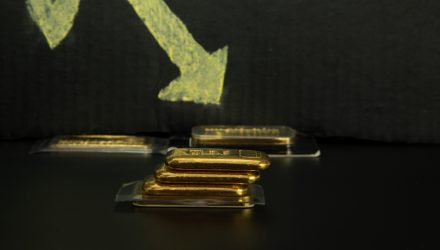

Commodities have been shedding the gains they’ve been building up amid inflation fears, and gold hasn’t been safe from the recent sell-off either. Fortunately, there are ways to get tactical using inverse exchange traded funds (ETFs).

Now, recession risks have been putting downward pressure on commodities after serving as an ideal inflation hedge amid rising consumer prices. Central bank tightening is now pushing rates higher to the point where growth could be hampered, causing a recession.

Right now, according to a Kitco News report, the European Union appears most at risk for a recession. However, it’s not an isolated issue.

“Europe may command the closest attention, but this is a global problem. In a world of rising interest rates and central banks hellbent on putting the inflation genie back in the bottle, we’ve seen clear evidence of demand destruction – commodities have been the default expression of this thematic and right now there is just no visibility on growth or what changes the trend – even though the market lives in the future, it feels like this gets worse before it turns around,” said Pepperstone’s head of research, Chris Weston.

Playing the Bearish Side of Gold Prices

If gold prices continue to falter, consider the Direxion Daily Gold Miners Index Bear 2X Shares (DUST). A broad sell-off in commodities is currently spilling over into gold and other precious metals after a strong first half of 2022.

“Commodities face a war on two fronts – demand destruction and king USD and this is causing some intense bear trends in commodities, and it wouldn’t be a stretch to think the systematic trend-following crowd would already be running hefty short positions in copper, silver, gold, U.S. gasoline and AG’s like wheat and soybeans,” said Weston. “Commodities are the default expression of recession risk – crude and gold get the flow from clients but for those who like momentum and trend this is the space to pay attention to.”

DUST seeks daily investment results before fees and expenses of 200% of the inverse of the daily performance of the NYSE Arca Gold Miners Index. The fund invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse or short leveraged exposure to the index equal to at least 80% of the fund’s net assets.

The index is a modified market capitalization-weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets and are involved primarily in mining for gold and, to a lesser extent, silver.

For more news and information, visit the Leveraged & Inverse Channel.