ETF investors looking beyond broad small cap exposure can opt for a revenue-focused fund using the Invesco S&P SmallCap 600 Revenue ETF (RWJ).

For a 0.39% expense ratio, RWJ seeks to track the investment results of the S&P SmallCap 600® Revenue-Weighted Index. The fund will invest at least 90% of its total assets in the securities that comprise the index.

The index is designed to measure the performance of positive revenue-producing constituent securities of the S&P SmallCap 600® Index. The Parent index is comprised of common stocks of approximately 600 small-capitalization companies that generally represent the small cap universe of the U.S. equity market.

“This ETF offers exposure to small cap U.S. stocks, an asset class that is included in most long-term portfolios and can be useful for tactical traders looking to implement a tilt towards riskier securities,” an ETF Database analysis stated. “RWJ is one of dozens of options for small cap exposure through ETFs, distinguishing itself from the alternatives though the unique weighting methodology employed.”

The fund has been a stellar performer. RWJ is up 43% so far this year and 160% the past 12 months.

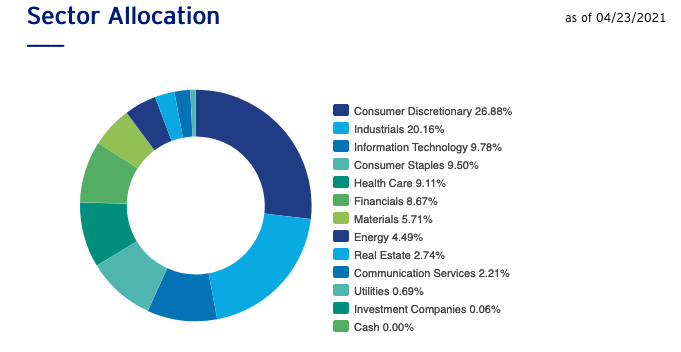

A Strategy Titled to Consumer Discretionary and Industrials

RWJ’s sector allocation is currently skewed towards consumer discretionary and industrials. However, the fund isn’t too heavy on one certain stock. Its top holding, United Natural Foods Inc, sits at just 3% of the fund’s assets.

“The related benchmark consists of all the stocks included in the S&P SmallCap 600, but determines the individual allocations based on top line revenue (as opposed to market capitalization),” the ETF Database analysis said further. “That methodology may be appealing for investors who see value in a strategy that shifts exposure towards companies with low price-to-sales multiples, and may also be appealing for those looking to utilize alternatives to market cap-weighting (which has a tendency to overweight overvalued stocks, and underweight undervalued companies).”

A Quality Small Cap Option

Another fund to consider for small cap exposure is the Invesco S&P SmallCap Quality ETF (XSHQ). XSHQ seeks to track the investment results of the S&P SmallCap 600® Quality Index.

The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. S&P DJI weights each component stock of the underlying index by the total of its quality score multiplied by its market capitalization; stocks with higher scores receive relatively greater weights.

For more news and information, visit the Innovative ETFs Channel.