By Jack Forehand

Value investing is far from an exact science. Not only is there significant debate about the proper metrics to use to define value, but there is also conceptual debate as to what value investing is in the first place.

For systematic value investors, value represents something along the lines of the Ben Graham approach to value. It means buying stocks that are cheap using current financial metrics like book value or earnings or cash flow. But for other investors, value means buying quality companies and trying to acquire them as cheaply as possible. This is more in line with the Warren Buffett style of investing. And there is a third group who take the definition of value even further to mean buying anything at a discount to its future potential. For example, Cathie Wood referred to her holdings in a recent article as deep value stocks because of the discount she feels that they trade at to their future potential. And as much as that may make value investors like me a little uneasy, the reality is that in the past decade she has been right.

Regardless of the value style you advocate, one rule that has been pretty consistent throughout history is that as you move up the quality spectrum and acquire better companies, there is a price you have to pay for that from a valuation standpoint. Investing in high quality companies like Buffett is certainly a sound investment strategy, but even advocates of the strategy understand that to get these types of companies you have to pay a higher price relative to current fundamentals.

There are infrequent times, however, when this inverse relationship between value and quality can break down, and those times can offer a unique opportunity for long-term investors.

In my article last week, I looked at the fact that much of the returns of value funds since the market bottom has been driven by factors other than value. When you take a look at the factors that have driven the best performing value funds over that period, size and negative quality have played a bigger role than value has. In other words, cheap stocks have performed very well, but it didn’t happen because they were cheap.

Although that fact hasn’t been great for value funds that utilize quality in their process in the past year, it could be a significant positive for their expected returns going forward.

As low quality value stocks have gotten more expensive, the valuation spread that their higher quality counterparts usually enjoy over them has mostly disappeared. This has created a unique situation in which buying high quality value companies no longer costs more than buying value stocks further down the quality spectrum. In the current market, you could argue that you don’t have to choose between being Ben Graham or Warren Buffett because you can get Buffett quality for Graham prices (at least on a relative basis).

A Look at Value ETFs Through a Factor Lens

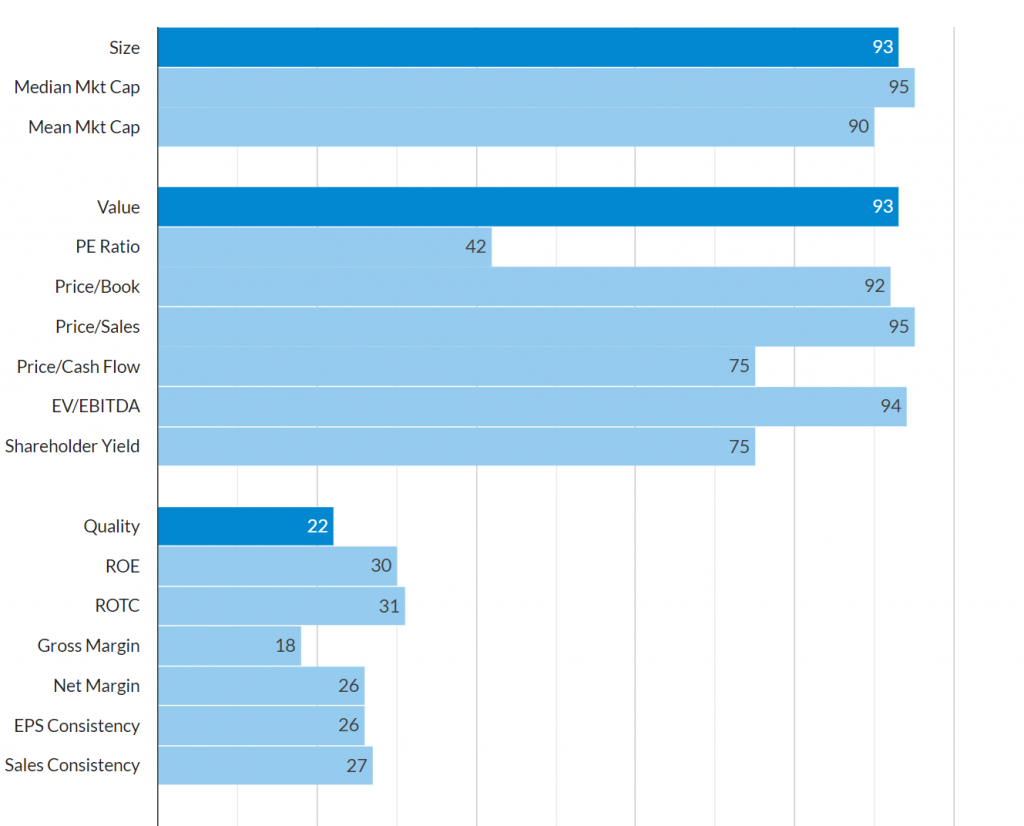

To illustrate this, let’s look at our ETF tool and look at one of the best performing value funds off the bottom. Below is the factor report for the Avantis Small-Cap Value ETF.

