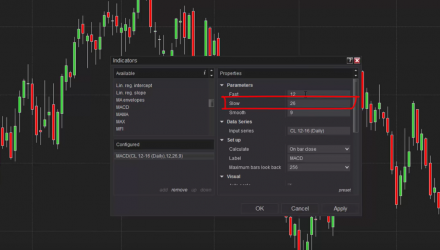

On many trading platforms like NinjaTrader, traders can use the MACD indicator–the Moving Average Convergence Divergence.

Per Investopedia, the MACD “calculates the difference between a currency’s 26-day and 12-day exponential moving averages (EMA). The 12-day EMA is the faster one, while the 26-day is a slower moving average. The calculation of both EMAs uses the closing prices of whatever period is measured. On the MACD chart, a nine-day EMA of MACD itself is plotted as well, and it acts as a signal for buy and sell decisions.”

Click the video below to find out how to use the MACD indicator in NinjaTrader:

For more investment strategies, visit the Leveraged Inverse Channel.