Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Elle Caruso discussed the pros and cons of using single-stock ETFs to express opinions on stock earnings.

James Comtois, staff writer, VettaFi: Ahoy, Elle! We’re soon approaching the first anniversary of AXS Investments launching the first single-stock ETFs. And with earnings season upon us, I think it’s high time we looked under the hood of this (relatively) new investment option.

Leveraged and inverse single-stock ETFs can allow short-term tactical investors to express an opinion on volatile stocks of high-profile companies (looking at you, Tesla (TSLA)). This makes these funds particularly appealing during earnings season when the market reacts to a company’s publicly released figures.

But they’re not just appealing during earnings: the current volatile investment environment is ripe for short-term tactical trading opportunities. Take, for example, inverse ETFs. So far this year, investors have pumped $5.8 billion into inverse ETFs. That’s roughly a quarter of inverse funds’ total assets at the start of 2023.

However, as bullish as I am on single-stock ETFs, these are not intended to be long-term holdings. I actually cannot stress this enough. Even issuers of these ETFs argue that they’re designed to be short-term trading tools for sophisticated traders.

Do Single-Stock ETFs Add to Concentration Risk?

Elle Caruso, staff writer, VettaFi: Hi, James! It’s a great time to discuss single-stock ETFs as earnings season wraps up and mega caps largely reported better-than-expected numbers. Here’s the thing, though: I’m quite skeptical of these instruments.

I want to start by taking a holistic look at portfolio composition right now. By and large, U.S. portfolios are largely biased toward domestic large-cap stocks. Therefore, U.S. investors are currently facing concentration risk near an all-time high. Apple (AAPL) and Microsoft (MSFT) comprise over 14% of the S&P 500 by weight, the highest level on record for two stocks in the benchmark.

Many portfolios are already overweight the mega-cap names available in single-stock ETFs, and therefore I oppose the idea of increasing a portfolio’s concentration risk further – then adding leveraged/inverse exposure on top.

While these ETFs can be used as a tactical play, it’s imperative investors first consider their total exposure to a security. That means looking under the hood at the other fund exposures in their portfolios. I would expect this may give them pause.

Truly Outsized Returns in Response to Stock Earnings

Comtois: I totally understand the skepticism, Elle. Because you’re right: these funds can be very, very risky. Again, these instruments are designed for traders who understand the risks involved.

But big risks can sometimes yield big rewards. And these single-stock ETFs have an ace up their sleeve that makes them potentially very rewarding: leverage. The leverage used in these funds can amplify the daily exposure of individual stocks, which allows investors to augment potential returns.

