The rotation to value out of high-flying technology names will help fuel more consumer discretionary names via ETFs like the Direxion Daily Consumer Discretionary Bull 3X ETF (NYSEArca: WANT). Bullish traders are starting to sense the need for consumer discretionary equities as more short sellers flee the scene.

WANT is up 35% year-to-date after finishing 2019 with a strong 90% gain. A lot of that performance is packed into its triple leverage exposure.

WANT seeks daily investment results equaling 300 percent of the daily performance of the Consumer Discretionary Select Sector Index. WANT is capitalizing off a strong start to 2019 with two consecutive months of phenomenal gains–up 23 percent in June and another 33 percent in July.

Just after the October sell-offs and amid the presidential election, bulls took over in WANT as the fund pushed beyond its 50-day moving average. The fund hasn’t quite breached the overbought level the past month, so traders may be able to squeeze out gains toward the end of 2020.

Short Interest Wanes in Consumer Discretionary

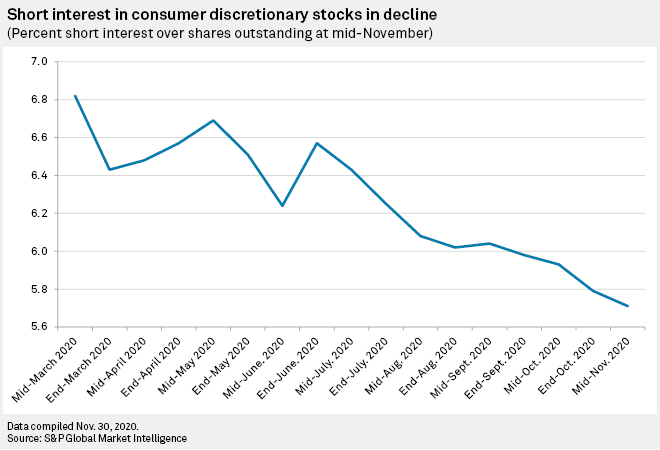

Thanks to the vaccine rally, short interest has been waning in the consumer discretionary sector per an S&P Global Market Intelligence article:

“Vaccine optimism drove down short interest in all sectors of the S&P 500 in the first half of November as investors recalibrated their outlooks amid a series of positive vaccine developments and stocks soared to all-time highs,” the article said. “Short interest in the S&P 500 amounted to 3.42% of shares outstanding as of Nov. 13, according to the most recent available data from S&P Global Market Intelligence, down from 3.95% in mid-March, when the pandemic began to take hold in the U.S. and the index began to crater.”

Was short interest simply a case of looking at the market with the half glass empty?

“Wall Street may have taken an overly pessimistic view on the U.S. consumer sector, said Ed Moya, a senior market analyst with OANDA,” the article said. “Moya said that with the declining percentage of short interest in mid-November and a surge in online spending in the U.S., traders are quickly abandoning the short trade in consumer discretionary stocks. Consumers spent an estimated $9 billion online the day after Thanksgiving this year, a nearly 22% jump from the same day in 2019, according to data from Adobe Analytics.”

“Weller said consumer discretionary stocks likely had the most to gain in the first half of 2021 from a successful vaccine and reopened economy,” the article added. “Paul Schatz, president of Heritage Capital, said shorts had gotten “super comfortable” without a vaccine, limiting investors’ outlooks for life to return to normal.”

For more news and information, visit the Leveraged & Inverse Channel.