For more than a month now, politicians, businesses and traders have attempted to anticipate the consequences of the global pandemic that has effectively shut down large swaths of commerce around the globe. And while there remains much uncertainty about the coming months, traders have begun to show outsized interest in countries where the virus spread and, therefore, have experienced the longest epidemiological response.

Taking a look at Direxion’s collection of international ETFs provides an interesting survey of how these East Asian markets are responding to the months-long pandemic to which they bore early witness.

China Resets

The first confirmed case of the novel coronavirus strain, now known as COVID-19, was officially reported to the World Health Organization’s China office on December 31, 2019, by officials of the city Wuhan in Hubei province, China; although doctors in that region date the first onset of symptoms to early December and report that their warnings of the new SARS-like virus were censored by the ruling Chinese Communist Party.

Though reported cases of COVID-19 in China spiked, they appear to have plateaued following months of drastic lockdown measures. The country is only now beginning to lift some of the compulsory lockdown measures put in place to slow the rapid acceleration of the virus. However, like much of rest of the world, there remains uncertainty about if or when “normalcy” will resume for the country.

Nevertheless, those baby steps, as small and unsure as they are at this point, have drawn the attention of traders seeking to make up some ground from the previous month of heavy selling in equities. Direxion’s Daily FTSE China Bull 3X Shares (YINN) has gained about 40% since hitting a low of $8.27 halfway through March.

Source: Bloomberg Data. As of 4/3/20. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most standardized and the most recent month-end performance click click here.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Leading the trend in the ETF has been an interesting collection of Chinese internet concerns such as Tencent Holdings, which is up more than 20% from its 2020 low, and online food delivery company Meituan Dianping, which is up nearly 25% after reporting strong earnings growth for the final quarter of 2019, but expressing a lower outlook for the current and future quarters.

Other prominent Chinese stocks and sectors have also seen a bounce in recent weeks, including the online retail giant Alibaba. Still, there remain looming questions about whether COVID-19 is yet entirely under control and whether it could return.

Japan’s Curve Flattens

Japan registered their first confirmed case of COVID-19 in early-to-mid-January just south of Tokyo in Kanagawa Prefecture from a Chinese national who had recently returned from a visit to Wuhan. While cases did begin rising fairly rapidly, Japan did not see anywhere near the same exponential growth as most other nations inflicted with the virus. This is despite some slight delay in responding to the rising incidence of the virus, only implementing lockdown and social distancing measures in late-February.

Nevertheless, cases in Japan have flattened. And while the government is still cognizant of the possibility of worsening infection rates, public life in Japan has not been as drastically altered as other nations. This may be both a cause for optimism and worry, as commerce and travel in Japan remain relatively unchanged, though some large gatherings and events—such as the 2020 Olympic Games in Tokyo—were postponed until 2021.

