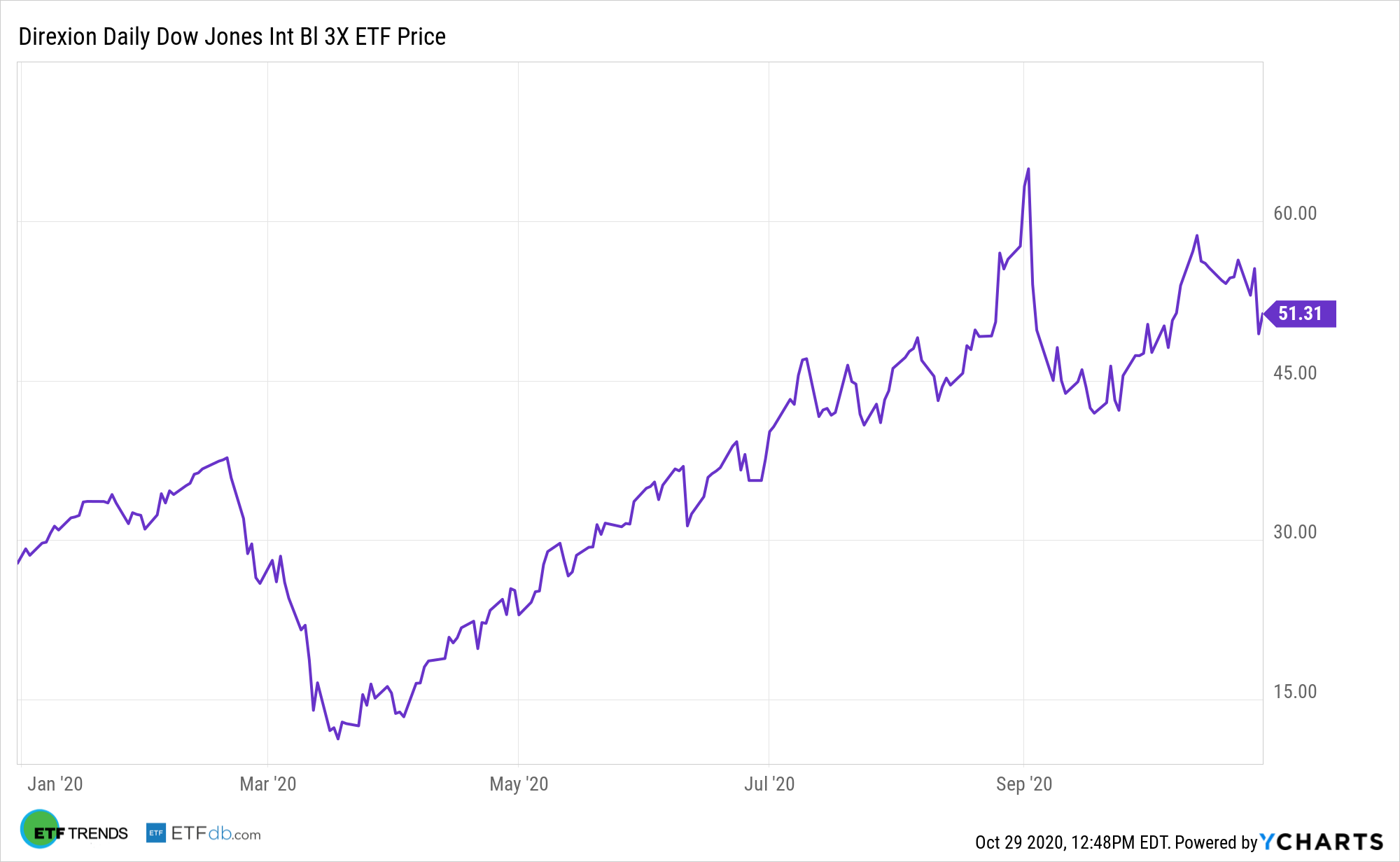

More than ever, internet use is becoming a necessary part of our lives in order to function in this new do-everything-from-home normalcy. It’s getting to the point where internet data will be a much sought-after commodity, which actually bodes well for ETFs like the Direxion Daily Dow Jones Internet Bull 3X Shares (WEBL).

Whether it’s working from home or attending classes, the need for the internet will only intensify, especially if the resurgence of coronavirus cases forces additional lockdowns. France and Germany are already experiencing this–could the U.S. be next?

“The coronavirus pandemic led millions of Americans to turn their homes into offices and classrooms. It also forced many to change their habits to keep their internet bills in check,” a Wall Street Journal article said. “The amount of time consumers spend streaming TV, gaming and using Zoom or other videoconference platforms substantially increased since the start of the pandemic, activities that often eat up large amounts of data.”

“The practice of limiting the internet usage of customers and charging heavy users more is common among many of the nation’s internet providers,” the article added further. “Doing so partly helps offset the revenue lost from subscribers abandoning their traditional pay-TV plans in favor of internet-based options—a phenomenon known as cord-cutting. Users who consistently need more data are encouraged to upgrade to a pricier plan.”

As for WEBL, the fund seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Dow Jones Internet Composite Index. The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments that track the index and other financial instruments that provide daily leveraged exposure to the index or to ETFs that track the index. The index includes companies that generate at least 50% of their annual sales/revenue from the internet as determined by the index provider.

A more broad play in tech is the Direxion Daily Technology Bull 3X ETF (NYSEArca: TECL). TECL seeks daily investment results, before fees and expenses, of 300% of the daily performance of the Technology Select Sector Index.

For more news and information, visit the Leveraged & Inverse Channel.