Within the thematic space, the e-commerce industry can serve as a multi-sector play on strong consumer

spending combined with rapid technology growth. As many investors know, e-commerce has been

strengthening for several years, supported by mobile and internet penetration. E-commerce has grown steadily in the mid-teen percentage range since 2010, but the COVID-19 pandemic pulled forward e-commerce growth to the high 30% range throughout the end of 2020. Now with year-over-year growth averaging about 6.6% in 3Q21, the growth rate has diminished and seems somewhat “less exciting” at first glance. However, e-commerce sales continue to show positive growth at a more sustainable level than previous years despite tough comps in 2020 and 2021. E-commerce sales also remain a high portion of overall retail sales at levels above 13% since 3Q20—compared to 11% pre-pandemic. Today’s note discusses the S-Network Global E-Commerce Index (ECOMX) and how it captures e-commerce growth and future trends in consumer retail.

Why e-commerce now?

Several overarching trends have contributed to the strength in e-commerce. First of all, e-commerce has been excelling alongside the growth of mobile and internet usage. While it seems like the typical American household already has several mobile phones, tablets, and laptops, global cellular coverage is still extremely limited and possible reaches only 15% of the world.1 As cellular coverage expands with the help of 5G and commercial satellites, access to online purchases and e-commerce may increase. Second, consumer habits have been changing. Supply chain issues have created fears of shortages—particularly with food, beverages, and other grocery essentials. As long as funds are available, there is less opportunity risk to buy extra food/product rather than running out early (e.g., toilet paper in the height of the COVID-19 pandemic). These habits—in addition to movement into the suburbs and spending more time at home—have led to an increase in bulk buying (bulk product has increased over 2% since 2019 according to some sources), which may be cheaper and easier to order online.2 Third, remote work has been increasing with as many as 11% of total U.S. workers teleworking in December 2021 (for more corporate positions—measured by those with a Bachelor’s degree or higher—those percentages were in the 20-25% range).3 With less consumers making an afternoon commute, it’s not as simple to stop by stores on their way home from work. Instead, consumers may find it easier to order online, especially given faster shipping times (i.e., next day, same day). While companies like Amazon (AMZN) have led the push for faster shipping times, other logistics companies could become more competitive with the growth of automated and electrified last mile delivery services—for example, companies like United Parcel Service (UPS) and FedEx (FDX) are investing capital to modernize their delivery fleet for faster and more efficient delivery.

ECOMX supports e-commerce trends with a multi-sector approach to consumer retail strength.

The ECOMX index is constructed to represent the breadth of the e-commerce space and includes 60 equal-weighted constituents allocated evenly across each of its four main business segments—online marketplaces, online retailers, content navigation, and e-commerce infrastructure. Online marketplaces are among the most well-known and primary beneficiaries in the e-commerce space—these include constituents like Amazon (AMZN) and eBay (EBAY). These online marketplaces connect buyers with multiple sellers, typically via website and mobile app. In addition, most traditional brick-and-mortar retailers have shifted business models to incorporate online retailing. For example, large retailers like Walmart (WMT) have increased net e-commerce sales by over 30% in the first nine months of 2021 compared to the same time period in 2020.4 These online marketplaces/retailers are typically enabled by content navigation providers (e.g., advertisements, social media, consumer tracking). Finally, companies that supply infrastructure for e-commerce growth include anything from warehouses that hold inventory to transportation companies which can deliver goods as far as across the globe or as close as from store to household.

