BondBloxx – October 2022 Commentary

▪ BondBloxx notes Positive corporate earnings, a visible end to rate hikes, and attractive valuations drove returns higher for equities and spread-based products during late October, contrasting with further weakness in Treasury products.

▪ Broad equities rose +8.1% and provided underlying support for tighter spreads across High Yield markets as strong earnings buoyed the outlook for corporate balance sheets.

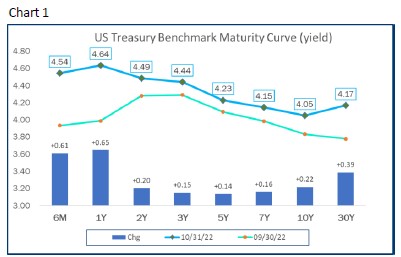

▪ The prospect for this week’s rate hike and uncertainty about further inflation drove short-end yields higher while longer-term economic health impacted rates at the 30-year point. (Chart 1)

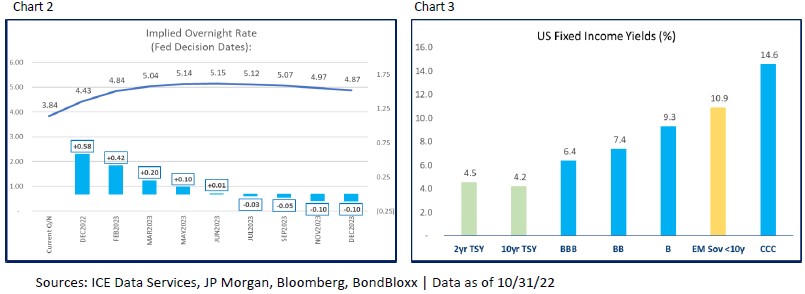

▪ Following Wednesday’s (as-expected) +75 bps hike to 4.00, the market now expects a peak Federal Reserve rate of about 5.2% following hikes into Q1 2023. (Chart 2)

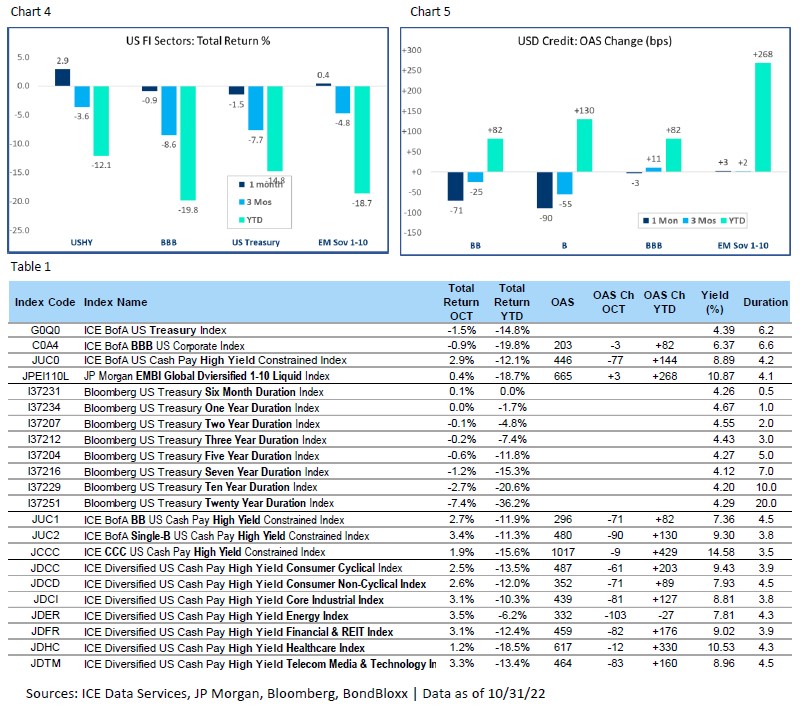

▪ High Yield spreads tightened by 77 bps for the month, with single-B bonds a full 90 bps tighter, and a total return of +3.4%.

▪ Emerging Market Sovereign debt eked out a +0.4% return for the month.

▪ BBB corporates were down slightly as rate weakness drove returns lower. (Table 1)

Fixed Income Sector Performance

▪ October saw the 2nd strongest month of performance in High Yield and Emerging Market Debt, with investors reacting to strong corporate earnings and the outlook for stable rates in Q1 2023.

▪ With many bond classes on track to cap off the worst performance in over 40 years, investors have found safety, and now higher expected returns, in the short-end of the treasury curve.

