The banking sector would like to see low interest rates go away as quickly as possible. With a global vaccine deployment underway for the COVID-19 pandemic, signs of life could appear for the banking sector in 2021, which bodes well for the Direxion Daily Regional Banks Bull 3X Shares (DPST).

DPST seeks daily investment results, before fees and expenses, of 300% of the daily performance of the S&P Regional Banks Select Industry Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

The index is a modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the GICS regional banks sub-industry. Signs of life are starting to show in the fund’s YTD chart with the price moving above its 50-day moving average of late.

The Challenge Ahead for Banks

Low rates for banks mean that income on products like mortgages are reduced. As such, challenges remain for the banking sector as “central banks around the world hold borrowing rates at record- low levels to ward off further economic damage from the coronavirus pandemic, the cost to the global banking industry could prove to be steep,” per an American Banker report.

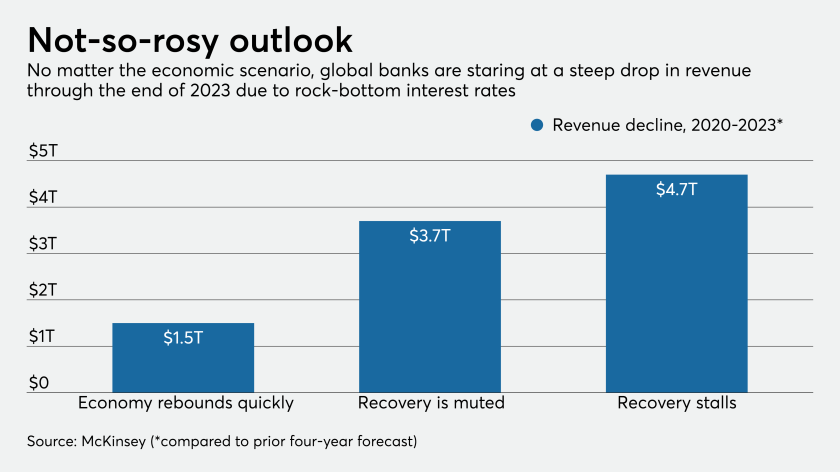

“A recent report from the consulting firm McKinsey estimates banks around the world could lose out on $3.7 trillion between the start of this year and the end of 2023, when compared with earlier projections,” the report added. “That’s assuming the economy recovers modestly from the pandemic. If the recovery takes longer, global banks could miss out on as much as $4.7 trillion in revenue, McKinsey predicts. Meanwhile, reserve builds meant to cushion against loan losses could pass levels last seen during the 2008-09 financial crisis, according to the report.”

One way the banking sector can push through the challenges is to reduce unnecessary costs in current operations.

“Given these twin challenges, banks will have little choice but to boost production through volume and reduce expenses by upgrading technology, shrinking headcount throughout their organizations and shedding unneeded real estate, according to the report,” the article noted further.

“For some banks, these measures may not be enough,” said Marie-Claude Nadeau, a San Francisco-based McKinsey partner and the author of the report. “Mergers might be the best way out. Some banks are already pursuing M&A before things get worse.”

For more news and information, visit the Leveraged & Inverse Channel.