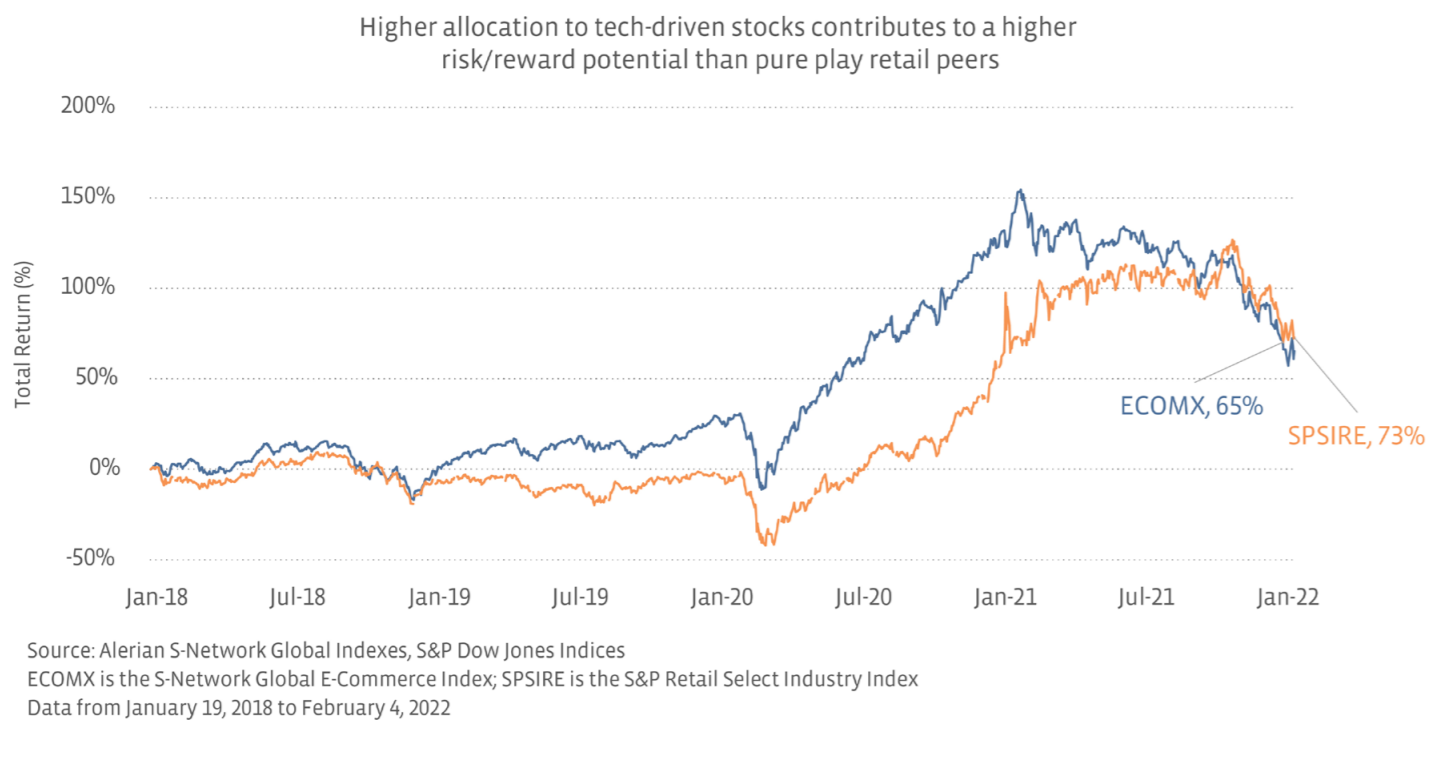

With the majority of online marketplaces and online retailers considered consumer discretionary stocks, this sector’s weighting in the ECOMX Index is currently about 40%. But the index is further differentiated from other consumer retail indexes (which typically hold 100% weighting toward consumer discretionary/staples) by a large weighting to tech and industrial-focused sectors. The heavier allocation to tech-oriented sectors gives the index a higher risk/reward potential compared to pure-play consumer retail indexes.

Bottom Line:

Investors who believe that traditional retail models are evolving may have interest in the growing e-commerce space. Because of its tilt toward higher growth tech-driven stocks, indexes like ECOMX may be able to provide higher reward in exchange for higher risk when compared to traditional retail peers.

The S-Network Global E-Commerce Index (ECOMX) is the underlying index for the First Trust S-Network

E-Commerce ETF (ISHP)

Related Research:

Holiday Travel Metrics Suggest 2022 Won’t Be 2020, Too

Digging into 2021 Gold Miners Index Performance

A Healthy Dose of Good News for SMID-Cap Biotech Indexes

Four Megatrends Elevating the Commercial Space Industry

Crypto Mining for Digital Gold is Turning Green

[1] Iridium Satellite Communications

[2] Two Years Into Pandemic, Shoppers Are Still Hoarding – WSJ

[3] Effects of the coronavirus COVID-19 pandemic (CPS) (bls.gov)

[4] Walmart 3Q2020 10-Q (sec.gov)

For more news, information, and strategy, visit ETF Trends.