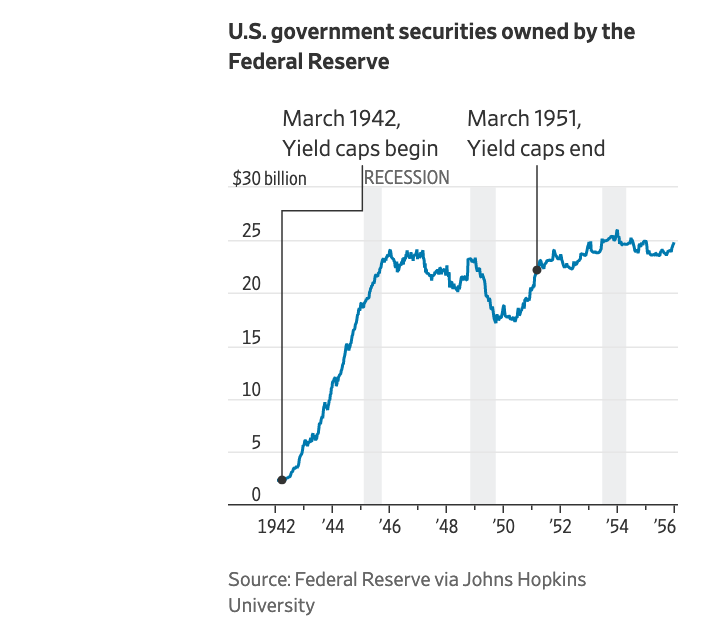

It’s never too early for the Federal Reserve to start thinking about what measures to take in order to stymie the effects of a recession, especially at a time now when many market experts feel the extended bull rally may be running out of steam. The Fed is looking at capping Treasury yields as an option to help stimulate the economy when the next recession takes place–a move that hasn’t been done since World War II.

Capping Treasury yields is a difficult concept to fathom in today’s environment where yields across the globe are at lows. At today’s rates, in order for investors to get beyond a 2% yield, they have to assume more duration risk by going on the long end of the curve–20 and 30 years out.

Nonetheless, the thought of capping yields is not beyond the realm of possibilities.

“Short-term yield-curve control is something that is worth looking at,” said Fed Chairman Jerome Powell.

4 ETFs to Trade Treasurys

Investors salivating at an opportunity to trade Treasurys can look at these four leveraged ETFs to trade:

- Direxion Daily 20+ Year Treasury Bull 3X Shares (NYSEArca: TMF): seeks daily investment results, before fees and expenses, of 300% of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than 20 years.

- Direxion Daily 20+ Year Treasury Bear 3X ETF (NYSEArca: TMV): seeks daily investment results before fees and expenses of 300% of the inverse (or opposite) of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than 20 years.

- Direxion Daily 7-10 Year Treasury Bull 3X Shares (NYSEArca: TYD): seeks daily investment results, before fees and expenses, of 300% of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years.

- Direxion Daily 7-10 Year Treasury Bear 3X Shares (NYSEArca: TYO): seeks daily investment results before fees and expenses of 300% of the inverse (or opposite) of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years.

For more market trends, visit ETF Trends.