Semiconductor companies were one of the sectors that looked dead in the water in the wake of the financial crisis over 10 years ago, but they’ve risen from the depths to become strong outperformers the past decade. ETF investors looking to continue to ride this wave should take a closer look at semiconductor-focused funds.

“Flash forward 10 years to the turn of a new decade, cutting-edge chipmakers stand out as the best-performing industry across sectors and regions, becoming the backbone of the economy through the prevalence of internet-connected devices,” a CNBC report noted. “Semiconductors now power the most essential products and technology to humankind, from advanced mobile networks to the iPhones of the world to the next-generation artificial intelligence.”

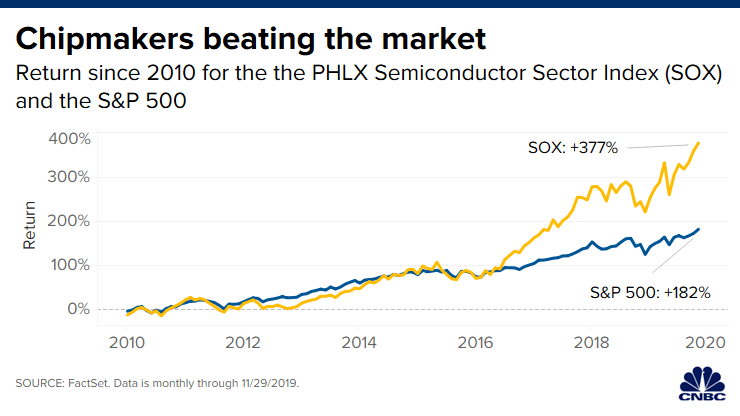

“The sector soared 377% in the past 10 years, more than doubling the S&P 500′s 182% climb,” the report added. “The biggest exchange-traded funds in the industry — the VanEck Vectors Semiconductor ETF which tracks the 25 largest U.S. chipmakers— also surged more than 400% this decade.”

“The industry seems to have benefited from bullish investor sentiment given the prospects for emerging technologies” in computing, storage, and enhanced connectivity, said Michael Cohick, VanEck’s senior product manager.

Here are three ETFs to look at for semiconductor exposure:

VanEck Vectors Semiconductor ETF (NYSEArca: SMH): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index. The index includes common stocks and depositary receipts of U.S. exchange-listed companies in the semiconductor industry. Such companies may include medium-capitalization companies and foreign companies that are listed on a U.S. exchange.

iShares PHLX Semiconductor ETF (NasdaqGM: SOXX): seeks to track the investment results of the PHLX Semiconductor Sector Index composed of U.S. equities in the semiconductor sector. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. The underlying index measures the performance of U.S.-traded securities of companies engaged in the semiconductor business. T

Direxion Daily Semiconductor Bull 3X ETF (NYSEArca: SOXL): for traders seeking a leveraged trade, SOXL seeks daily investment results, before fees and expenses, of 300% of the daily performance of the PHLX Semiconductor Sector Index. The fund, under normal circumstances, invests at least 80% of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index measures the performance of domestic companies engaged in the design, distribution, manufacture and sale of semiconductors.

For more market trends, visit ETF Trends.