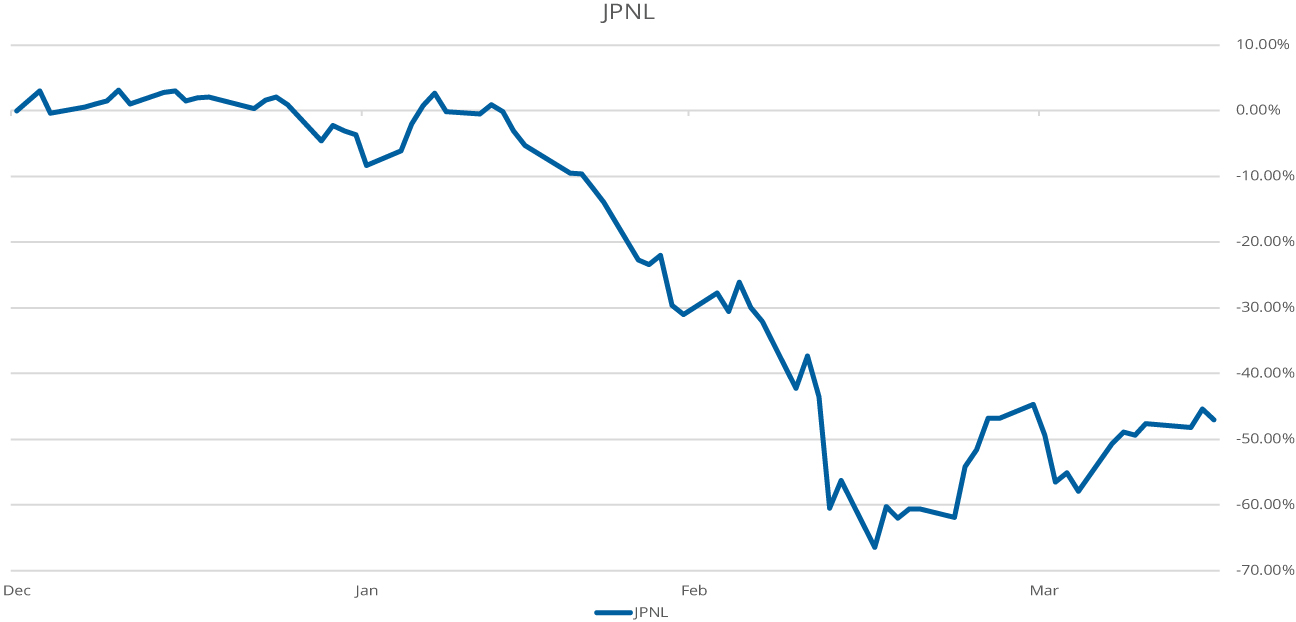

The upshot for Japanese equities is that the country is still open for business, which has increased interest in the components of the MSCI Japan Index (NDDUJN) and pushed the Direxion’s Daily MSCI Japan Bull 3X Shares (JPNL) higher by more than 50% from its most recent low.

Source: Bloomberg Data. As of 4/3/20. The performance data quoted represents past performance. Past performance does not guarantee future results.

While the nation’s manufacturing concerns like Toyota, Honda, and Keyence are each up around 15% from their most recent low, the real leader has been technology-focused holding company Softbank, which was higher by 43% in the final days of March. Another strong component of the index was Takeda Pharmaceutical Company, which gained 25% off its low as a result of its involvement in researching potential treatment for COVID-19.

It’s important to remember these gains are still occurring in the relatively early days of the pandemic, and there is still a chance the virus may find purchase and spur another wave of infection. While Japan and the rest of the world are hopeful this is the case, the coming weeks and months will remain a tense time for the world.

South Korea’s Experience Pays Off

South Korea logged its first confirmed case of COVID-19 in late January. Since then, the country has become the poster child for what a quick and decisive response looks like in this outbreak, instituting extensive testing and quarantine measures in early February in areas around the city of Daegu in the North Gyeongsang Province that had the highest incidence of cases.

These measures, themselves a consequence of the nation’s previous battles with the SARS and MERS coronavirus strains, helped the nation rein in what was quickly becoming an exponential infection rate. Two months after the first case, South Korea has managed to halt the spread of COVID-19 without implementing major lockdown procedures, keeping the number of cases and, critically, deaths relatively low.

Although South Korea is not entirely out-of-the-woods with regard to COVID-19, it has so far masterfully avoided the initial swell of cases that has overwhelmed much of the world, including the U.S.

