The first shoe has dropped in what some soothsayers, tea leave readers, and economists feel is the first sign of what could be an upcoming recession: the inverted yield curve. In this instance, it was the yield on the 10-year Treasury note falling below that of the 3-month note.

Whether or not the second sneaker will meet terra firma, and how hard it will hit, remains to be seen. As reliable as yield curve inversion is in signaling a recession (it’s happened before every recession for the past 60 years) the down time in between the dip in long-term yield and an actual economic downturn can be as long as two or three years.

However, recession or no, fixed income is now in the spotlight. Since fixed income prices and its yield share an inverse relationship, demand for short- and medium-term government bills is way up, and fears of a recession promise to drive more investors to the safety of debt instruments.

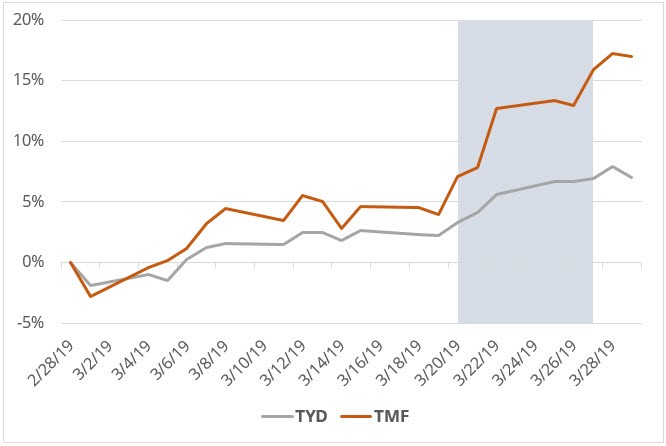

For a gauge on how demand has grown in the fixed income space, we can look to ETFs with broad exposure to Treasury note prices like the Direxion Daily 7-10 Year Treasury Bull 3X Shares ETF (TYD) and the Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF).

You can see that, although TYD is up 6 percent and TMF is only up about 20 percent since the beginning of March, both saw most or all of this move come over the course of just five days following the most recent FOMC meeting.

While the Fed’s dovish rate signal and mounting worries about a slowing economy are obvious catalysts for this rush to Treasurys, less obvious is just how drastic the change in demand actually was. Not only was the post-Fed move the steepest upswing for Treasurys this year, it also represented the notes’ highest price since late 2017.

Going forward, there are some key things to watch for that might further indicate where fixed income is headed. Right now, investors can keep an eye on the price in the longer-term 20-30 year Treasurys, which tend to lead the 10-year notes in buying and selling activity, for an indication of which direction bond prices might be headed overall. Additionally, keep an eye on the U.S. dollar index, which remains relatively strong and has attracted international investors as a value store, more so than government bonds.

More critically, fixed income investors should pay attention to what the Fed is doing beyond its interest rate policy. Since last year, the central bank has slowly been unraveling its balance book from the era of quantitative easing, allowing its bond portfolio to mature without reinvesting into new bonds. That tightening went hand-in-hand with their previous anti-inflationary approach to interest rates, removing more than $500 billion in bonds purchased during the recession from its balance sheet and into the general bond market.

But in 2019, the body has since backed away from gradually raising rates, to the point that some believe there may actually be a cut in the year. That decision also came with an announcement that they plan on ending their first round of quantitative tightening this September, and could potentially start buying up Treasurys again.

This all signals a more accommodative approach to fiscal policy in the face of 2019-2020 recessionary threats, which is bad news for Treasury prices, but good news for equity and bond yields. However, just like with QE, no one really knows the impact QT might have with regard to borrowing or inflation, let alone any other purchasing programs the central bank might have lined up.

Overall, traders should remain aware of how the Fed is shaping its currency policy. Since bonds and Treasury notes rise in the face of uncertainty, it can be hard to anticipate the right time to buy. However, when both the stock market and central bank sends as many mixed signals as it has over the past 12 months, uncertainty is the only thing you can count on.

Stay nimble, traders.

Related Leveraged ETFs

• Direxion Daily 7-10 Year Treasury Bull 3X Shares

• Direxion Daily 20+ Year Treasury Bull 3X Shares

This leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. The ETF should not be expected to provide returns which are three times the return of its benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

TYD Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to investment in U.S Treasury securities, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

TMF Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, risks specific to investment in U.S. Treasury securities, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 646-569-9363 or click here. A Fund’s prospectus and summary prospectus should be read carefully before investing.