Fixed income investors looking to get high yield exposure outside of the U.S. while limiting duration risk will want to consider the Invesco Global Short Term High Yield Bond ETF (PGHY).

PGHY offers investors the yield they desire in this current fixed income environment. While the Federal Reserve has been mum on whether it will raise rates, the common notion circulating the capital markets is that it will eventually have to shift its interest rate policy.

As per the fund description, PGHY seeks to track the investment results (before fees and expenses) of the DB Global Short Maturity High Yield Bond Index. The fund invests at least 80% of its total assets in securities that comprise the underlying index.

The underlying index is composed of bonds issued by corporations, as well as sovereign, sub-sovereign, or quasi-government entities that: are denominated in U.S. dollars; are rated below investment grade; have not been marked as defaulted by any rating agency; have three years or less to maturity; have a minimum amount outstanding of at least $250 million; and have a fixed coupon.

Sector and Country Allocations

When it comes to sector allocation, PGHY skews the toward financials. The financial sector, particularly banks, can certainly benefit in a rising-rate environment.

As rates rise, banks can earn more revenue on their loan-based products offered to consumers. This includes mortgage loans, personal loans, business loans, and other similar products.

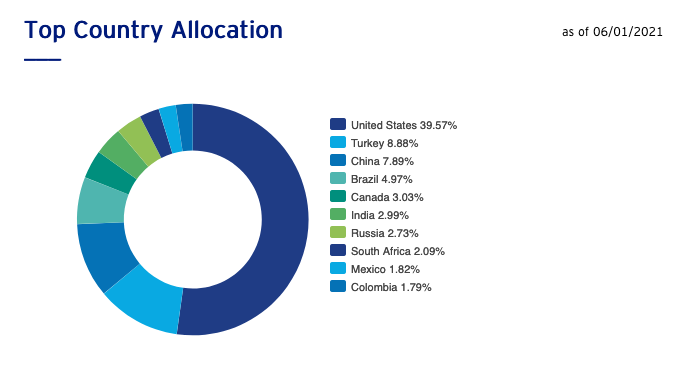

While investing in high yield certainly carries a higher degree of risk, particularly when venturing outside the U.S., PGHY still allocates 40% of its assets towards debt issued right here in the States.

Other assets are spread globally, and never exceed more than 9%. As of June 1, the next highest allocation is Turkey. China and Brazil follow.

For more news and information, visit the Innovative ETFs Channel.