By Direxion

It might seem like ages ago in market-time, but this September marked one year since the major indexes posted their highest readings of 2018. While that by itself might not be extraordinarily noteworthy, what has followed those highs is.

The intervening 12 months have been marked by reversals. The S&P 500 has gone from correction territory to making four new all-time closing highs, while the Fed has gone from raising interest rates to implementing two rate cuts. And although the reasons underlying the chaotic activity in stocks are myriad and complex, the results are less ambiguous, with a good number of sector funds—such as those in technology, healthcare, and energy— still below their 2018 high-water mark.

Other sectors have had a strong bull run over the past year and have managed to greet fall 2019 at or near record highs. Below are four bullish sector ETFs from Direxion’s stable of leveraged investments that have weathered the past year’s uncertainty to hit new 52-week highs.

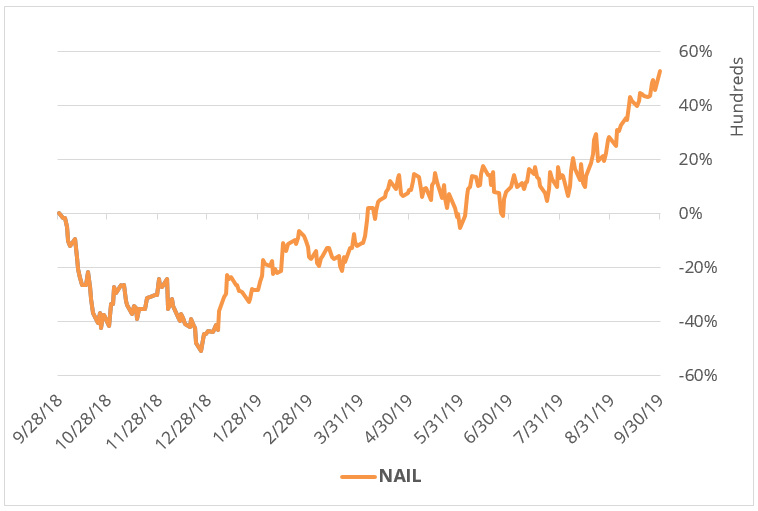

Homebuilders

Of all of the sectors and industries included in this list, homebuilder and construction-related companies had the toughest road to hoe, as evidenced by the 62% drop in the Direxion Daily Homebuilders & Supplies Bull 3X Shares (NYSE: NAIL) between September and December in 2018.

Source: Bloomberg. Data as of September 23, 2019 Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Since then, NAIL has rallied back 182% to reach its current 52-week high. This is thanks largely to strong performance in the likes of D. R. Horton Inc. (NYSE: DHI), PulteGroup, Inc. (NYSE: PHM) and Home Depot Inc. (NYSE: HD), which have thrived in an environment of steady housing demand and low inventory.

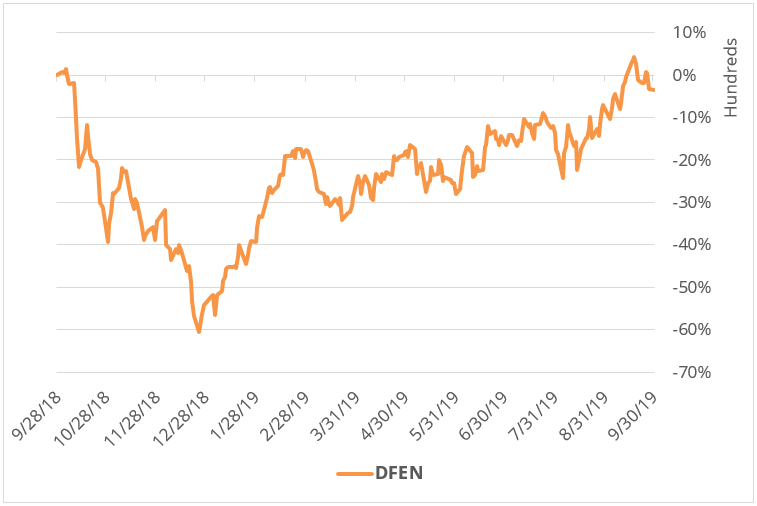

Aerospace and Defense Contractors

It may seem shocking given the high-profile trouble surrounding Boeing Co (NYSE: BA) 737 Max airplane, but the Direxion Daily Aerospace & Defense Bull 3X Shares (NYSE:DFEN) is above its price from one year ago by about 1% from a high it hit back in October of last year.

Source: Bloomberg. Data as of September 23, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

While Boeing may have sputtered on the runway through 2019, other defense industry workhorses like Lockheed Martin Corporation (NYSE: LMT) and Northrop Grumman Corporation (NYSE: NOC) have managed to pick up the slack, each posting about 60% growth from their respective 2018 nadirs.

