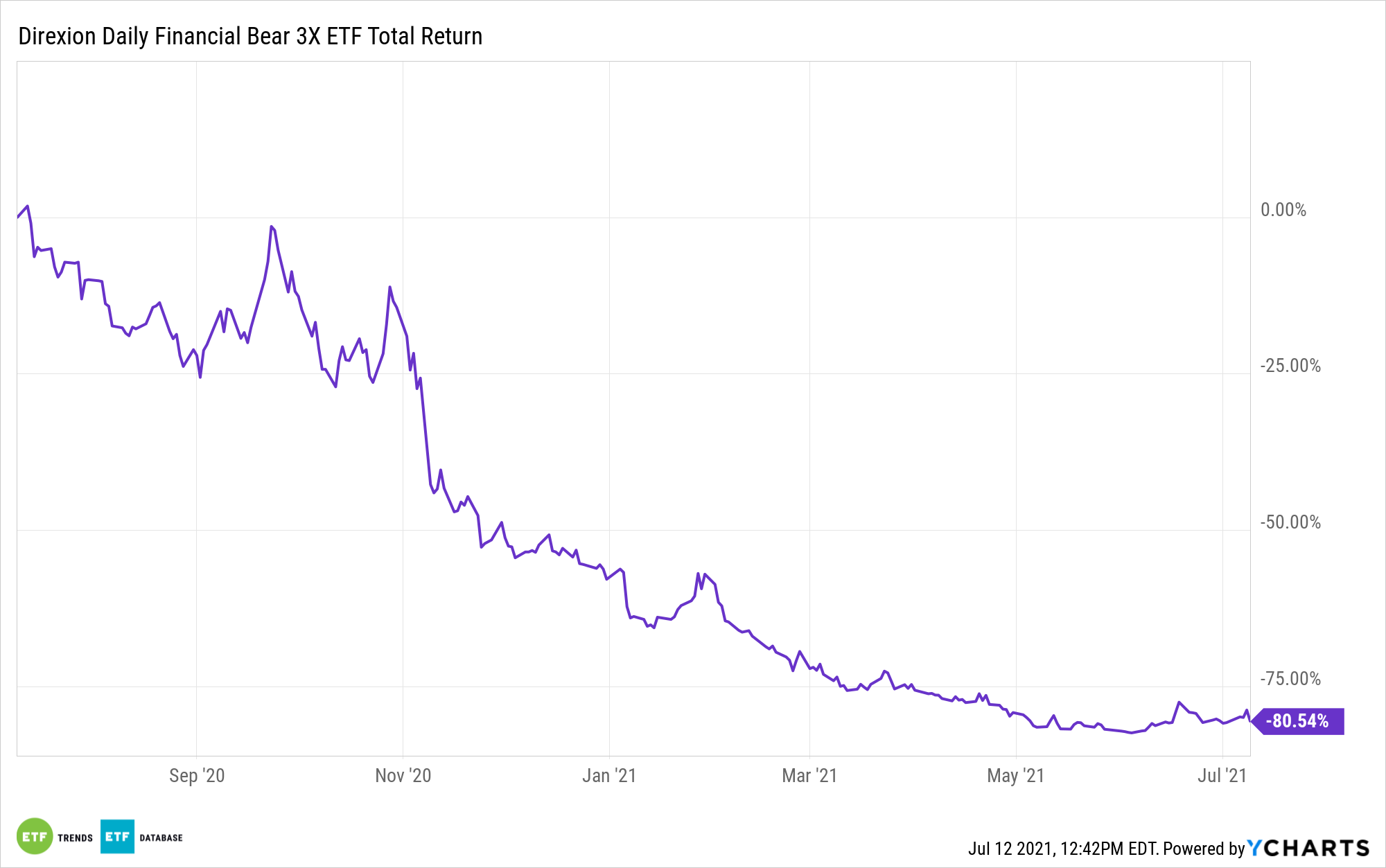

Bond yields have been falling, which begs the question: could inflationary pressures really be transitory? The Direxion Daily Financial Bear 3X ETF (FAZ) certainly hopes so.

The Federal Reserve has already said it won’t raise rates for at least another year, which could mean less profits for banks that rely on revenues from lending products like loans.

“This decline in bond yields could be signaling that the inflation burst is transitory, and/or that the Delta variant will slow growth, although at 1.25% this morning that seems extreme,” said Ed Hyman, founder and chairman of Evercore ISI and head of economic research.

FAZ seeks daily investment results that equate to 300% of the inverse (or opposite) of the daily performance of the Russell 1000® Financial Services Index. The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets.

The index is a subset of the Russell 1000® Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market. Like most if not all leveraged products, only seasoned investors should consider funds like FAZ.

