Direxion’s weekly ETF fund flows could shed light on what traders are thinking. The top three point to interest in long-term bond prices, biotech strength, and semiconductor weakness.

Rising Yields, Biotech Bulls, and Chip Shortages

Traders could be banking on the expectation of rising yields and thus, falling bond prices. The Direxion Daily 20+ Yr Trsy Bear 3X ETF (TMV) seeks daily investment results before fees and expenses of 300% of the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

TMV invests in swap agreements, futures contracts, short positions, or other financial instruments that provide inverse or short leveraged exposure to the index, which is a market value weighted index that includes publicly issued U.S. Treasury debt securities that have a remaining maturity of greater than 20 years.

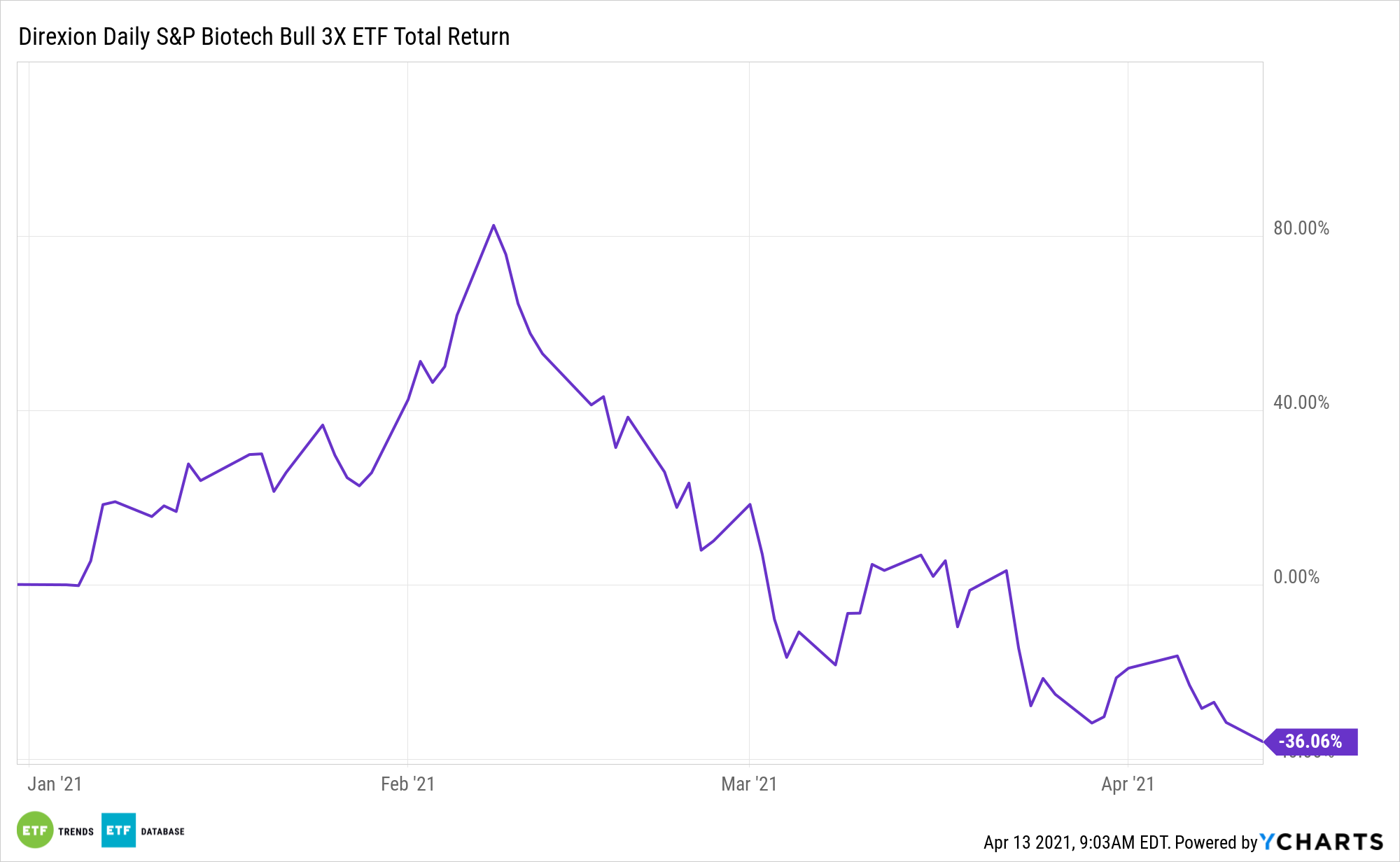

Is the Covid-19 trade still benefiting healthcare and biotech? If so, traders could see Direxion Daily S&P Biotech Bull 3x Shares (LABU) rebounding from recent weakness.

LABU seeks daily investment results of 300% of the daily performance of the S&P Biotechnology Select Industry Index. The fund invests at least 80% of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index, ETFs that track the index, and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index.

