By Micah Walter-Range, Founder, Space Investment Services LLC; Stacey Morris, CFA, Director of Research, Alerian and S-Network Global Indexes

The burgeoning global space economy has a wide range of participants across sectors and geographies. These companies are focused on various space-related activities from manufacturing or operating satellites to producing the equipment used on Earth to leverage systems in space. Given the diversity of activities and participants, a classification system tailored to the space industry can be a helpful resource for investors, allowing them to quickly assess the role a company plays in the space industry. This piece introduces the four sector classifications for constituents of the S-Network Space Index (SPACE), which serves as the benchmark index for the global space industry (read more). SPACE is also the underlying index for the Procure Space ETF (UFO), which is celebrating its two-year anniversary.

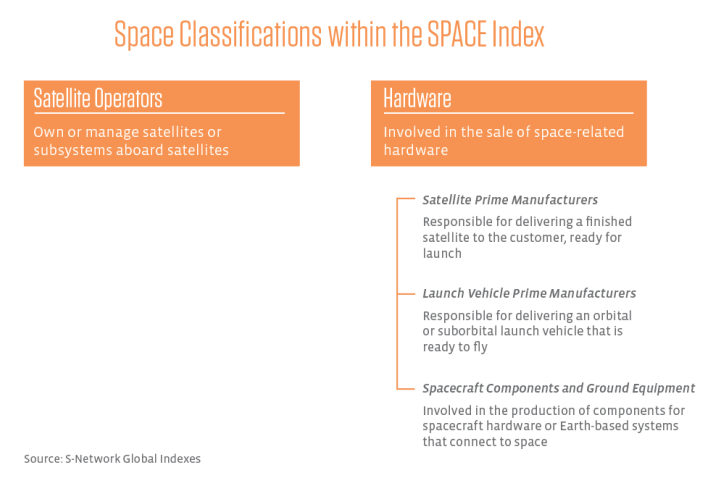

Introducing the Space Classifications within the SPACE Index

The SPACE Index includes two main business groupings – Satellite Operators and Hardware. Satellite Operators are companies that own or manage satellites or subsystems aboard satellites. Hardware companies are involved in the sale of space-related hardware. The Hardware segment is comprised of Satellite Prime Manufacturers, Launch Vehicle Prime Manufacturers, and Spacecraft Components and Ground Equipment. The following diagram includes a brief description of each classification with additional detail below.

Satellite Operators own or manage either satellites or subsystems aboard satellites. While some satellites are owned and operated entirely by a single company, others are the result of arrangements whereby some of the satellite’s capability is leased to other companies by the owner and managed by the lessee. Alternatively, a satellite may host additional hardware owned by a different company that simply plugs into the satellite’s main power and control systems.

Satellite Prime Manufacturers are responsible for delivering a finished satellite to the customer, ready for launch. In some cases, these manufacturers also operate the satellites after launch, either for their own business or on behalf of the customer who owns the satellite.

Launch Vehicle Prime Manufacturers are responsible for delivering an orbital or suborbital launch vehicle that is ready to fly. Due to the complexity of launches and the need for ready access to technical expertise for troubleshooting purposes, the prime manufacturer also tends to either conduct the launch itself or have a close working relationship with the launch operator.

Spacecraft Components and Ground Equipment companies are involved in the production of components for spacecraft hardware or Earth-based systems that connect to space. This category includes the companies that are part of the supply chain for the Prime Manufacturers. It also includes companies that produce the ground equipment necessary to gain value from space systems, such as antennas used for controlling satellites and receivers that are embedded into consumer electronics to enable access to space services such as GPS.

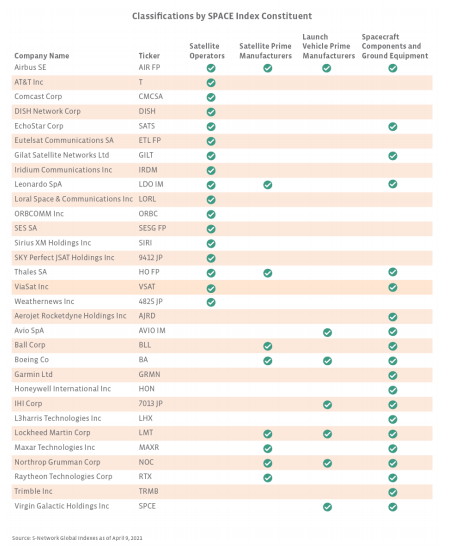

One of the distinguishing features of the SPACE Index is its emphasis on companies with pure-play space exposure. As discussed in the index methodology, 80% of the index by weighting is allocated to companies that generate at least 50% (but typically 100%) of their annual revenue from space-related activities. Whether pure-play space companies or diversified, all index constituents fit into at least one of these four classifications, and many companies, particularly in the Hardware grouping, fit into more than one category. The table on the following page shows the classifications for each of the 31 current index constituents.

While these four classifications are well-suited for the space industry of today, it bears noting that additional classifications could be required in the future. As discussed in the index methodology, there could one day be companies focused on space resource exploration and extraction, space colonization and infrastructure, or space tourism, including not only transportation but hospitality as well. As progress is made and new opportunities arise, it could warrant the addition of new space classifications to better reflect this dynamic industry.

How can investors and industry participants use these classifications?

Classification systems provide a simplified way to categorize companies within a sector. For the space industry, a classification system is particularly helpful given the variety of space-related business activities. Investors can use this classification system to gain a simplistic understanding of how certain companies participate in the space economy. Classifications can also be useful for investors in performing comparative analyses or attribution analyses for an index or portfolio of space stocks. For companies, particularly space pure plays, these classifications can help identify or validate competitors used for performance benchmarking or other comparisons. While these classifications are integral to the construction of the SPACE Index, they can also serve as a useful resource for investors and industry participants.

SPACE is the underlying index for the Procure Space ETF (UFO).

For a discussion of the investment considerations for the space industry, please see this note from January, Will the Space Industry Rise to New Heights in 2021?.

The space industry has grown into a far-reaching global economy. But how does one effectively seize exposure? Read our white paper SPACE: The Benchmark Index for the Global Space Industry.

Originally published by S-Network Global Indexes, 4/12/21

About Alerian and S-Network Global Indexes

Alerian is a leading independent index provider focused on building innovative, index-based investment strategies. The firm acquired S-Network Global Indexes in 2019, expanding their index offerings and services to partners. Combined, the firm serves the global investment community through indexing, benchmarking and calculation services. Built on a foundation of data rigor and specialty research, Alerian and S-Network Global Indexes offer a comprehensive family of energy, income, and thematic indexes. Today, the firms cumulatively have over $23 billion in total assets tracking its indexes and over 200 customers world-wide.