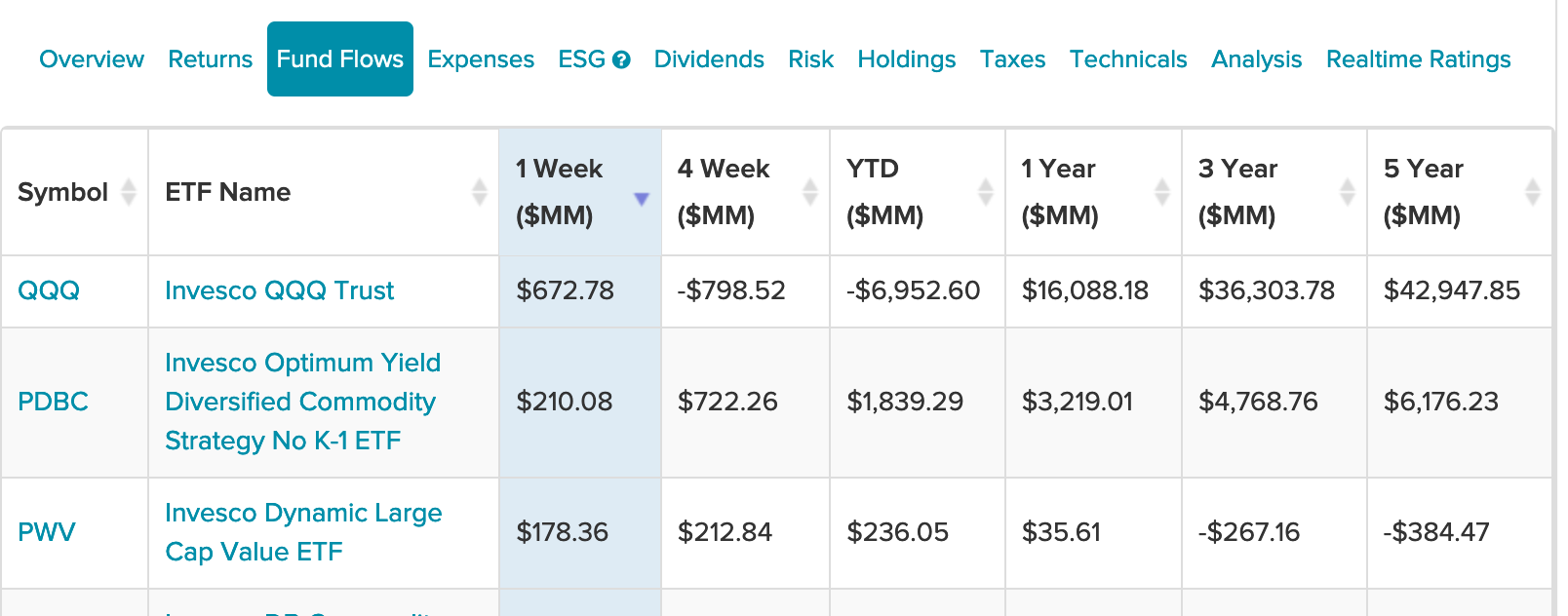

Exchange traded fund (ETF) inflows can provide insight on where money is going given certain event-driven scenarios. In the case of Russia’s invasion of Ukraine, that was readily apparent in the inflows to certain Invesco ETFs.

When market volatility hits, the Invesco QQQ Trust (QQQ) is always a favorite. With its heavy trading liquidity and broad market exposure to heavy-hitters in big tech, it’s a choice for short-term and long-term investors alike.

However, QQQ can’t have all the inflow fun.

Commodities and Large-Cap Value

Inflation remains top-of-mind for investors, and one way to hedge against it is commodities. As such, the ETF with the second highest inflows is the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

By using an active management strategy, PDBC seeks long-term capital appreciation. The fund seeks to achieve its investment objective by investing in a combination of financial instruments that are economically linked to the world’s most heavily traded commodities.

Commodities are assets that have tangible properties, such as oil, agricultural produce, precious metals, or raw metals. They give investors alternative assets that are relatively uncorrelated to broad stock market indexes.

Furthermore, PDBC offers exposure to commodity futures without the tax hassle of a K-1. The fund also attempts to avoid “negative roll yield,” which could erode returns over time.

To help smooth out volatility, one option is to add more large-cap stability with a touch of value. So rounding out the top three in inflows is the Invesco Dynamic Large Cap Value ETF (PWV).

PWV is based on the Dynamic Large Cap Value Intellidex℠ Index, which is designed to provide capital appreciation while maintaining consistent stylistically accurate exposure. The Style Intellidexes apply a rigorous 10-factor style isolation process to objectively sort companies into their appropriate investment style and size universe.

For more news, information, and strategy, visit the Innovative ETFs Channel.