Inflation worries continue to swirl about the capital markets. Investors can help ease their fears with the Invesco DB Commodity Index Tracking Fund (DBC).

Commodities consist of assets that have tangible properties. Prominent examples include oil, agricultural produce, precious metals, and raw metals. They give investors alternative assets that are relatively uncorrelated to the stock market.

Additionally, rising prices in these products can offer investors a hedge against inflation. Why is this important?

“Because rising prices can have a damaging effect on an investor’s money,” Invesco said on its website. “They reduce the purchasing power of every dollar, meaning that it requires more money to purchase the same good today then it did yesterday when prices were lower. As a result, holding onto cash or being in an investment that doesn’t keep up with inflation is a losing proposition. One way to help combat this threat is by having an allocation to commodities.”

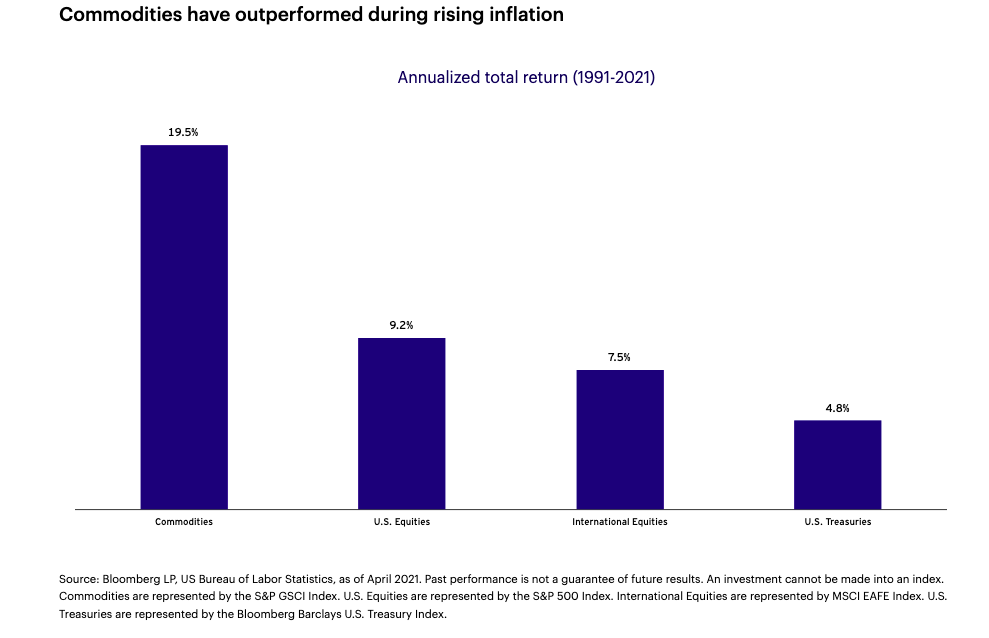

Commodities have also outperformed the broader market during stretches of rising inflation.

Per the fund’s description, DBC seeks to track changes, whether positive or negative, in the level of the DBIQ Diversified Agriculture Index Excess Return™ (DBIQ Diversified Agriculture Index ER or Index), plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income less the fund’s expenses.

