If gold had to give a “thank you” speech for its recent run, it better mentions the coronavirus pandemic. Gold has been benefitting from a sustained flight to safe haven assets like precious metals, but there might be too much exuberance for gold—is it time for the bears to shine now?

“The gold-timing community has become exceedingly bullish, and contrarian investors know that excessive bullishness is a bad short-term omen,” wrote Mario Tama in a MarketWatch report.

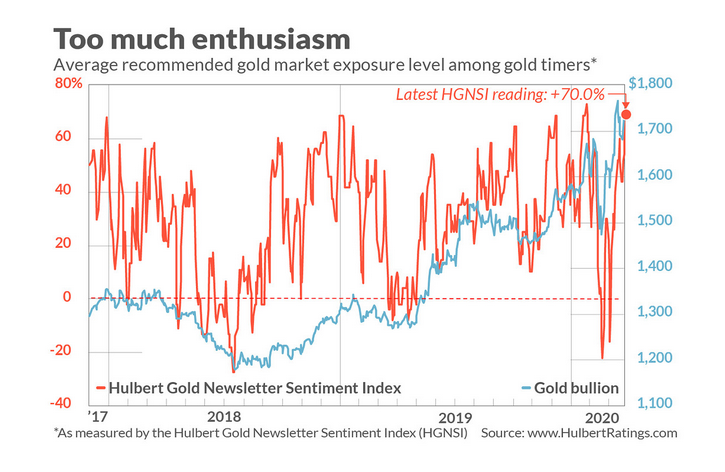

Tama, in particular, is looking at the Hulbert Gold Newsletter Sentiment Index. The index jumped to 70%, which registers higher than 97% of readings for the last 20 years.

As such, when it comes to bullishness for gold, too much of a good thing can be detrimental—as in all things.

“Recently I devoted a column to this sentiment index, which came after several weeks in which gold had particularly disappointed investors,” Tama wrote. “Far from hedging the S&P 500’s bear market, gold fell along with it. Many erstwhile gold bulls threw in the towel in response and, as a result, the HGNSI had fallen to minus 2.4% — which meant that the average gold timer was allocating 2.4% of his gold trading portfolio to going short.”

“In that column, I wrote that contrarians were starting ‘to smell opportunity,’” Tama added. “Two days subsequently, the HGNSI dropped even further, to minus 22.0%, which — as shown in the chart below — was one of the lowest readings in several years. Gold’s price is almost $250 higher now.”

Can gold bulls stage a comeback at this point? It’s possible, but the odds aren’t in their favor.

“How much would the HGNSI have to fall in order to shift the odds to the more bullish ones at the top of the table? It would have to drop from its current 70% to at least minus 20% — a decrease in average gold exposure of 90 percentage points,” wrote Tama. “While anything is possible, such a huge shift in sentiment is unlikely to occur in just a few days’ time. Gold’s decline on Monday of this week is only the beginning.”

For now, bearish traders can feast on the Direxion Daily Gold Miners Index Bear 2X Shares (DUST). DUST seeks daily investment results before fees and expenses of 200% of the inverse of the daily performance of the NYSE Arca Gold Miners Index.

The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets. The index is a modified market capitalization weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, to a lesser extent, in mining for silver.

For more market trends, visit ETF Trends.