Insurance companies are looking to invest more capital into shoring up their robotics to help support core business operations. As such, the Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 2X ETF (UBOT) is worth noting.

More companies, regardless of business sector, are incorporating more robotics. In the case of insurance companies, more robots can mean greater accuracy at a reduced cost of doing business.

“Insurance companies are increasing their investment in robotic systems aimed at helping claims adjusters evaluate storm-damaged properties with greater safety and less cost,” a Wall Street Journal article reported. “Travelers Cos., United Services Automobile Association and Farmers Insurance Group were among the major property and casualty companies to deploy aerial drones this summer to inspect property damage in the wake of Hurricane Ida.”

According to the WSJ report, insurance companies worldwide are expected to throw over $600 million at robotics systems. That number should hit $1.7 billion by the year 2025.

“All these technologies are about augmenting the capacities of the so-called knowledge workers,” said Patrick Van Brussel, research director at the technology research company International Data Corp.

Leveraging the Move to Robotics

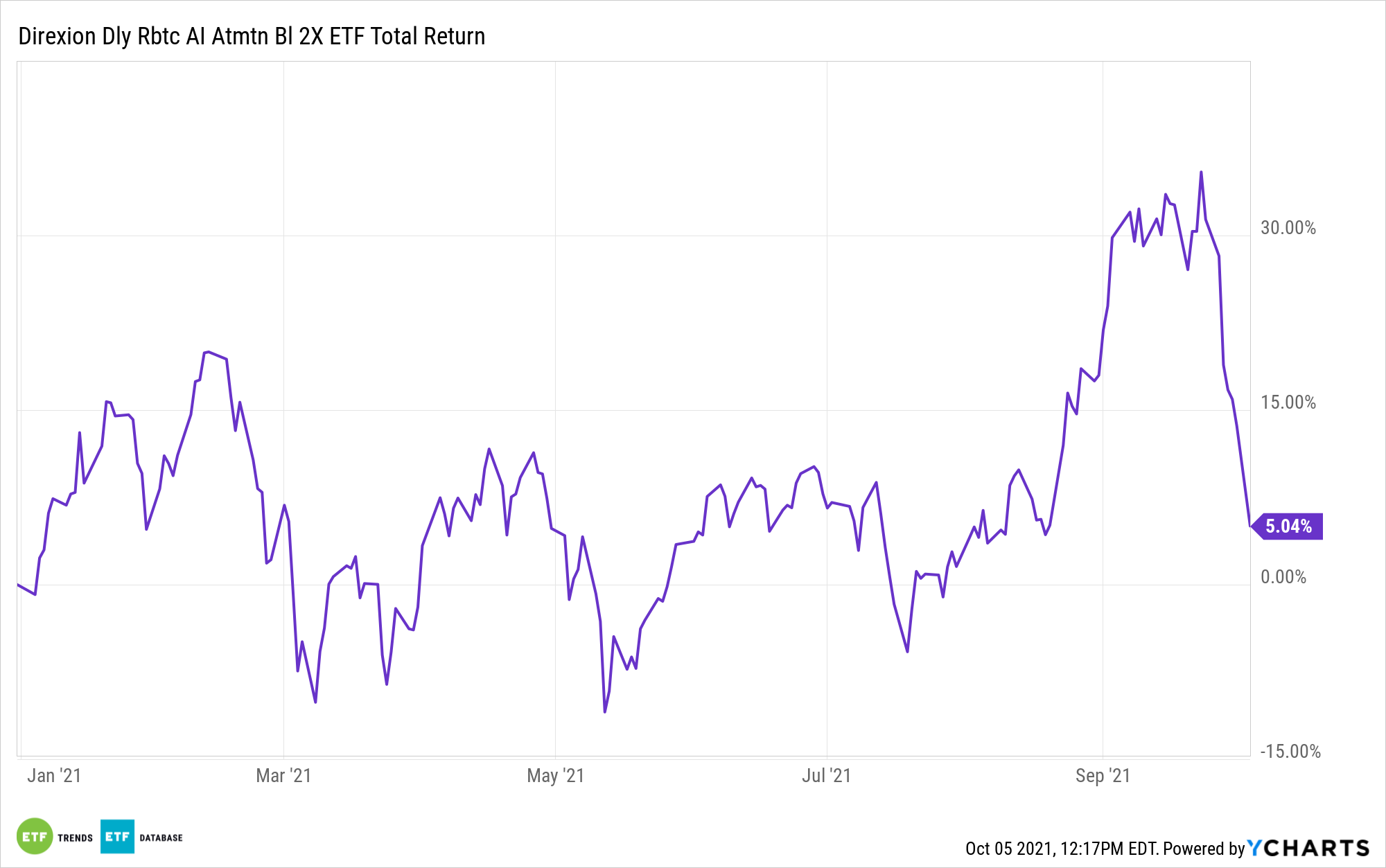

Traders looking to capitalize on the move to robotics can use UBOT as a tool. UBOT seeks daily investment results equal to 200% of the daily performance of the Indxx Global Robotics and Artificial Intelligence Thematic Index, which is designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence.

The robotics space is certainly in a push-pull dichotomy of investors capitalizing on the latest in disruptive technology, while at the same time getting pushback from those threatened by the wider adoption of robots. The fears are warranted given that robotics technology has the capacity to supplant human jobs.

Key characteristics of UBOT:

- The Indxx Global Robotics and Artificial Intelligence Thematic Index (IBOTZNT) is designed to provide exposure to exchange-listed companies in developed markets that are expected to benefit from the adoption and utilization of robotics and/or artificial intelligence, including companies involved in developing industrial robots and production systems, automated inventory management, unmanned vehicles, voice/image/text recognition, and medical robots or robotic instruments, as determined by the index provider, Indxx.

- Companies must have a minimum market capitalization of $100 million and a minimum average daily turnover for the last six months greater than or equal to $2 million in order to be eligible for inclusion in the index.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.