Its profile looks very similar to many value funds that have produced the best performance in the past year. It has significant exposure to value, significant exposure to size and low exposure to quality. This is a perfectly reasonable way to construct a value strategy, since negative quality typically comes with the territory of buying cheap stocks, and value has historically worked better in the small-cap space.

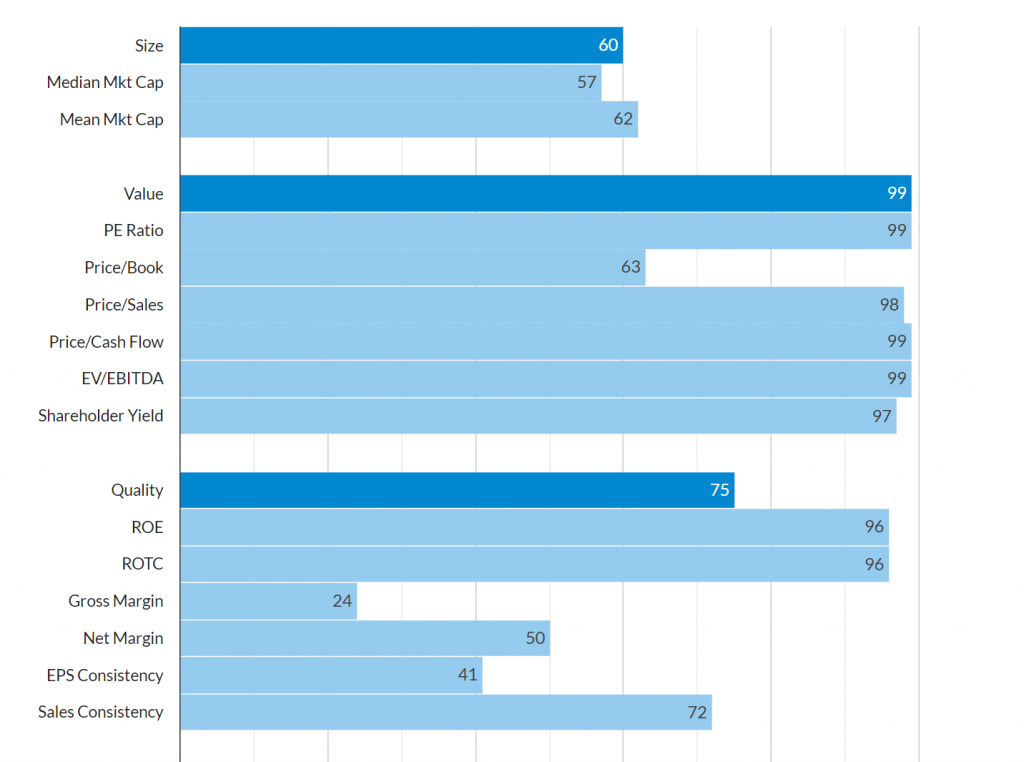

Now let’s look at the Alpha Architect Quantitative Value ETF (QVAL)

A few things should stand out right away relative to the other ETF. First, this ETF actually has more value exposure right now. Second, it has substantually more exposure to quality. So unlike what is normally the case, the big recent run up in the so-called “junk” stocks has created a situation where the usual trade off between value and quality doesn’t seem to exist and value investors can acquire higher quality stocks without having to pay up for them.

The Rise of High Quality Within Value

To look at this another way, I looked at our factor data for our investable universe (about 2800 stocks) and looked at the cheapest 10% of stocks both at the market bottom last March and today. I then looked at what percentage of those stocks were in the top 20% of our universe based on their quality scores. So the idea here is to look at the cheapest stocks and to then see how many of them are high quaity based on profitability, earnings and sales growth consistency, and the other metrics we measure.

Here are the results:

- Percentage of Value That Was High Quality on 3/26/2020: 12%

- Percentage of Value That Was High Quality of 3/15/2021: 24%

The results show the same thing as looking at the individual ETFs. Value investors today have twice as many high quality companies to choose from as they did at the market bottom. This is a direct result of the massive rally in low quality stocks that has left many high quality firms behind.

The Opportunity Within High Quality Value

So what does all of this mean? In the short-term, probably very little. There is no reliable way to time something like this and the so-called junk rally might continue for a long time. But for longer-term investors, the opportunity to buy high quality value stocks at the same price as their lesser quality counterparts certainly seems like a pretty good one. There is rarely a free lunch in investing, but the current quality dynamics within value may offer something close to one for patient investors.

Originally published by Validea, 3/17/21