With his plan for clean energy initiatives, Democratic candidate Joe Biden could be a boon for certain exchange-traded funds (ETFs). As such, the sun could be shining on funds like the Invesco Solar ETF (TAN) should Biden’s bid for the U.S. presidency prove to be a successful one come November 3.

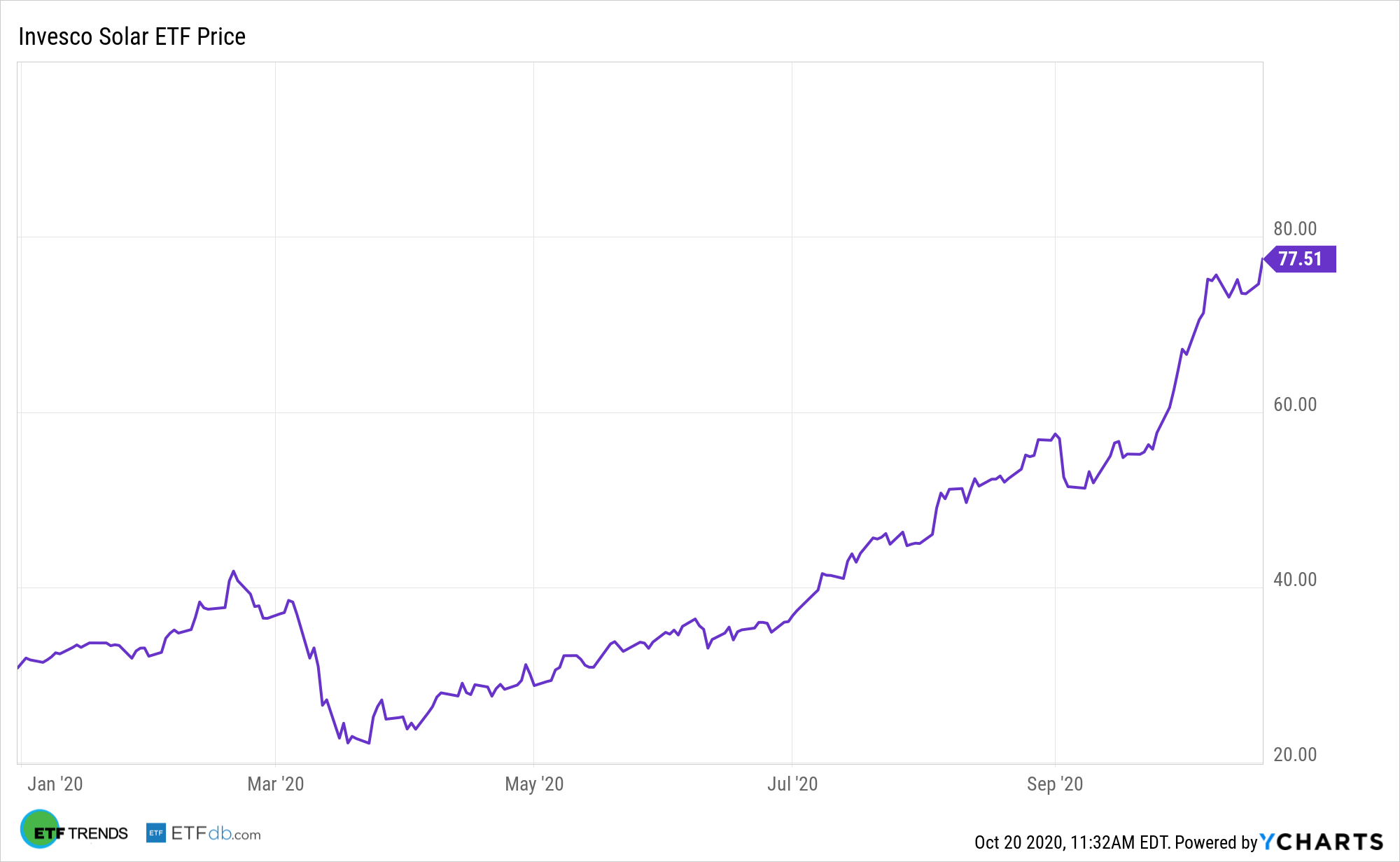

It’s not like TAN was already in the dark even before the election. The fund has been providing astronomical gains despite a challenging year for much of the capital markets in 2020 thanks to the Covid-19 pandemic.

According to a CNBC article, TAN “has become one of the market’s hottest exchange-traded funds, up almost 139% year to date and counting as former Vice President Joe Biden leads President Donald Trump in presidential election polls. Biden’s $2 trillion infrastructure plan, which would focus on promoting clean energy, has been a source of enthusiasm for investors anticipating a Biden victory come November.”

TAN, which started back in 2008, seeks to track the investment results of the MAC Global Solar Energy Index, which is designed to provide exposure to companies listed on exchanges in developed markets that derive a significant amount of their revenues from the following business segments of the solar industry: solar power equipment producers including ancillary or enabling products.

Here are additional funds to consider in the clean energy space:

- ALPS Clean Energy ETF (ACES): seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the CIBC Atlas Clean Energy Index. The underlying index utilizes a rules-based methodology developed by CIBC National Trust Company, which is designed to provide exposure to a diverse set of U.S. and Canadian companies involved in the clean energy sector including renewables and clean technology. The fund is non-diversified.

- KraneShares MSCI China Environment Index ETF (KGRN): seeks to provide investment results that correspond to the price and yield performance of MSCI China IMI Environment 10/40 Index. The underlying index is a modified, free float-adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies that derive at least a majority of their revenues from environmentally beneficial products and services, as determined by MSCI Inc.

- VanEck Vectors Low Carbon Energy ETF (SMOG): seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Global IndexSM (Extra Liquid). “Low carbon energy companies” refers to companies primarily engaged in alternative energy, including renewable energy, alternative fuels and related enabling technologies (such as advanced batteries).

For more market trends, visit ETF Trends.