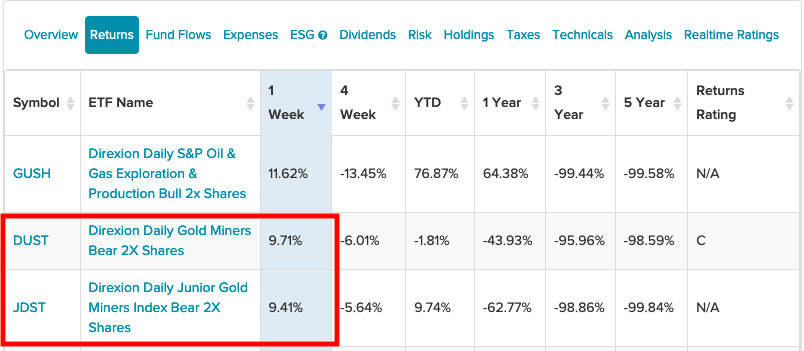

Gold miner bears ruined the bulls’ picnic over the past week. A pair of leveraged exchange traded funds (ETFs) from Direxion topped the past week’s best performers.

Gold bulls had all the fun in 2020, but so far this year, the precious metal is down about 6%. Rather than make an inverse play on the price of gold itself, traders can also play miners with the Direxion Daily Gold Miners Index Bear 2X Shares (DUST) and the Direxion Daily Jr Gld Miners Bear 2X ETF (JDST).

With a double dose of leverage, DUST and JDST don’t go too overboard on the exposure. This gives traders interested in levering up their trades a taste of amplified exposure, but not quite triple the exposure.

With a double dose of leverage, DUST and JDST don’t go too overboard on the exposure. This gives traders interested in levering up their trades a taste of amplified exposure, but not quite triple the exposure.

Either way, leveraged products from Direxion aren’t intended for neophyte investors.

DUST seeks daily investment results before fees and expenses of 200% of the inverse of the daily performance of the NYSE Arca Gold Miners Index. The ETF invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets. Meanwhile, JDST seeks daily investment results equal to 200% of the inverse of the daily performance of the MVIS Global Junior Gold Miners Index, which tracks the performance of foreign and domestic micro-, small-, and mid-capitalization companies.

Strong Economic Data Keeps Hurting Gold

Thanks to a healthy injection of fiscal stimulus dollars during the first quarter, investors have soured further on safe haven investments. That, of course, includes gold, which fell the past week thanks to strong economic data.

Consumers were more apt to open their wallets and spend money during the first quarter. Meanwhile, Treasury yields have been ticking higher, which is adding more downward pressure on the precious metal.

The benchmark 10-year Treasury yield reached its highest level in over two weeks as the Federal Reserve also decided to keep rates in check. After last year’s bond-buying bonanza, the Fed is also deciding to keep its bond purchases steady after Q1.

“This string of consecutively strong U.S. economic data is weighing on gold,” said Stephen Innes, managing partner at SPI Asset Management “Gold still remains bid, it is just not a strong hand right now, because of the month-end rebalancing.

“Ongoing strength in domestic data should lead to an incrementally hawkish turn in Fed guidance over the coming months,” UBS analysts said in a note.

For more news and information, visit the Leveraged & Inverse Channel.