Value plays like the financial sector are leading the markets to highs in the S&P 500 and Dow Jones Industrial Average. It could translate to more strength in the coming months, which can give traders the opportunity to play the long and short side of the financial sector with a pair of Direxion Investments ETFs.

“As 2019 seems to be coming to an end quickly, value is outperforming growth again, and this might be sustainable into 2020,” wrote registered investment advisor David Templeton on Seeking Alpha. “For value to have an edge over growth though, financials and consumer discretionary stocks will likely need to be strong performers.”

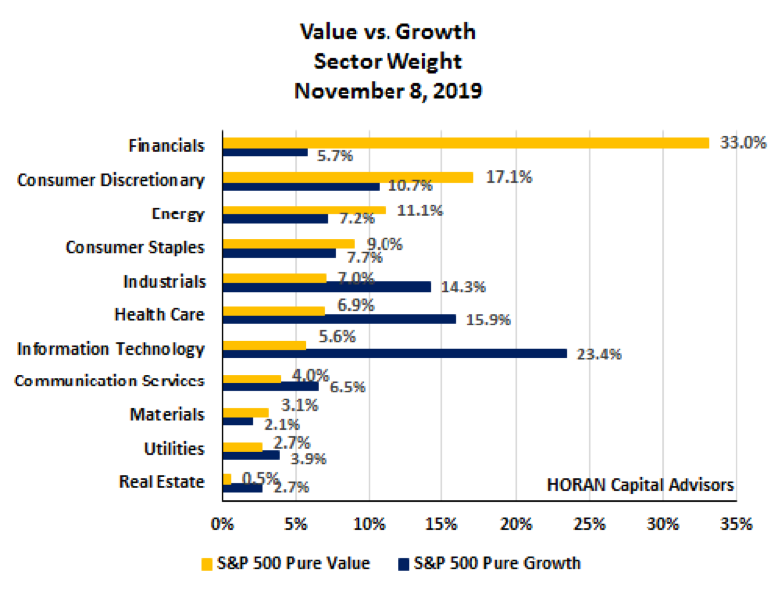

“As the below table shows, financials and consumer discretionary stocks, as a group, account for 50% of the Pure Value Index (RPV),” Templeton added. “In 2016 these two sectors accounted for more than half of value’s outperformance and at that time the two sectors were 40% of the Pure Value Index. Additionally, on a relative basis, if technology and healthcare stocks are laggards in 2020, this will benefit the Pure Value style as the two sectors are underweight in the pure value style relative to the pure growth style.”

Traders who want to leverage the strength in the financial sector can look to funds like the Direxion Daily Financial Bull 3X ETF (NYSEArca: FAS). As for FAS, the fund seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index.

Traders who want to leverage the strength in the financial sector can look to funds like the Direxion Daily Financial Bull 3X ETF (NYSEArca: FAS). As for FAS, the fund seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Russell 1000® Financial Services Index.

The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

On the opposite end of the spectrum, traders can opt for the Direxion Daily Financial Bear 3X ETF (NYSEArca: FAZ). FAZ seeks daily investment results that equate to 300% of the inverse (or opposite) of the daily performance of the Russell 1000® Financial Services Index.

The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets. The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

For more market trends, visit ETF Trends.