The Federal Reserve decided to continue to stand pat on interest rates during Wednesday’s trading session. This move could see fixed income investors taking on more risk in order to obtain yield, good news for ETFs like the Invesco BulletShares 2021 High Yield Corporate Bond ETF (BSJL).

“The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals,” the latest Fed statement said. “The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic.”

BSJL seeks to track the investment results (before fees and expenses) of the Nasdaq BulletShares® USD High Yield Corporate Bond 2021 Index. The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index.

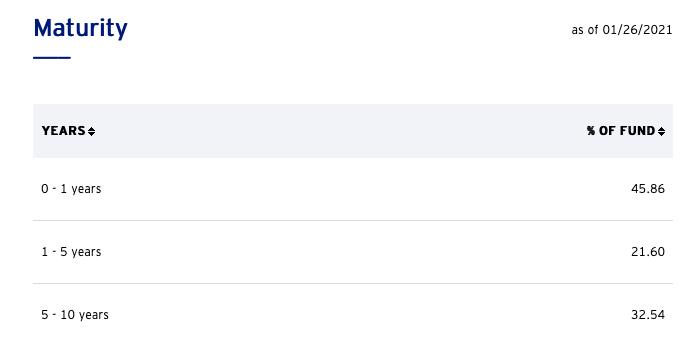

The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated high yield corporate bonds (commonly known as “junk bonds”) with maturities or, in some cases, “effective maturities” in the year 2021 (collectively, “2021 Bonds”). Delving deeper into its debt holdings, investors can affirm that maturities are on the short side of duration, as about 67% of the maturity dates don’t exceed five years.

BSJL Benefitting from the Corporate Bond Rally

BSJL’s case can is helped by the latest corporate bond rally. As investors are more apt to assume risk as a global vaccine helps to stymie the economic effects of the pandemic, look for more interest in high yield.

“Hopes for an economic rebound and a slowdown in borrowing have powered U.S. corporate bonds to a strong start in 2021,” a Wall Street Journal article noted. “As of Thursday, the average extra yield, or spread, investors demanded to hold investment-grade corporate bonds over U.S. Treasurys was 0.93 percentage points, according to Bloomberg Barclays data. That was down from 1.05 percentage points one month ago and the narrowest gap since January 2020.”

“The move reflects investors’ growing confidence that highly rated U.S. companies will endure the pandemic, boosted by vaccine rollouts, economic stimulus and easy money from the Federal Reserve,” the article added further. “Spreads had widened sharply during 2020’s early year market turmoil, when many investors feared the pandemic would spark a wave of defaults and bankruptcies, fueling losses in corporate debt.”

For more news and information, visit the Innovative ETFs Channel.