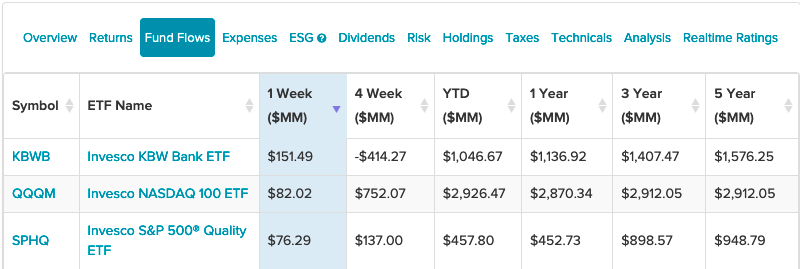

The Invesco KBW Bank ETF (KBWB) has been taking in the most fund flows within the past week, highlighting the recent strength in bank stocks.

With the Omicron variant slowly fading away into the background, inflation can now come to the forefront. The Federal Reserve is looking to taper its stimulus measures amid rising inflation, so interest rates are expected to rise in 2022.

“At the upcoming meeting, the Fed is expected to discuss speeding up the tapering of its bond purchases, which could open the door to rate hikes as soon as next year,” CNBC reports.

Banks, especially those that rely on lending products for their revenue, will see their profit margins expand as rates rise. In addition, increased spending by consumers could mean more loans taken out, translating into more revenue.

KBWD, which is up 37% year-to-date, seeks to track the investment results of the KBW Nasdaq Bank Index, which is a modified market capitalization-weighted index of companies primarily engaged in U.S. banking activities, as determined by the index provider. The underlying index is designed to track the performance of large national U.S. money centers, regional banks, and thrift institutions that are publicly traded in the U.S. “This ETF offers exposure to banks, delivering targeted exposure to a unique corner of the U.S. financials sector,” an ETF Database analysis suggests. “Given the narrow focus of KBWB, this fund might be most useful for investors looking to implement a shorter term tactical tilt towards this corner of the market, though it can certainly also be used as a complimentary holding in many long-term portfolios as well.”

“This ETF offers exposure to banks, delivering targeted exposure to a unique corner of the U.S. financials sector,” an ETF Database analysis suggests. “Given the narrow focus of KBWB, this fund might be most useful for investors looking to implement a shorter term tactical tilt towards this corner of the market, though it can certainly also be used as a complimentary holding in many long-term portfolios as well.”

Get Bank Exposure With a High-Dividend Component

Another option to play banks, but with a monthly fixed income component, is the Invesco KBW High Dividend Yield Financial Portfolio (KBWD). The fund carries a 30-day SEC yield of 8%.

KBWD seeks to track the investment results of the KBW Nasdaq Financial Sector Dividend Yield Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is a modified dividend yield-weighted index of companies principally engaged in the business of providing financial services and products, as determined by the index provider. The underlying index is designed to track the performance of financial companies with competitive dividend yields that are publicly traded in the U.S. For more news, information, and strategy, visit the Innovative ETFs Channel.

For more news, information, and strategy, visit the Innovative ETFs Channel.