E-commerce or online retail has been a growing trend that quickly accelerated this year due to the coronavirus pandemic. Investors can also look to exchange traded fund strategies to capture this shift in consumer habits.

“This year has been a particularly strong growth year for online shopping for all products. As COVID-19 concerns kept people away from stores, many shopped online for the first time. Online grocery shopping especially received a boost. While some may see this as a temporary state of affairs, we do not agree. In our opinion, the growth of e-commerce is a fundamental structural trend that has been accelerated by recent events, one whose ‘demand has been brought forward,’ as the economists would say, so that the base level will remain higher even when we’re past the pandemic,” George Evans, Chief Investment Officer, Global Equities, Invesco; and Alice Fricke, Senior Client Portfolio Manager, Invesco, said in a research note.

A Short-Term Jump, A Long-Term Reality

“This ‘step-up’ in demand was caused by an unforeseen event, but this long-term structural growth trend was and is clear. We expect the reorganization of retail to continue, and we expect to continue finding investment opportunities among companies benefitting from this theme,” the strategists added.

The new structural demand growth trend among shoppers around the world can potentially provide rewarding opportunities for investors. Investors should target these companies found all along the chain of activities that are necessary to online shopping. For example, investors can look to retailers seeking to sell goods online or e-commerce platform firms that can provide them with the ability to build an store.

Furthermore, digital payments are a sensitive part of this transaction process, and there are companies specialized in online payments, providing their services to the platform firms.

Due to this new industry that has produced various disruptors in the traditional retail sector, “we’ve seen the rise of some highly specialized ‘category killers’ with significant technological leads, in various industries, at each of these chokepoints,” the strategists noted.

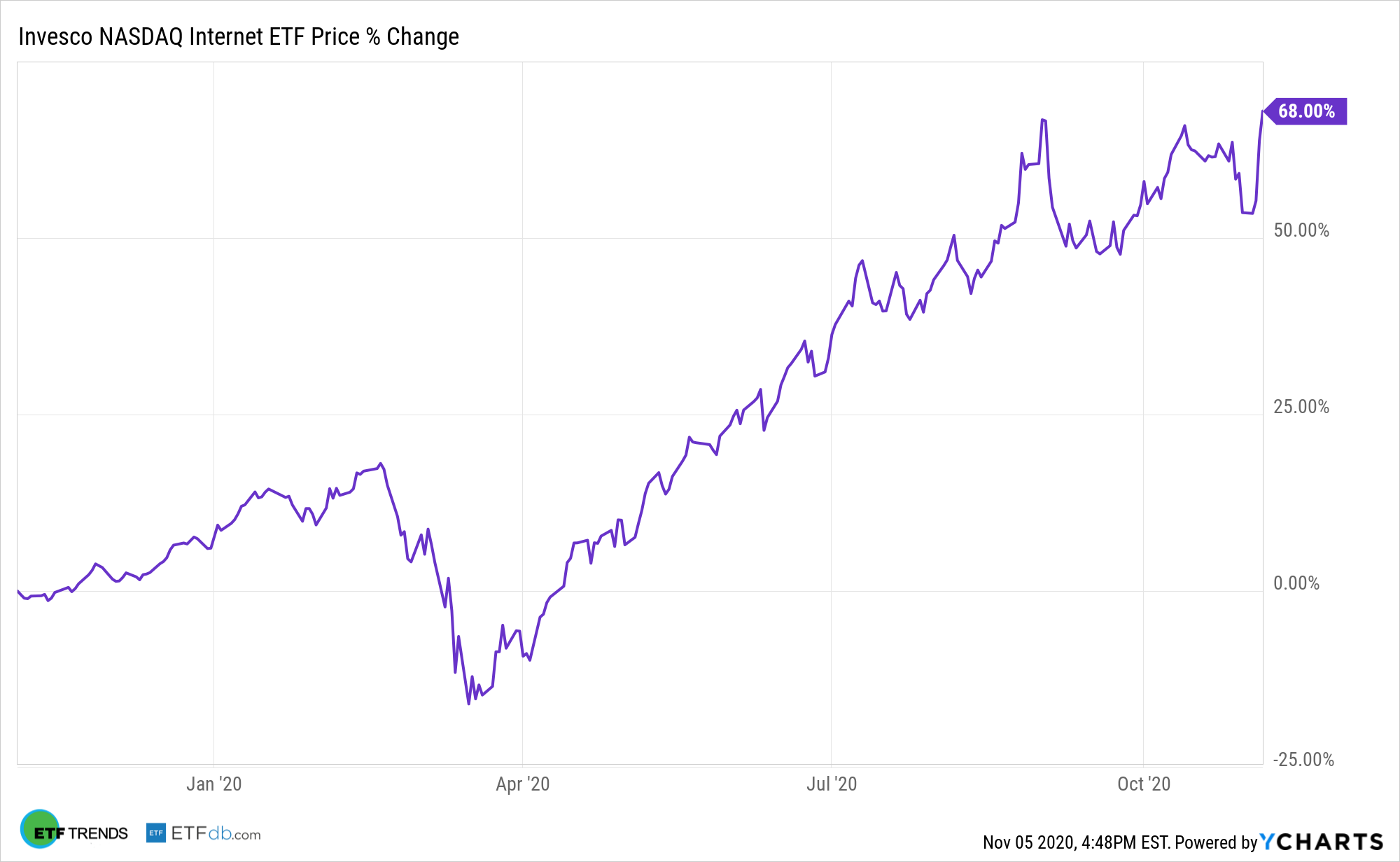

As a way to capture this rise in online shopping, investors can look to ETFs like the Invesco NASDAQ Internet ETF (NASDAQ: PNQI). PNQI tracks the NASDAQ Internet Index. The underlying index is designed to track the performance of the largest and most liquid U.S.-listed companies engaged in Internet-related businesses that are listed on one of the three major U.S. stock exchanges. Top sector weights include 30.4% internet & direct marketing retail, 23.9% interactive media & services and 20.8% software. Top holdings include e-commerce giants like Alibaba Group 8.1% and Amazon.com 7.4%.

For more news and information, visit the Innovative ETFs Channel.