Direxion launched four new 3X leveraged ETFs on Thursday designed to be a dynamic way for tactical traders to gain access to key parts of the equity market that either systematically look to capture a high volatile basket or to take advantage of the internet industry’s potential for booms and busts.

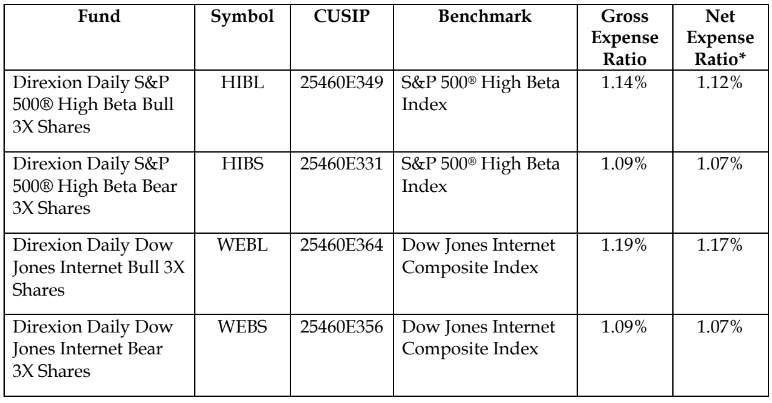

The Direxion Daily S&P 500® High Beta Bull and Bear 3X Shares (NYSEArca: HIBL/HIBS), and the Direxion Daily Dow Jones Internet Bull and Bear 3X Shares (NYSEArca: WEBL/WEBS) seek to achieve 300%, or 300% of the inverse, of the daily performance of the S&P 500® High Beta Index and Dow Jones Internet Composite Index.

Dave Mazza, Managing Director at Direxion, told ETF Trends that traders are currently faced with the potential for a highly volatile market, consumed with economic and geopolitical uncertain, thus Direxion wanted to provide them with an opportunity to fully capitalize on the market’s high beta securities from both the bull and bear side.

“While humorous at this point, it is safe to say that internet stocks are here to stay; therefore, we wanted to provide investors an opportunity to capture the internet industry’s cyclical uptrends or downturns,” Mazza said.

If you take a look at the Dow Jones Internet Composite Index, while it has a similar market cap to the S&P 500, Mazza said it currently trades at a higher multiple with considerably higher EPS growth expectations.

“Therefore, the funds provide an opportunity for traders to capture the markets’ opinion on the expected growth with large returns on investment,” he said. “As one would expect, the S&P 500 High Beta Index has a much high beta than the broader market, which currently tilts it away from mega-caps and towards undervalued companies with high growth expectations.”

Like all of Direxion’s leveraged and index ETFs, Mazza said these four funds ultimately provide traders with an opportunity to express their tactical views on precise areas of the market with leverage.

The S&P 500® High Beta Index provides concentrated exposure to 100 stocks in the S&P 500 Index with the highest sensitivity, or beta, over the last 12 months, which may lead to magnified market movements. The Dow Jones Internet Composite Index tracks the performance of the 40 largest and most actively traded stocks of U.S. internet technology and commerce companies offering a broad selection of internet companies not based on traditional GICS sector definitions.

Like all leveraged ETFs, these Direxion products are intended only for investors with an in-depth understanding of the risks associated with seeking leveraged investment results, and who plan to actively monitor and manage their positions. There is no guarantee that this Fund will meet its objective.

For more leveraged and inverse ETF news and strategy, visit our Leveraged & Inverse ETF Channel.