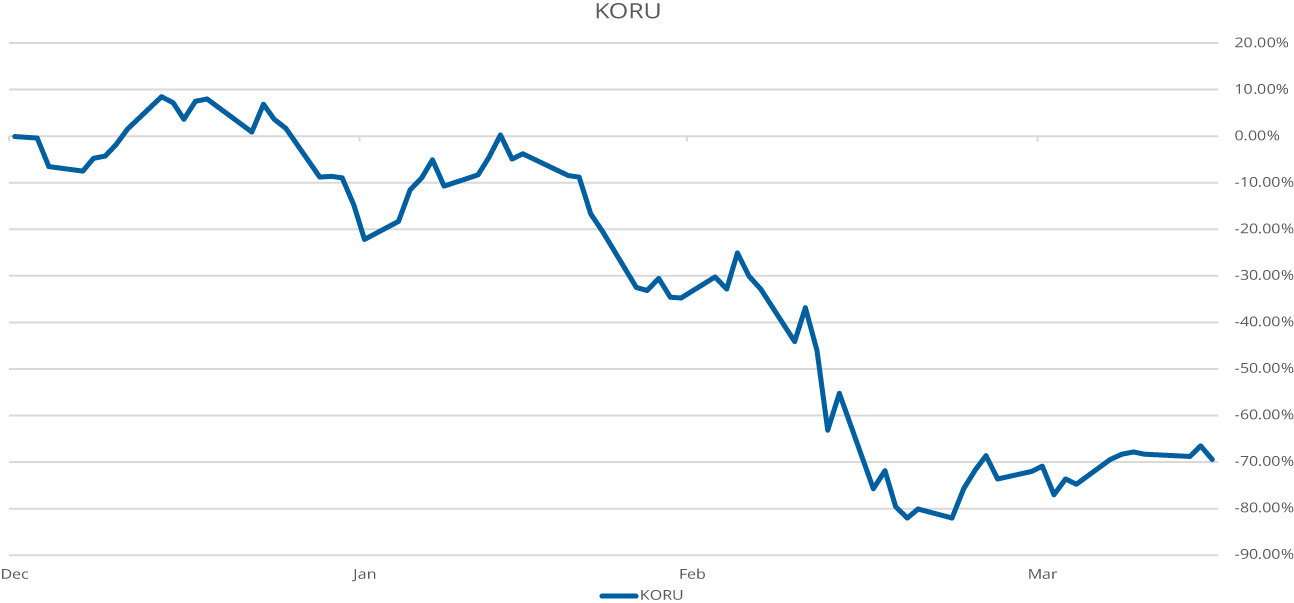

This strong response, and the relatively minor disruption it had on South Korean business activities (at least within the country), has prompted traders to look to South Korea for some portfolio stability and helped push the MSCI Korea 25/50 Index (M1KR2550) higher. This is clear when looking at the Direxion Daily South Korea Bull 3X Shares (KORU), which is higher by 80% from its most recent low.

Source: Bloomberg Data. As of 4/3/20. The performance data quoted represents past performance. Past performance does not guarantee future results.

Given its outsized position in the nation’s economic ecosystem, Samsung is a good bellwether of this rebound, with the stock about 12% off its recent low. However, other tech components of the Korean economy have also shown resilience in the closing days of March, including internet company Naver Corporation, more than 20% off its March low, as well as global semiconductor giant SK Hynix, bouncing 25% from its low.

But technology alone isn’t what has helped buoy the South Korean market in recent weeks. The nation’s banks have attracted the most investor attention, with two of the nation’s largest financial institutions in Shinhan Financial Group, KB Financial Group both bouncing roughly 30% from their most recent lows.

Again, it’s critical to realize that markets will be in flux for the near future. While East Asian nations are among the first to negotiate the hazards of this pandemic, the global consequences are myriad and far-reaching and will likely remain so for months to come.

So now, more than ever, across all markets, direction matters.

Related Leveraged ETFs:

Direxion’s Daily FTSE China Bull 3X Shares (YINN)

Direxion’s Daily MSCI Japan Bull 3X Shares (JPNL)

Direxion Daily South Korea Bull 3X Shares (KORU)

FTSE China 50 Index Top Ten Holdings as of 3/31/20

| Tencent Holdings | 9.11 |

| China Construction Bank | 9.05 |

| Ping An | 7.69 |

| Industrial Commerc Bk China | 7.02 |

| Meituan Dianping | 4.92 |

| China Mobile | 4.65 |

| Bank Of China | 4.00 |

| Cnooc | 3.91 |

| China Life | 3.38 |

| Cm Bank | 3.18 |

MSCI Japan Index Top Ten Holdings % as of 3/31/20

| Toyota | 4.46 |

| Sony | 2.37 |

| SoftBank | 1.88 |

| Mitsubishi | 1.84 |

| Keyence | 1.77 |

| Takeda Pharmaceutical | 1.64 |

| KDDI | 1.45 |

| Recruit | 1.40 |

| Sumitomo Mitsui | 1.35 |

| Honda | 1.27 |

MSCI Korea 25/50 Index Top Ten Holdings % as of 3/31/20

| Samsung | 23.01 |

| SK Hynix | 6.47 |

| NAVER Corp | 3.30 |

| Shinhan Financial | 2.44 |

| KB Fgi | 2.39 |

| Hyundai | 2.34 |

| Posco | 2.33 |

| Hyundai Mobis | 2.23 |

| Celltrion | 2.15 |

| LG Chemical | 1.86 |

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Direxion Shares Risks: An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.

Market Disruptions Resulting from COVID-19. The outbreak of COVID-19 has negatively affected the worldwide economy, individual countries, individual companies and the market in general. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to to the Fund.

Distributor: Foreside Fund Services, LLC.

Direxion © 2010 – 2020