The Bullish Side of the Fence

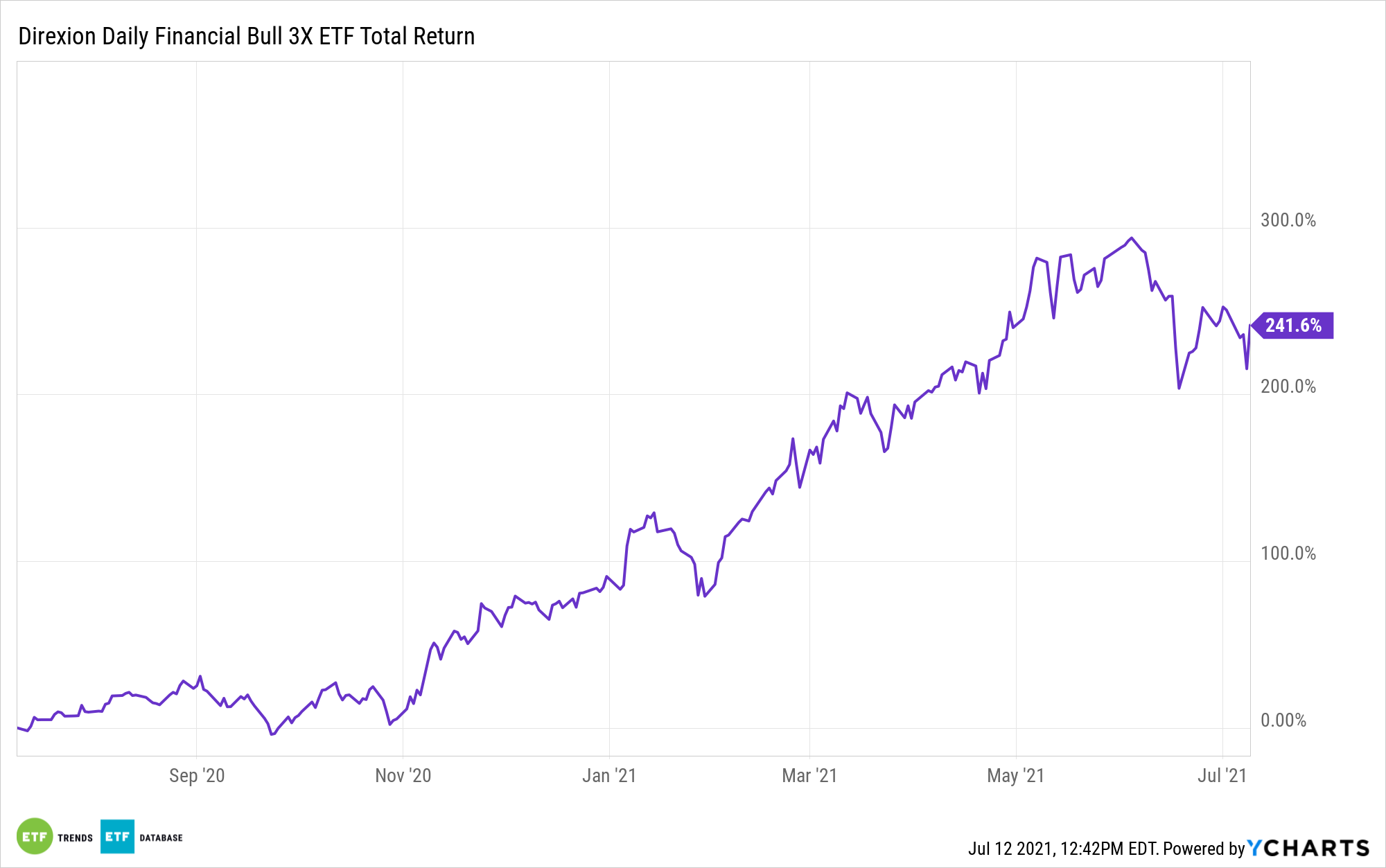

On the other side of the trade, the Federal Reserve could reverse course and opt to eventually raise rates—a positive for banks that offer loan products making money off of higher rates. Financial sector bulls can consider the Direxion Daily Financial Bull 3X ETF (FAS).

Taking the opposite side of FAZ, FAS seeks daily investment results worth 300 percent of the daily performance of the Russell 1000 Financial Services Index. The fund invests at least 80 percent of its net assets in financial instruments and securities of the index.

The fund also invests in ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is a subset of the Russell 1000 Index that measures the performance of the securities classified in the financial services sector of the large-capitalization U.S. equity market.

For more news and information, visit the Leveraged & Inverse Channel.