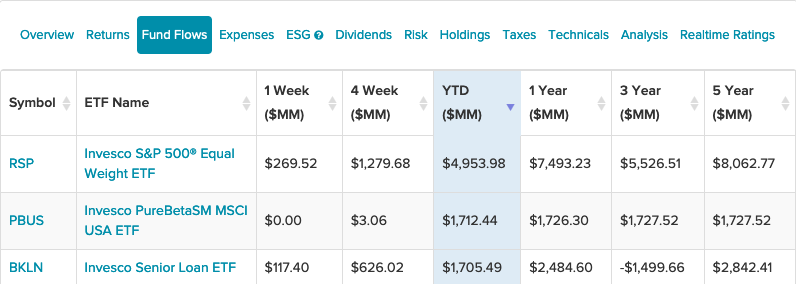

An equal weight strategy, pure beta play, and senior loan option are sitting atop Invesco’s year-to-date inflows leaderboard.

At the top of the heap is the Invesco S&P 500 Equal Weight ETF (RSP), which uses a strategy to diversify holdings in order to eliminate concentration risk. RSP equally weights its holdings, so the ETF leans toward smaller companies with reduced concentration risk when compared to the cap-weighted benchmark S&P 500 Index.

The size factor offers the potential higher-than-benchmark returns associated with relatively smaller stocks within the universe being considered. Furthermore, investors can get this equal weight strategy from RSP at a low 0.20% expense ratio.

“This ETF is linked to the S&P 500 Index, however its unique weighting methodology will make it useful for some, while impractical for active traders,” an ETF Database analysis said. “Like many Rydex products, RSP is linked to an equal-weighted index, meaning that component companies receive approximately equal allocations.”

Pure Beta Exposure

The second highest fund flows go to the Invesco PureBeta MSCI USA ETF (PBUS), which gives ETF investors a heavy emphasis on large cap equities and the ability to closely mirror the movements of the market. PBUS boasts the lowest expense ratio of the three ETFs at 0.04%.

Overall, PBUS seeks to track the investment results of the MSCI USA Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The index is designed to measure the performance of the large- and mid-capitalization segments of the U.S. equity market. Top holdings feature familiar big tech names like Apple, Microsoft, Amazon, Facebook, and Google.

Senior Loan Exposure

Investing in debt will always mean the possibility of a default. In this vein, senior loan investing can look especially attractive with ETFs like the Invesco Senior Loan ETF (BKLN).

BKLN seeks to track the investment results of the S&P/LSTA U.S. Leveraged Loan 100 Index. The Adviser and the fund’s sub-adviser define senior loans to include loans referred to as leveraged loans, bank loans, and/or floating rate loans.

Banks and other lending institutions generally issue senior loans to corporations, partnerships, or other entities. Senior loans are typically used for business recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s loan portfolio will include the purchase of loans from banks or other financial institutions through assignments or participations.

For more news and information, visit the Innovative ETFs Channel.