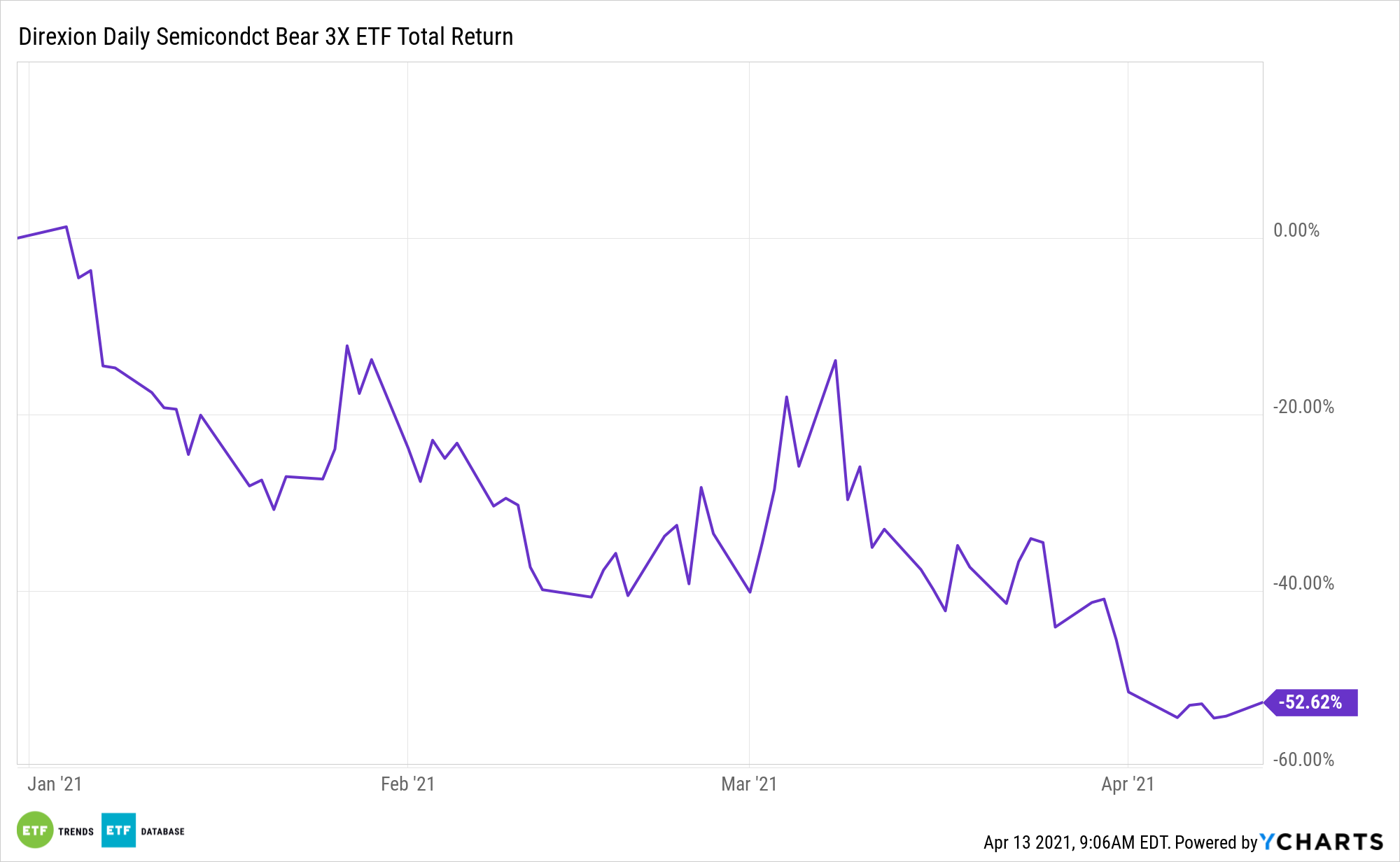

According to an NPR report, U.S. president Joe Biden is ready to tackle the ongoing chip shortage in the U.S as evidenced by a recent meeting with industry experts and policy advisors. A heavier reliance on tech has forced the need for chips, but without the supply to meet the heavier demand.

With this latest move by the president, are traders betting on chip prices to fall as supply ramps up? The Direxion Daily Semiconductor Bear 3X Shares (SOXS) seeks daily investment results, before fees and expenses, of 300% of the inverse (or opposite) of the daily performance of the PHLX Semiconductor Sector Index.

The fund, under normal circumstances, invests in swap agreements, futures contracts, short positions, or other financial instruments that, in combination, provide inverse (opposite) or short leveraged exposure to the index equal to at least 80% of the fund’s net assets (plus borrowing for investment purposes). The index measures the performance of domestic companies engaged in the design, distribution, manufacture and sale of semiconductors.

For more news and information, visit the Leveraged & Inverse Channel.