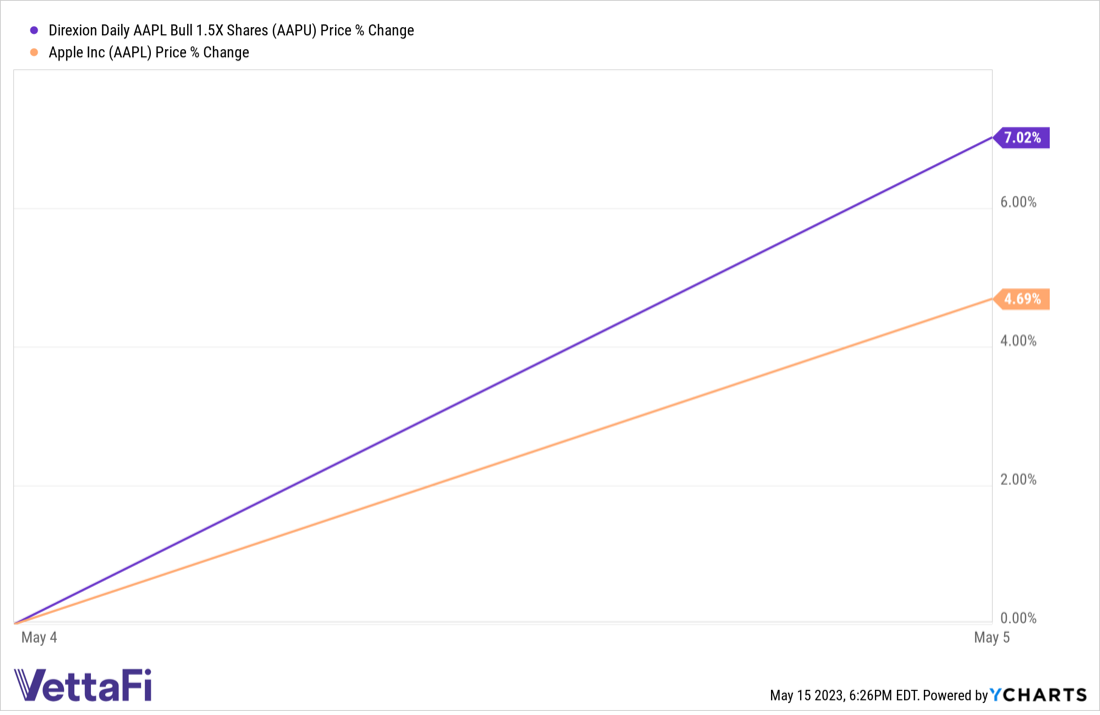

Consider the Direxion Daily AAPL Bull 1.5X (AAPU), which seeks daily investment results equal to 150% of the performance of Apple (AAPL). The day after the tech giant reported its second-fiscal quarter earnings, AAPU outperformed AAPL by 233 basis points.

After Apple reported Q2 earnings, AAPU outperformed AAPL by 233 basis points.

Now let’s check out an example of a bear fund. The AXS TSLA Bear Daily ETF (TSLQ) provides leveraged short (“bear”) daily exposure to Tesla. Days after the EV company released its Q1 figures, TSLQ returned more than 16%. Meanwhile, Tesla’s stock dropped by more than 14% during that period.

Tesla’s stock dropped by more than 14% post-earnings, but TSLQ rose 16%.

So, clearly, there’s the potential to deliver truly some outsized returns. Provided a.) you time it right, and b.) your conviction is right.

