South Korea’s economy is recovering at an astounding rate, opening up opportunities for traders in the Direxion Daily South Korea Bull 3X Shares (KORU).

While the world is contending with another wave of Covid-19 infections, South Korea continues to forge on with a strong end to the second quarter.

“South Korea’s economy grew at its fastest pace in a decade in the second quarter on the back of robust exports and rebounding consumption, but the optimism was damped by a wave of Covid-19 infections,” a Financial Times article noted.

“Gross domestic product expanded 5.9 per cent from a year earlier in the April-June quarter, according to the Bank of Korea, partly owing to the low base effect from last year when the country was hit hard by the pandemic,” the article added. “Asia’s fourth-largest economy continued to exceed pre-crisis levels but momentum slowed, with GDP expanding 0.7 per cent from the previous quarter.”

KORU seeks daily investment results, before fees and expenses, of 300% of the daily performance of the MSCI Korea 25/50 Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

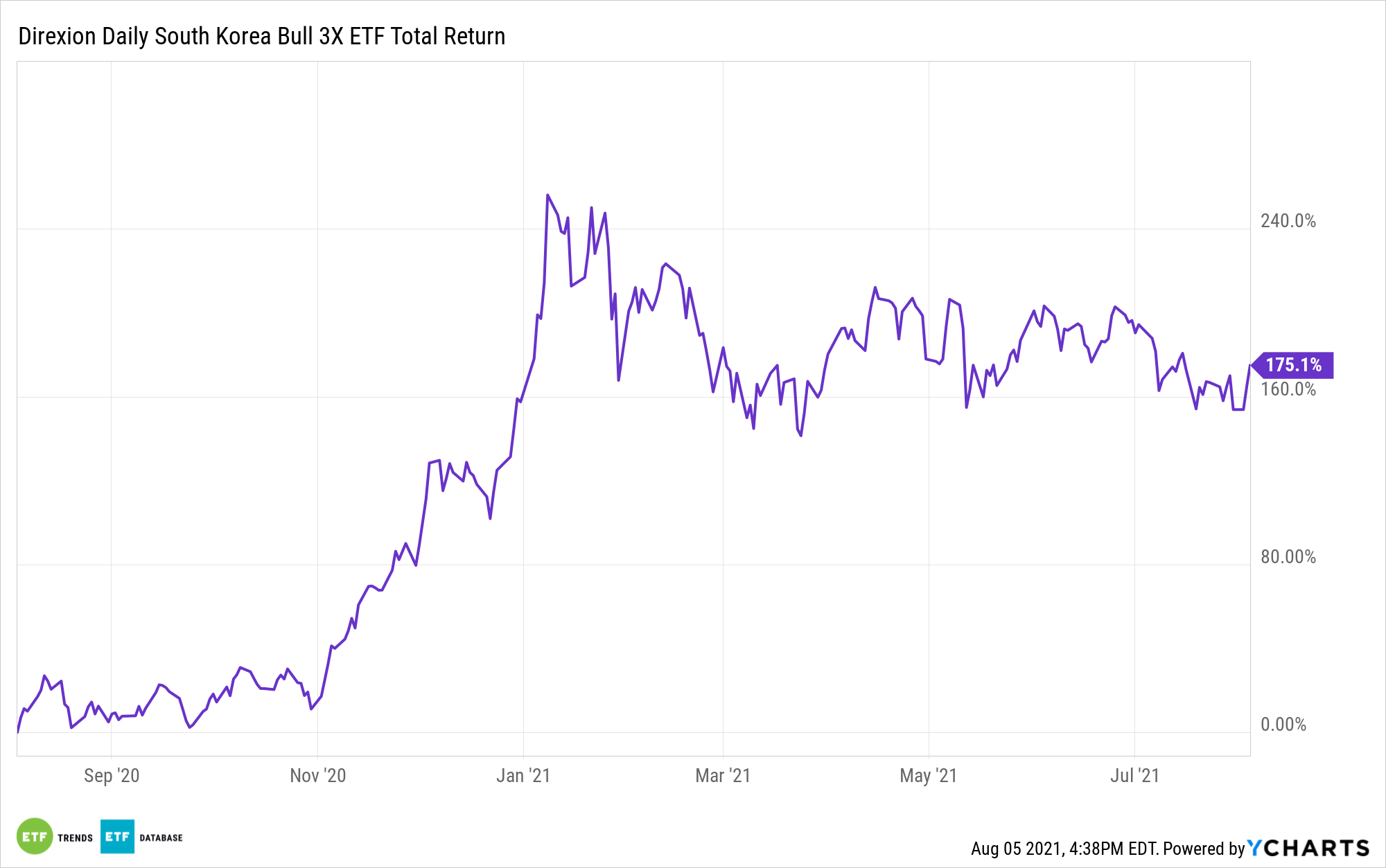

The index is designed to measure the performance 4of the large- and mid-cap segments of the South Korean equity market, covering approximately 85% of the free float-adjusted market capitalization of South Korean issuers. The fund has been a stellar performer the past year, rising to a gain of over 175%.

A Rise in South Korean Consumption

As the economy was undergoing the healing process, a rise in consumption has helped to spur a rise in exports. Semiconductors, vehicles, and ships have all seen heightened demand while spending rises in all business sectors public and private.

“The economic recovery was underpinned by a jump in exports amid robust demand for semiconductors, cars and ships, surging 22.4 per cent year on year in the second quarter,” the Financial Times article mentioned. “Private consumption and government spending rose 3.5 per cent and 3.9 per cent, respectively, quarter on quarter.”

For more news and information, visit the Leveraged & Inverse Channel.