▪ High Yield returns (+2.9%) were driven by sharply tighter spreads throughout the month, while Emerging Markets turned to positive territory with a +0.4% return.

U.S. High Yield Ratings Performance

▪ High Yield performance was positive across all ratings buckets in October, with single-B’s leading the asset class with a +3.4% total return, compared to +2.7% for BBs and +1.9%for CCCs.

▪ The Single-B category benefitted from a strong corporate and growth outlook, while being less impacted by recession fears and continued rising rates fears.

▪ Single-B and BB names are nearly tied for year-to-date returns of -11.3% and -11.9%, respectively, while CCCs are down over 15%.

▪ As a reminder, market-cap weighted measures of U.S. High Yield are comprised approximately of 50% BB, 40% single-B, and 10% CCC (and lower) rated securities.

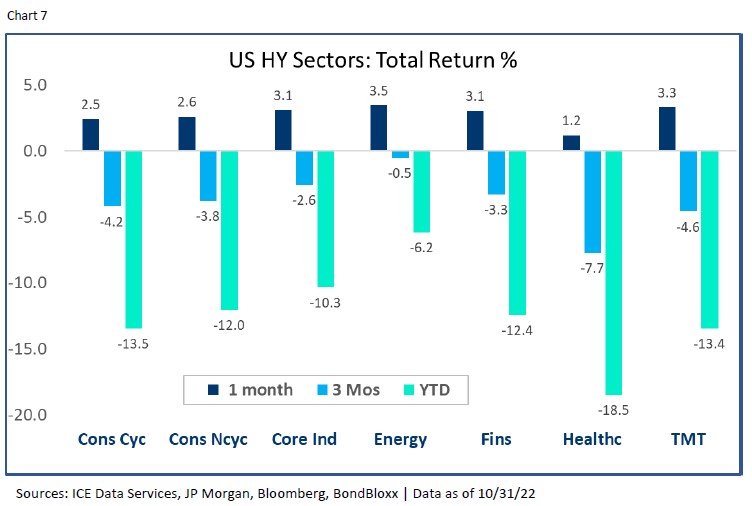

U.S. High Yield Sector Performance

▪ High Yield reported a positive market return of +2.9% in October, with a range of over 200 bps between best and worst sector. For the YTD period, there was a 12% difference between the top performing sector and the lowest performing sector.

▪ With a stabilization of oil prices and strong earnings from oil and gas companies, High Yield Energy led performance in October, with a +3.5% return, though TMT, Financials, and Industrials weren’t far behind, all up over 3.0% on the month.

▪ With impacts from specific credit issues, cost pressures, and COVID impacts, High Yield Healthcare lagged, reporting returns of +1.2% for the month and -18.5% year-to-date.

DISCLOSURES

Carefully consider each Fund’s investment objectives, risks, charges, and expenses before investing. This and other information can be found in each respective Fund’s prospectus or, if available, the summary prospectus, which may be obtained by visiting www.bondbloxxetf.com. Read the prospectus carefully before investing.

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on.

Distributor: Foreside Fund Services, LLC.

BondBloxx Investment Management Corporation (“BondBloxx”) is a registered investment adviser. The content of this presentation is intended for informational purposes only and is not intended to be investment advice. Not for distribution to the public.

Nothing contained in this presentation constitutes investment, legal, tax, accounting, regulatory, or other advice. Information contained in this presentation does not constitute an offer to sell or a solicitation of an offer to buy any shares of any BondBloxx ETFs. The investments and strategies discussed may not be suitable for all investors and are not obligations of BondBloxx.

Decisions based on information contained in this presentation are the sole responsibility of the intended recipient. You should obtain relevant and specific professional advice before making any investment decision. This information is subject to change without notice.

BondBloxx makes no representations that the contents are appropriate for use in all locations, or that the transactions, securities, products, instruments, or services discussed are available or appropriate for sale or use in all jurisdictions or countries, or by all investors or counterparties. By making this information available, BondBloxx does not represent that any investment vehicle is available or suitable for any particular investor. All persons and entities accessing this information do so on their own initiative and are responsible for compliance with applicable local laws and regulations.

Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent ratings services, such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength or it’s ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which are the highest grade, to ‘D’, which is the lowest grade.

Index performance is not illustrative of fund performance. One cannot invest directly in an index. Please visit bondbloxxetf.com for fund performance.

Institutional Use Only – Not For Distribution to The Public