With April seeing major indexes bounce back after one of the most tumultuous periods in market history, one would be forgiven for thinking an economic recovery is imminent. Volatility abated in April, earnings reports have thus far largely met or exceeded (admittedly low) expectations, and the S&P 500 just returned its best month since October 1974.

The rally is a familiar tune to anyone who’s paid attention to the last decade: once again, tech has led the way. Technology-focused indexes like the S&P’s Technology Select Sector Index or the Dow Jones Internet Composite Index have surged roughly 30% from their recent lows over the past month.

But even within the much-trusted tech sector, there are trends to be found. Not all technology companies have rebounded equally. Direxion’s top-performing tech ETFs over the past month show how this is true.

Direxion Daily Technology Bull 3X Shares (TECL)

Higher by 120% from the lows it hit late in March, the Direxion Daily Technology Bull 3X Shares (TECL) is the third-best performer of Direxion’s tech ETFs, benefitting from increased interest in many of the same growth stocks that have supported the market in the past. This includes Apple and Microsoft, which are both higher by more than 30% from their recent lows.

However, looking at TECL’s top-performing components over the course of the past few weeks reveals that much of the ETFs momentum has actually been built on the back of financial technology companies. This includes blue-chip stocks like Mastercard and Visa, which are both off of their lows by about 30%, and companies like Intuit and Paypal, which have both gained as much as 45% from their recent lows. In Paypal’s case, the stock has surged back to new all-time highs.

Of course, there is a whole segment of TECL that we’ve neglected, which leads to the second-best performing tech industry ETF.

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

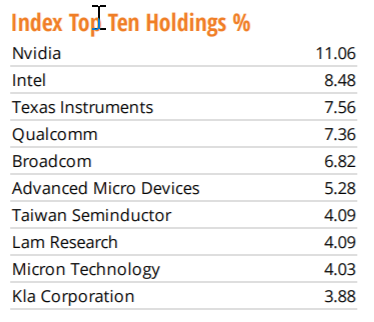

That segment is, of course, the semiconductor industry, which has seen some of the best post-crash performance throughout the entire U.S. equity market. The 133% increase in the Direxion Daily Semiconductor Bull 3X Shares (SOXL) ETF is reflective of this outperformance.

Again, many of the leaders within the industry are those that have led the market previously. Chief among these are Advanced Micro Devices (up 47% from its March low), NVIDIA (up 65%), and Apple-supplier Broadcom (up 78%).

The financial strength of these component companies seems likely to remain robust so long as their patrons in the tech field also remain in demand. But even the high-flying semis have been outshined in the last month by another area of tech.

Direxion Daily Dow Jones Internet Bull 3X Shares (WEBL)

Finally, Direxion’s top-performing tech ETF is intuitively composed mainly of companies that have benefitted from the necessities of the global pandemic and social distancing. The Direxion Daily Dow Jones Internet Bull 3X Shares (WEBL) has surged 172% since mid-March, thanks in large part to increased interest in online software and streaming services that help close the distance people are being compelled to keep.

The array of companies with large percentage moves is fairly diverse, including e-commerce names like eBay and Etsy, up 50% and 110%, respectively, as well as cloud-computing firms such as Okta and Vonage, up by 75% and 95%, respectively.

However, despite the high relative performance of these stocks, a lot of the dominant performance in the segment can be traced back to large-cap tech. Specifically, Amazon, which went from being at a 52-week low to a new all-time high in a matter of weeks, and Netflix which also made a new all-time high in April.

All indications are that we are heading for the worst economic year since The Great Depression. But that hasn’t stopped investors from looking ahead. So while a lot may still be uncertain about the shape of an economic recovery, traders are seemingly sure that technology will be the sector to lead the market higher.

Related Leveraged ETFs:

Direxion Daily Technology Bull 3X Shares (TECL)

Direxion Daily Semiconductor Bull 3X Shares (SOXL)

Direxion Daily Dow Jones Internet Bull 3X Shares (WEBL)

TECL as of 3/31/2020

SOXL as of 3/31/2020

WEBL as of 3/31/2020

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

For the funds’ standardized and most recent month end performance click here (www.direxion.com/etfs)

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to the Funds.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Distributor for Direxion Shares: Foreside Fund Services, LLC.

Direxion © 2010 – 2020