The tax filing deadline was extended to mid-May, that day is still approaching quickly. Investors who held the Invesco S&P 500 Equal Weight ETF (RSP) will incur zero capital gains in 2020.

RSP equally weights its holdings, so the ETF leans toward smaller companies with reduced concentration risk when compared to the cap-weighted benchmark S&P 500 Index. The size factor offers the potential higher-than-benchmark returns associated with relatively smaller stocks within the universe being considered.

Smaller capitalization companies tend to have higher growth potential, and are less widely researched. Furthermore, they move closer in lockstep to the broader economy, but can exhibit more volatility when markets are fluxing up and down.

The ETF wrapper holds a number of benefits for assets like RSP.

“Unlike mutual funds, ETFs generally do not sell securities when investors redeem their shares,” a CFRA “Funds in Focus” market research report noted, highlighting RSP as one of the funds that incurred no capital gains tax last year. “Most trading takes place in the secondary market, with sell orders being crossed with buy orders through the exchange as they are with stocks.”

“One of the benefits investors in ETFs have historically enjoyed is strong tax efficiency,” the report added. “ETF-focused advisors and investors in 2020 received fewer surprises at year end and we expect more people that mix ETFs and mutual funds together will be more inclined to shift toward strategies to avoid paying higher capital gains taxes in the future. There are a range of strong tax-efficient actively managed and index-based ETFs to consider.”

Advantages of an Equal Weight Strategy

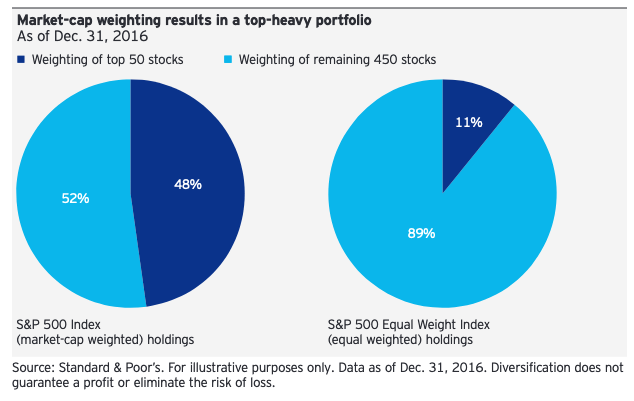

An Invesco “Strategy Insights” report recently highlighted the benefits of using an equally-weighted investment approach. A couple of those include diversification potential and historically higher returns when comparing the S&P 500 Index and S&P 500 Equal Weight Index (EWI).

“Due to market-cap weighting, performance of the S&P 500 Index can be dominated by a small number of stocks,” the report said. “The 50 largest securities in the index represent nearly 50% of its weight, leaving the next 450 stocks to account for the remaining 50%. The top 50 stocks in the S&P EWI, on the other hand, comprise just 11% of that index.”

“Equal weighting means every stock has the same potential influence on the returns of the S&P EWI, whereas in the S&P 500 Index, a stock with a weight of 2% has 10 times the influence of one with a weight of just 0.2%,” the report noted.

For more news and information, visit the Innovative ETFs Channel.