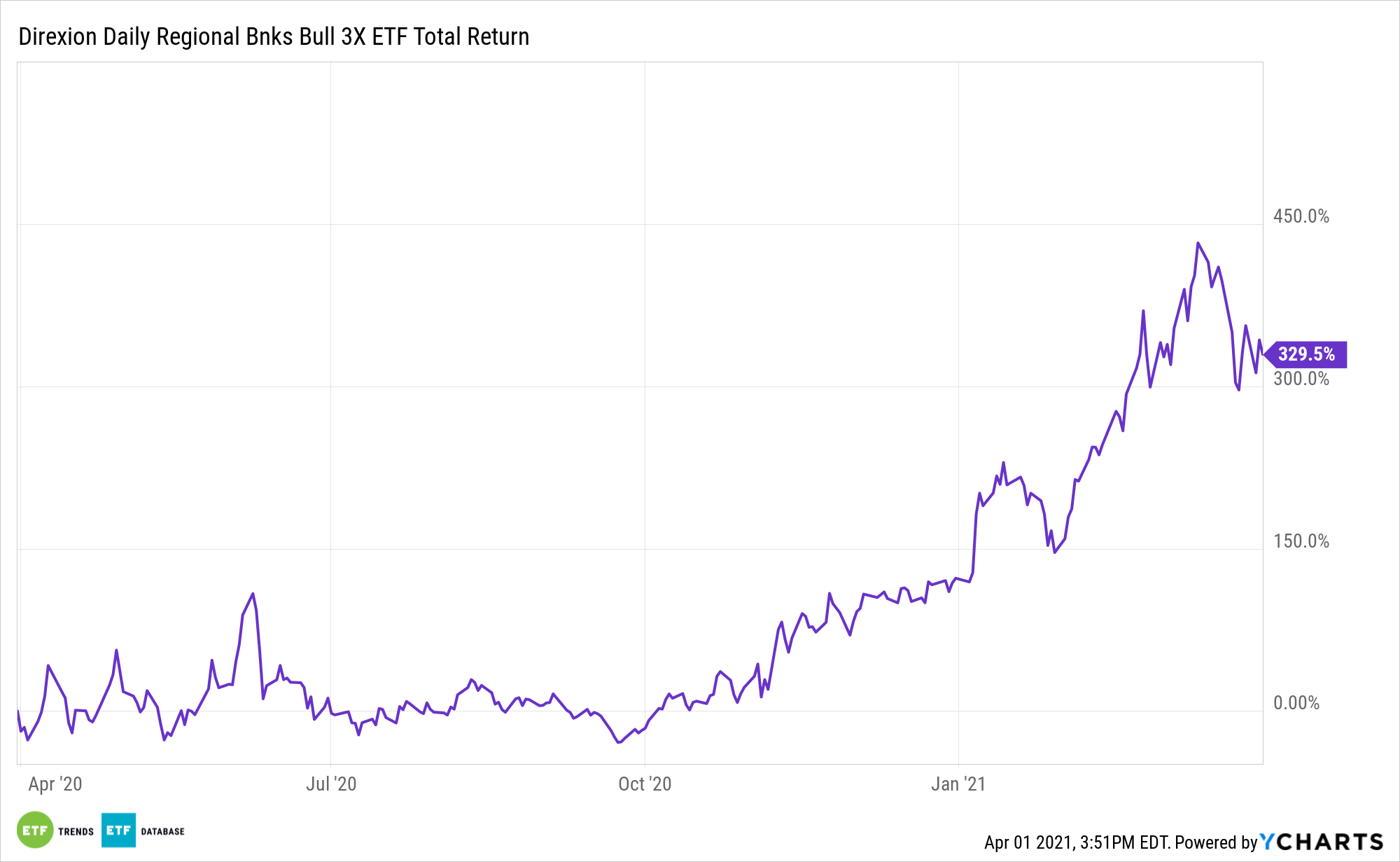

Up 325% the past year and over 90% in 2021, the Direxion Daily Regional Banks Bull 3X Shares (DPST) has been keeping bullish traders happy.

The Federal Reserve has been steadfast in keeping interest rates where they are, but as the economy continues to show signs of improvement, that could change. Benchmark Treasury yields are already ticking higher, which could be a boon to regional banks.

As for DPST, it seeks daily investment results equal to 300% of the daily performance of the S&P Regional Banks Select Industry Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index is a modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the GICS regional banks sub-industry. Signs of life are starting to show in the fund’s YTD chart, with the price moving above its 50-day moving average of late.

“Investors are living in a bond world,” a Wall Street Journal article noted. “But bank stocks are enjoying a renaissance, too.”

“U.S. bond yields have risen at a fast clip,” the WSJ article added. “The yield on the 10 year Treasury rose to 1.459% in February, the largest one-month gain since 2016. The bond yield started February at 1.007%. That rise has also been good for bank stocks, since higher rates typically mean higher profits.”

Higher Yields Translate to Higher Profits

While rising yields won’t do bond investors any favors, regional banks are happy to see them. The cost of money via loan products can help boost regional banking profits.

“The rising bond yields also help. When interest rates rise, banks are able to charge more on loans. That is especially important for regional banks,” the WSJ article explained. “Unlike larger banks, they don’t have big Wall Street operations, so higher rates and stronger economic growth are more important to them.”

“While what we’ve heard from [Jerome] Powell remains pretty dovish, the interest rates are expected to continue to move higher,” said Steven Chubak, managing director at Wolfe Research, referring to the Federal Reserve chairman.

For more news and information, visit the Leveraged & Inverse Channel.