The energy sector seems to have all the momentum in a stock market that’s been feeling downward pressure from inflationary fears, which is evident in the Invesco DB Energy Fund (DBE), which is up almost 60% for the year.

It can be an ideal choice for investors looking to hedge their portfolios against inflation after the U.S. Federal Reserve just hiked the federal funds rate another 50 basis points. More rate hikes are expected through the rest of the year.

“Commodity exposure in a portfolio used to be a binary choice, either one invested in them, or they did not,” an ETF Database analysis says. “Now, commodities have been proven as powerful inflation hedging tools with the power to generate powerful returns for an individual portfolio.”

DBE seeks to track the DBIQ Optimum Yield Energy Index Excess Return, which is intended to reflect the changes in market value of the energy sector. The index commodities consist of light, sweet crude oil (WTI), heating oil, Brent crude oil, RBOB gasoline, and natural gas, while investing in futures contracts in an attempt to track its index.

Future Looks Bright for Energy

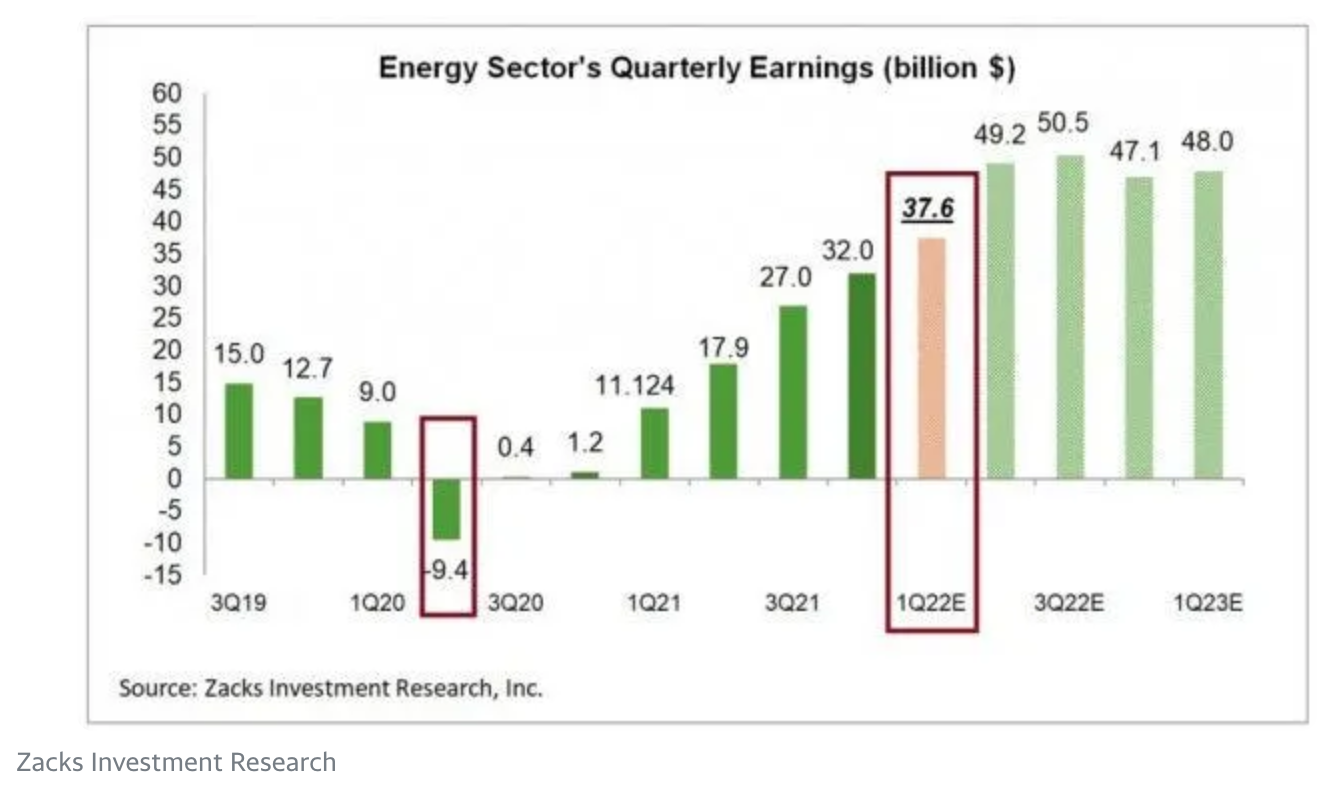

The question now is whether the energy sector can continue riding this momentous wave of strong earnings as energy prices continue to climb. It’s a far cry from when oil prices hit negative territory at the height of the pandemic — what a difference a year makes.

“Every type of business in the oil patch is thriving at the moment,” a Yahoo! Finance article says. “There is no surprise why these companies are enjoying the sunshine, given what’s been happening to oil and natural gas prices lately.”

“The pandemic was tough on the oil patch, with the immediate aftermath of Covid lockdowns pushing oil futures prices into negative territory,” the article adds. “But the rebound has been equally impressive. You can see this in the chart below that shows the Zacks Energy sector’s quarterly earnings in billion of dollars.”

The Fed will do what it can to try to temper inflation, but right now, momentum is on the side of energy. Unless fundamentals prove otherwise, it looks like energy’s strength could continue at least through the rest of the year.

For more news, information, and strategy, visit the Innovative ETFs Channel.