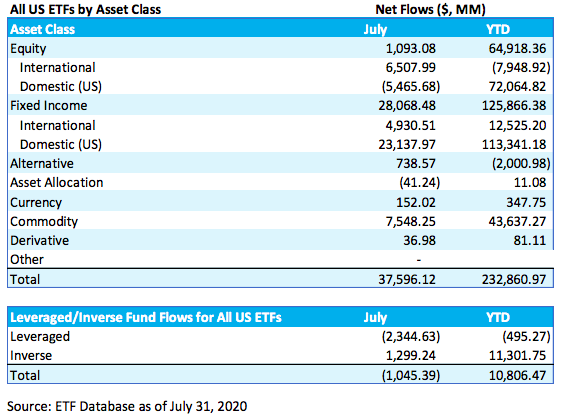

ETF flows for the month of July were over $37 billion, making for a solid but not record month of ETF inflows, and putting the year-to-date totals at $232 billion, on pace for an impressive, and possibly record-breaking, year.

While investors pulled money out of domestic U.S. equity focused ETFs, they overwhelmingly reallocated into fixed income ETFs, signaling a fairly traditional “risk off” move. Similarly, gold ETFs were responsible for nearly all of the $7.5 billion that flowed into commodities ETFs. These flows are counter to the narrative markets have been seeing since the dramatic drawdown in U.S. equity markets in March – that of an unfettered V-like recovery in stocks.

Inside the Bond Story

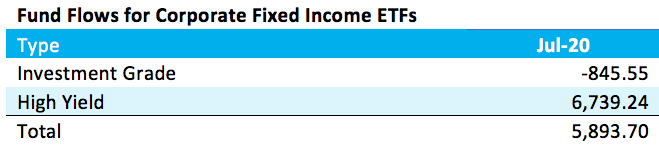

While it would be easy to assume that the bond flows are monolithic or simply chasing the Federal Reserve’s purchases of corporate bonds, the bulk of flows have been “threading the needle,” – favoring fixed income funds that provide either the potential for better-than-treasury yields or a modicum of duration protection while still generating some income. For example, in the corporate space, investors favored high-yield over investment grade:

Source: ETF Database as of July 31, 2020

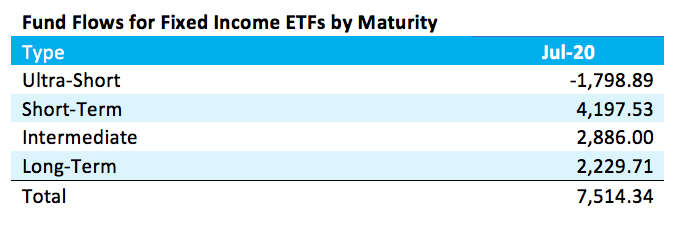

And from a maturity perspective, investors seem to be shedding some “cash-like” vehicles in favor of longer maturities:

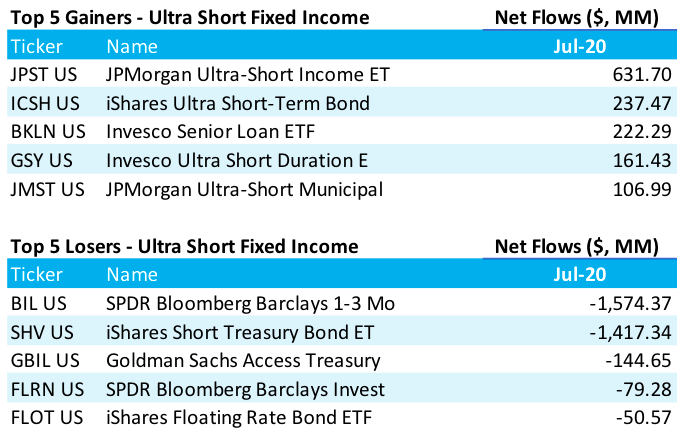

But even this doesn’t tell the complete story of how investors are fine tuning their exposures. Inside the “losing” category of ultra short funds, for example, we can see clear investor preferences:

As it’s become apparent that “lower for longer” is the new normal in Federal Reserve policy, investors are looking to alternative strategies for their exposures, no matter how short the expected duration, whether it’s through actively managed approaches like the JPMorgan Ultra-Short Income ETF (JPST), or fixed-income alternatives like Senior Loans.

While it’s sometimes difficult to see it in the daily reporting on the equity markets, ETF investors have sent a clear signal through July flows: they’re looking for lower-risk alternatives to the growth oriented firms that have dominated the headlines, with just a touch of income.