Small cap strength is showing itself in the Russell 2000, which is up over 46% within the last six months. The Invesco S&P SmallCap Value with Momentum ETF (XSVM), which is up almost 60% in that same time frame, adds dashes of value and momentum to the mix.

At a total expense ratio of 0.39%, XSVM seeks to track the investment results (before fees and expenses) of the S&P Small Cap 600 High Momentum Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains and calculates the underlying index, which is designed to track the performance of approximately 120 stocks in the S&P SmallCap 600® Index that have the highest “value” and “momentum” scores.

XSVM has gained almost 13% heading out of Q4 2020 and into the new year.

September 18, 2020 marked the point at which the 50-day moving averaged crossed up over the 200-day moving average. This ‘golden cross’ is typically followed by a bullish uptrend and the fund did exactly that by gaining over 40% since that day.

When applying a momentum indicator like the relative strength index (RSI), XSVM holds just below overbought levels to confirm the strong momentum. Adding the value factor to the fund helps screen out quality names within the index.

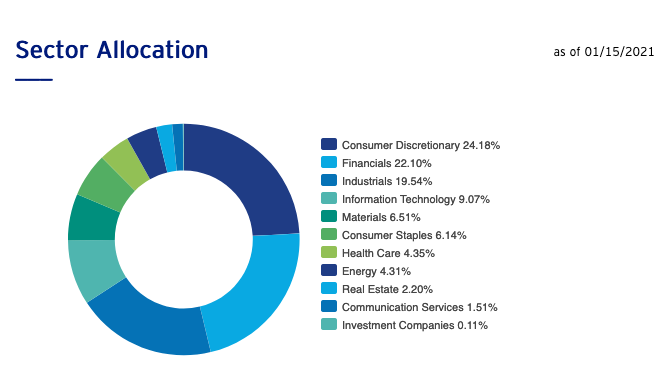

The portfolio’s holdings are a mixed bag. At the top, there’s a concentrated dose of consumer discretionary allocation, while financials and industrials round out the top three sectors.

Outpacing the Russell 2000 and MSCI Indexes

The ETF has outperformed the Russell 2000 index by about 12%. Screening out holdings for momentum and value appears to be working in the fund’s favor.

When extrapolating value and momentum, into two separate indexes via the MSCI ACWI Small Cap Value and MSCI EAFE Small Cap Momentum, XSVM also outperforms both those indexes. Compared to the value index, XSVM is higher by over 20% and when compared to the momentum index, the ETF is up over 30% higher overall.

For more news and information, visit the Innovative ETFs Channel.