With the rise in U.S. equities so far in 2019, it’s difficult to be a contrarian, but traders are finding opportunities in inverse exchange-traded products (ETPs) in futures, indexes, the greenback, and Treasury notes. More inverse opportunities could be had with fears of a global economic slowdown pairing up with a recent event–an inverted yield curve.

Investor fears of a yield curve inversion have been sending the markets on a volatile ride the past week. The short-term 3-month and longer-term 10-year yield curve inversion has been the prime focus the past week–an event that hasn’t been seen since 2007–just ahead of the financial crisis.

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. The inversion came after the central bank recently decided to keep interest rates unchanged. In addition, the central bank alluded to no more rate hikes for the rest of 2019 after initially forecasting two in December of last year.

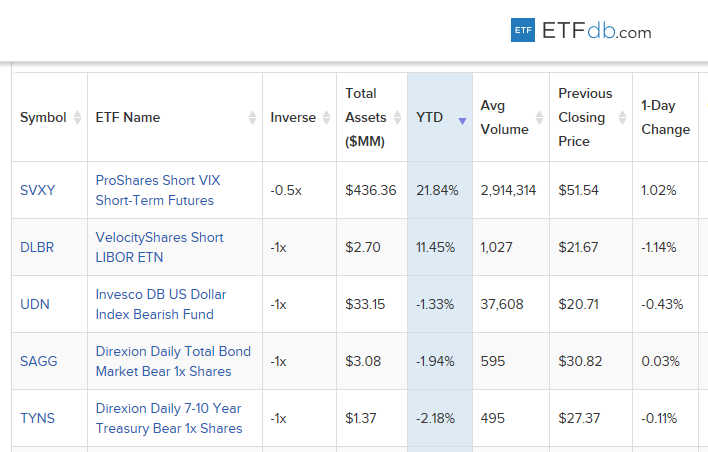

Even though a majority of inverse ETPs are experiencing a loss thus far year-to-date, the proper trigger event and a more dovish Fed can certainly result in their reversal of fortune. Here are the five best-performing inverse ETPs so far this year:

Chart via ETFdb.com

1. ProShares Short VIX Short-Term Futures ETF (NYSEArca: SVXY)

SVXY seeks daily investment results that correspond to one-half the inverse (-0.5x) of the performance of the S&P 500 VIX Short-Term Futures Index for a single day. The index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the implied volatility of the S&P 500 over 30 days in the future.

2. VelocityShares Short LIBOR ETNs (NYSEArca: DLBR)

DLBR’s short LIBOR ETNs are linked to the Janus Velocity Short LIBOR Index, which aims to approximate the daily performance of a hypothetical short position in the composite forward LIBOR rate, as if the composite forward LIBOR rate itself were an asset that could be shorted. It does so by tracking the return on a hypothetical long position in Eurodollar futures contracts, where that position is recalibrated daily to result in a return over the next Index Business Day that approximates the inverse of the percentage change in the composite forward LIBOR rate over that next day, subject to the short LIBOR floor.

3. PowerShares DB US Dollar Index Bearish (NYSEArca: UDN)

UDN seeks to track the changes in the level of the Deutsche Bank Short US Dollar Index Futures Index, which reflects the changes in market value over time, whether positive or negative, of a short position in the DX Contract which expires during the months of March, June, September and December. The fund seeks to track the index by establishing short positions in DX Contracts. DX Contracts are linked to the six underlying currencies, or the index currencies, of the U.S. Dollar index (USDX®), or the USDX®. The index currencies are Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

4. Direxion Daily Total Bond Market Bear 1X Shares (NYSEArca: SAGG)

SAGG seeks daily investment results of 100 percent of the inverse of the daily performance of the Bloomberg Barclays Capital US Aggregate Bond Index. The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse (opposite) or short exposure to the index equal to at least 80% of the fund’s net assets (plus borrowing for investment purposes). The index measures the performance of the investment grade, U.S. Dollar denominated, fixed-rate taxable bond market.

5. Direxion Daily 7-10 Year Treasury Bear 1x Shares (NYSEArca: TYNS)

TYNS seeks daily investment results equal to 100 percent of the inverse of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. The fund invests in swap agreements, futures contracts, short positions or other financial instruments that, in combination, provide inverse or short exposure to the index equal to at least 80% of the fund’s net assets (plus borrowing for investment purposes). The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years.

For more market news, visit ETFTrends.com.