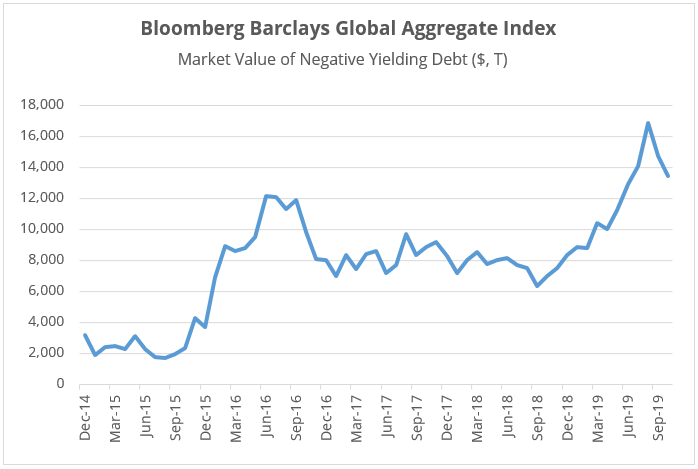

Negative-yielding debt has declined from its all-time peak, but it still represents close to 24% of all global bonds. Until recently, the idea of negative-yielding debt was unfeasible to many and now it is nearly a quarter of all debt issued around the world. Even $900 billion of corporate bonds trade at negative yields highlighting the pervasiveness of this phenomenon. Along with increased uncertainty about the direction of the economy, even as equity markets continue to reach new all-time highs, negative rates have contributed to driving up the price of gold as an asset class that famously offers no yield. And, when a large portion of the fixed income market generates less than that, nothing may actually be an attractive alternative!

NEGATIVE-YIELDING DEBT HAS DROPPED BUT REMAINS EXTREMELY HIGH

Source: Bloomberg Finance, L.P., as of October 31, 2019.

Source: Bloomberg Finance, L.P., as of October 31, 2019.

Don’t Fight the Fed

Gold has fallen from its recent highs as the market reacts positively to favorable Brexit news and progress on a trade deal between the U.S. and China. If traders believe that more monetary policy easing is coming, gold bullion and gold mining equities should remain on traders’ radars. More rate cuts, forward guidance, inflation targeting and increased asset purchases could all be on the table in 2020 as the Fed looks to support this recovery and remains focused on financial markets.

What would really make the outlook for gold more positive is an increase in inflation should aggressive monetary policy be successful at boosting the economy. This comes at a time when there is increased discussion about fiscal stimulus even as government debt levels have grown. According to Deutsche Bank, the total level of debt to GDP has increased from 225% in 1999 to 319% in 2019 as many in government no longer believe that inflation is a concern.

However, traders do not have the luxury to wait and see whether monetary policy or fiscal policy will cause the inflationary boogeyman to come out of hiding. So, what should they look for in the short-term?

In the near term, look to inflation expectations to gauge whether the investment community believes that pricing pressures may be sustained as they remain consistently lower than prior to the Global Financial Crisis and even the years after. More recently, the Federal Reserve has noted that low inflation is one of the reasons that they put their rate hiking cycle on hold, but a case can be made that the potential for pricing increases may be found by keeping rates lower for longer, especially if the economy starts to grow materially.

In addition, any weakness in the consistently strong U.S. dollar would be tailwind for gold as well. This may be coming soon as the economy outside the U.S. is showing some green shoots in manufacturing.

So, while traders can use gold bullion to gain access to these opportunity, gold mining stocks may be optimal thanks to their higher beta to the price of gold. In other words, as the broader investment community continues to balance the weak economic picture with the favorable financial market perspective, nimble traders can use gold mining stocks as their means to take either side of the trade.

Related Leveraged ETFs

- Direxion Daily Junior Gold Miners Index Bull 3X Shares (JNUG)

- Direxion Daily Junior Gold Miners Index Bear 3X Shares (JDST)

- Direxion Daily Gold Miners Index Bull 3X Shares (NUGT)

- Direxion Daily Gold Miners Index Bear 3X Shares (DUST)

ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investments. Due to the daily nature of the leverage employed, there is no guarantee of amplified long-term returns. Past performance is not indicative of future results.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. Each ETF is non-diversified and includes risks associated with the ETF concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are a multiple of the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, for each Bull Fund, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, for each Bear Fund, Daily Inverse Index Correlation/Tracking Risk and risks related to Shorting and Cash Transactions. In addition to these risks, there are risks associated with an ETF’s investment in a specific sector, industry, or stocks that comprise each Fund’s underlying index. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

The views in this material represent an assessment of the current market conditions and is not intended to be a forecast of future events. These views are intended to educated the reader and do not constitute investment advice regarding the funds or any security in particular. Past performance does not guarantee future results