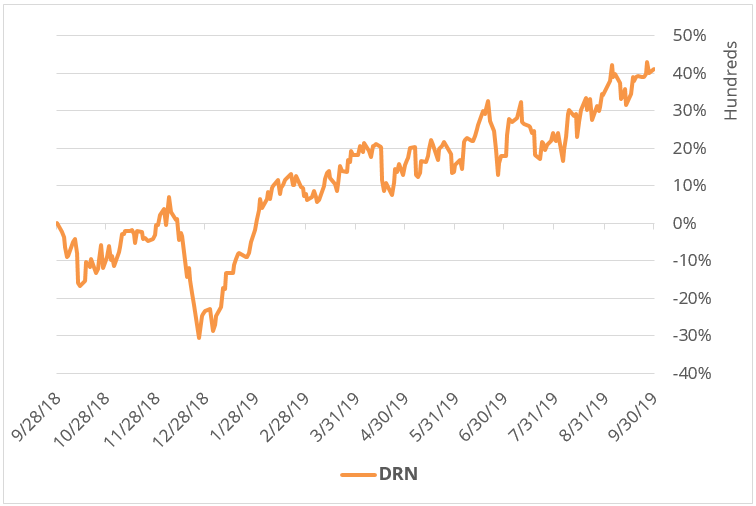

Real Estate

Similar to the demand seen in homebuilders, commercial REITs and other real estate firms have a good deal of positive price pressure through 2019 that has put the Direxion Daily MSCI Real Estate Bull 3X Shares (NYSE:DRN) up about 130% from its 2018 high. Unlike homebuilders though, DRN didn’t have quite the hole to climb out of, falling a modest 37% between its 2018 high and low.

Source: Bloomberg. Data as of September 23, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Barring one or two exceptions, pretty much every one of DRN’s top holdings is higher on the year, although retirement home owner Welltower Inc. (NYSE: WELL) and telecom REIT American Tower Corp (NYSE: AMT) are clear standouts, having gained 35% and 59% over the past year, respectively.

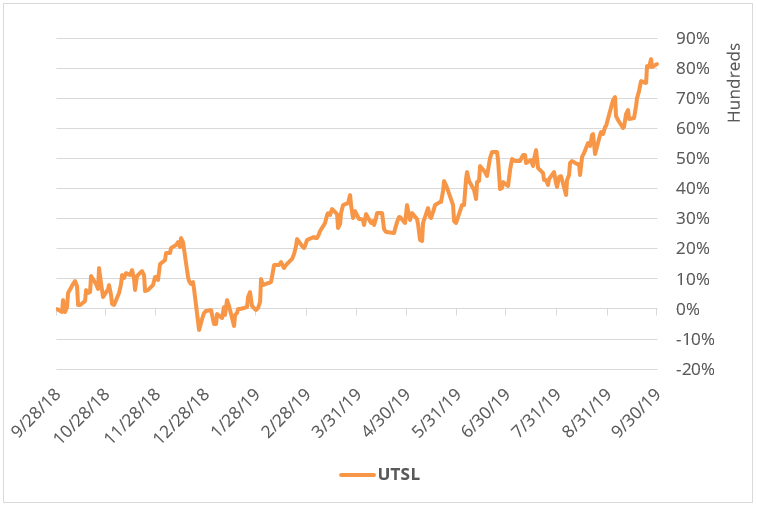

Utilities

Finally, the utilities industry has seen the highest upside of pretty much any other bullish ETF in Direxion’s catalogue (barring precious metals, of course). After 12 months of near constant growth, the Direxion Daily Utilities Bull 3X Shares (NYSE:UTSL) is up around 55% from where it was last year, in part because of the widespread volatility the rest of the market has seen.

Source: Bloomberg.Data as of September 23, 2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Although specific entities in the industry, like FirstEnergy Corp. (NYSE: FE) and Southern Co (NYSE: SO), have outperformed over the past 52 weeks, the primary reason utilities are up across the board is the sector’s reputation for stability. Not only do utility stocks provide relatively consistent appreciation compared to other equity investments, but the industry’s habit of offering dividends to investors makes them a good source of consistent income when other areas of the market underperform.

For leveraged ETF traders, that desire for reliability might be the primary takeaway from th

Related Leveraged ETFs

- Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL)

- Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN)

- Direxion Daily MSCI Real Estate Bull 3X Shares (DRN)

- Direxion Daily Utilities Bull 3X Shares (UTSL)

These leveraged ETFs seek investment results that are 300% of the return of its benchmark index for a single day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day.