Buy-and-Hold Returns vs. Spikes After Stock Earnings

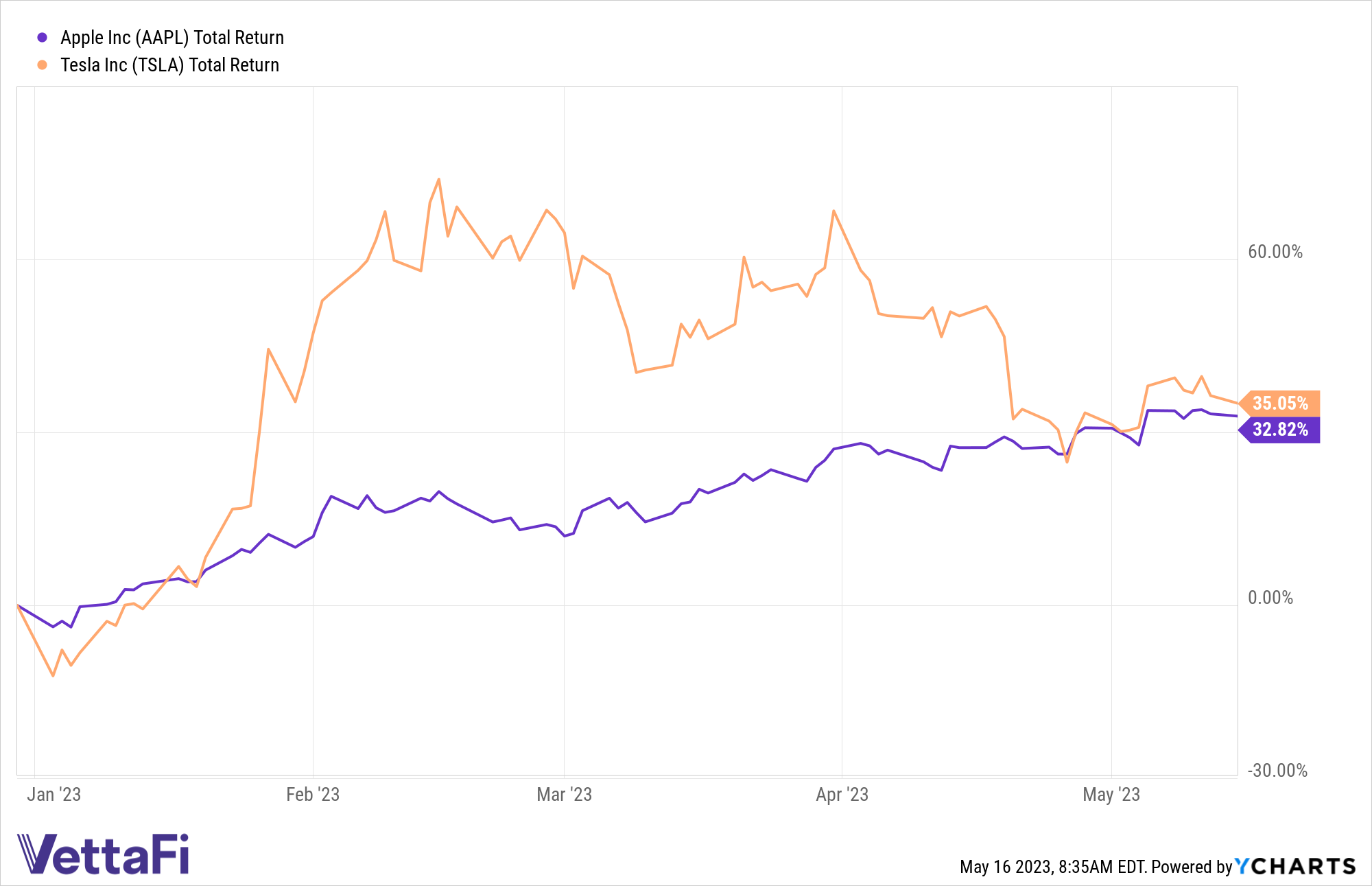

Caruso: James, you bring up some great use cases for AAPU and TSLQ. However, in both cases, investors would be better rewarded by buying and holding the security for a longer period.

Apple and Tesla have rallied 33% and 35% year to date as of May 15, well outperforming the short-term spike seen after reporting better-than-expected first-quarter earnings.

As of May 15, Apple and Tesla have rallied 33% and 35% year to date, well out-performing their short-term earnings bump.

Setting aside concentration risk, if an investor wanted to express a favorable opinion on Apple, I would instead recommend a fund like the Fidelity MSCI Information Technology Index ETF (FTEC) or the iShares Global Tech ETF (IXN), which gives Apple a weight over 23%. FTEC charges just 8 basis points, while AAPU and TSLQ each charge over 100 basis points, which erodes any positive returns anyway!

The Beauty of ETFs

Comtois: Pricing is absolutely an issue. But I should note that ETFs are still a very cost-efficient way to engage in this type of trading. In fact, that brings me to my third point. Single-stock ETFs provide retail investors access to this space without needing excessive knowledge of futures or derivatives markets.

Remember when I argued these instruments are designed for sophisticated traders? That may have been an overstatement. This type of investing, while complicated, is far less complex when accessed via the ETF wrapper. As we know, that’s the beauty of ETFs: their ease of use, regardless of the strategy.

ETFs are a better option than just buying the stock outright or buying futures on the stock. They’re easier to get leverage with than through the derivatives or futures markets. Investors don’t need to open a futures account with an ETF.

Things Can Go South for Investors in Single-Stock ETFs, Quickly

Caruso: I’m all for the democratization of investment products. However, it should not be understated how challenging it can be for even investment professionals to correctly predict in which direction a security will move. But that’s exactly what you have to do with single-stock ETFs. Investors need to be correct in choosing a leveraged or inverse product, or else they will see magnified losses.

In choppy markets where there is a lot of uncertainty and a security has no clear trend, single-stock ETFs’ daily reset will magnify tiny movements in the stock. This can quickly eat away at returns. Single-stock ETFs’ returns have the potential to diverge significantly from the performance of the underlying stock, especially if being held for longer than a single day, due to the effects of compounding and daily resets.

James, you’ve made a good case, but ultimately, I’m not sold on using these products to express opinions on earnings. Maybe I would feel differently if I had a crystal ball and could accurately predict a stock’s movement, but as of now, it’s all just based on speculation.

Understand the Risks

Comtois: You have made a very compelling case for why to be quite cautious with these funds, Elle. They’re very speculative, which is one of the reasons why I agree they’re not for everyone.

That said, while designed for high-conviction investors who can monitor their positions daily, single-stock ETFs can be a useful short-term tactical vehicle. If you have a strong opinion about how a particular mega-cap stock will move after it releases its quarterly earnings, they may be worth considering. Just remember these are not meant to be held over long periods and are best used by investors who understand the higher risks.

Until next time, Elle!

For more news, information, and analysis, visit the Leveraged & Inverse Channel.