An Active Option with Tax Benefits

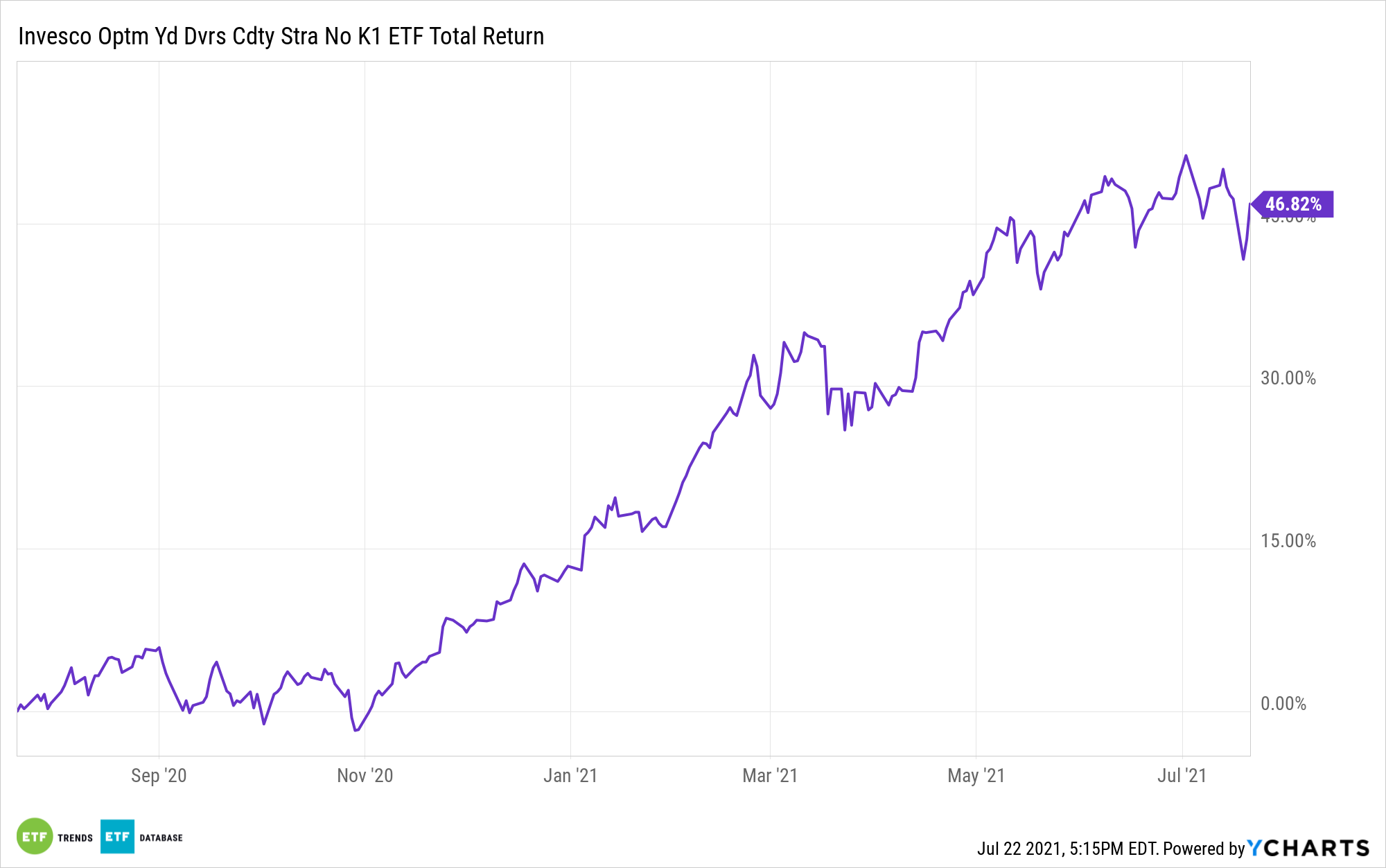

Another option is the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC). The primary difference with this ETF is its active management component and tax benefits.

By using an active management strategy, PDBC seeks long-term capital appreciation. The fund seeks to achieve its investment objective by investing in a combination of financial instruments that are economically linked to the world’s most heavily-traded commodities.

PDBC offers exposure to commodity futures without the tax hassle of a K-1. The fund also attempts to avoid “negative roll yield,” which could erode returns over time.

Both of these ETF products can potentially benefit from the economic growth because of their 55%-60% exposure to energy. Demand for oil, which is considered “energy” in this instance, may grow from the reopening as more cars hit the road and airline traffic increases.

For more news and information, visit the Innovative ETFs Channel.