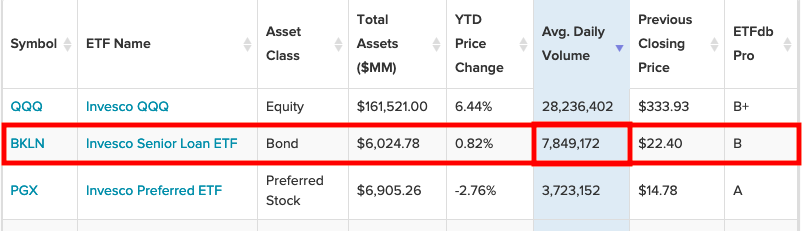

The Invesco Senior Loan ETF (BKLN) is seeing the second highest average daily volume in Invesco’s ETF lineup. What’s causing investors to flock to this senior debt ETF?

The pandemic put credit agencies on alert for more potential defaults during a weakened economy, but a new risk is emerging. Climate risk in the form of harsh winters throughout the U.S. could pose a problem for creditworthiness, which warrants the need for debt investors to be in senior loan position.

“Climate change has made the world a riskier place,” an International Monetary Fund blog article said. “The destruction wrought by heatwaves, droughts, hurricanes, and coastal flooding doesn’t stop with the toll on human lives and livelihoods—it can also have deep consequences for a country’s finances.”

“Recent IMF staff research has found that a country’s vulnerability or resilience to climate change can have a direct effect on its creditworthiness, its costs of borrowing, and, ultimately, the likelihood it might default on its sovereign debt,” the blog added further.

BKLN seeks to track the investment results of the S&P/LSTA U.S. Leveraged Loan 100 Index. The Adviser and the fund’s sub-adviser define senior loans to include loans referred to as leveraged loans, bank loans, and/or floating rate loans.

Banks and other lending institutions generally issue senior loans to corporations, partnerships, or other entities. Senior loans are typically used for business recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s loan portfolio will include the purchase of loans from banks or other financial institutions through assignments or participations.

Senior Loan Investing Advantages

As the pandemic continues to put stricter underwriting requirements on borrowers, senior loans are relatively safe. The higher risk of default for a borrower, the more important it is to be in senior position.

BKLN may acquire a direct interest in a senior loan from the agent or another lender via an assignment or an indirect interest in the loan by participating in another lender’s portion of a loan. BKLN sells the loans within the portfolio through an assignment, but it may also sell participation interests in the loans in order to fund redemption requests.

The inherent risks associated with senior loans are similar to the risks of junk bonds, but have seniority in the event of borrower default so if the business is forced to sell its assets in a liquidation scenario, the senior loan will be paid first. In addition, senior loans are secured by assets whereas junk bonds are not, making them a more attractive investment option when constructing a loan portfolio.

For more news and information, visit the Innovative ETFs Channel.