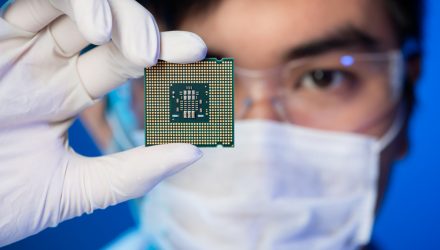

The global chip shortage could be wreaking havoc on the tech industry or if resolved, could help bring tech back to its dominant ways. Either way, Direxion Investments offers four ETFs to play the current tech scenario.

“The current scenario looks concerning for tech manufacturers, as mentions around new product and shipment delays rose by around 23% in Q1 2021. Additionally, 3% of the overall shortage mentions in Q1 2021 highlights that the adverse impacts are likely to last until 2022 or early 2023 due to the huge boom in demand,” said Rinaldo Pereira, senior business fundamentals analyst at GlobalData, in a release.

Betting on Semiconductors

First up, there’s the Direxion Daily Semiconductor Bull 3X ETF (SOXL), which seeks daily investment results equal to 300% of the daily performance of the PHLX Semiconductor Sector Index. The fund, under normal circumstances, invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

On the other side of the trade is the Direxion Daily Semiconductor Bear 3X Shares (SOXS), which seeks daily investment results equal to 300% of the inverse (or opposite) of the daily performance of the PHLX Semiconductor Sector Index. The fund also invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse (opposite) or short leveraged exposure to the index equal to at least 80% of the fund’s net assets (plus borrowing for investment purposes).

Both indices measures the performance of domestic companies engaged in the design, distribution, manufacture, and sale of semiconductors. This goes for both SOXL and SOXS.

Betting on Broad Tech

Traders can play the chip shortage with broad tech using the Direxion Daily Technology Bull 3X ETF (TECL). With its triple leverage, TECL seeks daily investment results equal to 300% of the daily performance of the Technology Select Sector Index.

The fund invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index includes domestic companies from the technology sector.

On the opposite side is the Direxion Daily Technology Bear 3X ETF (TECS). TECS seeks daily investment results, before fees and expenses, of 300% of the inverse (or opposite) of the daily performance of the Technology Select Sector Index.

For more news and information, visit the Leveraged & Inverse Channel.