If You Can’t Beat ‘Em…

As the world marches toward unprecedented levels of mechanization, no one truly understands the scale and impact of new technology and the tectonic shifts in the way the workforce will be have to adapt. A well-known PEW Research Center study showed that, while two-thirds of Americans believe automation will replace most of the work done by humans, 80 percent don’t believe that their jobs will be affected.

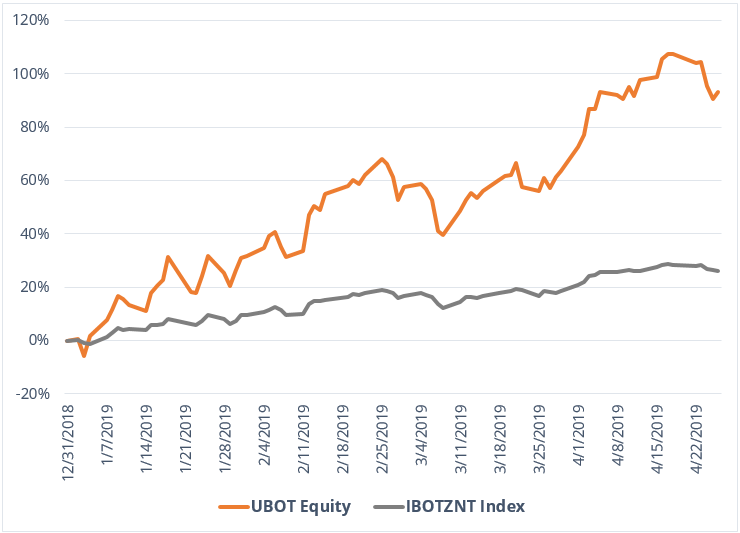

As the robot uprising gains pace, the Indxx Global Robotics & Artificial Intelligence Thematic Index, which is composed of companies producing the less consumer-facing technology that is quickly altering the workforce, is gaining popularity. Traders looking to go all in, and leverage exposure to this index, have been rewarded handsomely year-to-date. The Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 3X Shares ETF (UBOT) has returned over 90% through 4/24/19, as it benefited from positive compounding from the upward trending index performance.

Year-to-date, the index is up around 24% as of 4/22/19. Is there any end in sight?

Source: Bloomberg. Date range: Year-to-date performance of UBOT, 12/31/2018 – 4/26/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

The index that UBOT tracks aims to reflect the rapidly shifting landscape toward the precision and cost advantages that automation provides by including exposure to companies creating the systems, hardware and software with the greatest potential of eliminating the need for humans. Among companies like Mitsubishi Electric (7% of the index) and the multinational Fanuc Corporation (6.44%), which specialize in all aspects of automation, there are other companies included in the index that have certain specializations across a spectrum of other fields.

As a manufacturer that is already entrenched in providing processing power for self-driving cars and artificial intelligence software, NVIDIA holds 5.2% of the index. The rest of the list is populated by robotics and specialty automation companies from around the world, many of which remain unlisted in the major U.S. exchanges.

Discussed below are high exposure companies that largely specialize in factory and industrial automation. Both Yaskawa Electric Corporation and Hyundai Heavy Industries specialize in producing modular software, hardware and ambulatory robotics systems for factory or heavy industrial use. As with most modern robotics operations, these systems largely focus on increasing speed and efficiency in dangerous or repetitive fabrication and assembly tasks. Hyundai, in particular, manufactures robotic systems used to fit pipes on oil rigs and build massive freighter ships.

Related fields such as factory automation and system optimization, which aim to make the robotic factory floor as efficient as possible are also part of the index. Keyence Corporation, the largest component of the index at 7.44%, caters almost exclusively to the broad and seemingly endless market of defining new productivity analytics and synthesizing solutions for gauging and improving an increasingly mechanized workflow.

Finally, one of the most dramatic areas of mechanization is in healthcare. Unexpectedly, this is represented in the index by its second-largest component, Intuitive Surgical, Inc., which builds the leading robotic surgical system and has a global install base of 4,271 units. Japanese medical device maker Omron Corporation represents 5.16% of the index, although their products are primarily operational and extend beyond medicine, producing equipment and electrical systems related to everything from patient care to system automation for prisons.

… Join ‘Em.

The panoply of corporations involved in laying the foundation in this relatively new, less humane future, extend beyond the Apples, Google and Microsoft’s of the world. UBOT is for those who are “all in” on that future.

Direxion’s Leveraged and Inverse ETFs allow you to express your opinion in a way that’s athletic and flexible. Find out more.

Related Leveraged ETFs

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-569-9363 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.

This leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. The ETF should not be expected to provide returns which are three times the return of its benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

UBOT Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the return of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Robotics & Artificial Intelligence Companies and Industrials and Information Technology Sectors. Robotics and artificial intelligence companies may have limited product lines, markets, financial resources or personnel. These companies typically face intense competition and potentially rapid product obsolescence. Robotics and artificial intelligence companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Indxx Global Robotics and Artificial Intelligence Thematic Index (IBOTZNT) – Designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence, including companies involved in developing industrial robots and production systems, automated inventory management, unmanned vehicles, voice/image/text recognition, and medical robots or robotic instruments, as defined by the index provider, Indxx. Companies must have a minimum market capitalization of $100 million and a minimum average daily turnover for the last 6 months greater than, or equal to, $2 million in order to be eligible for inclusion in the Index. One cannot directly invest in an index.