After a lull in 2020 forced by the coronavirus pandemic, share repurchase activity among S&P 500 member firms is rebounding in significant fashion, and that could prove efficacious for buyback exchange traded funds, namely the Invesco BuyBack Achievers ETF (NASDAQ: PKW).

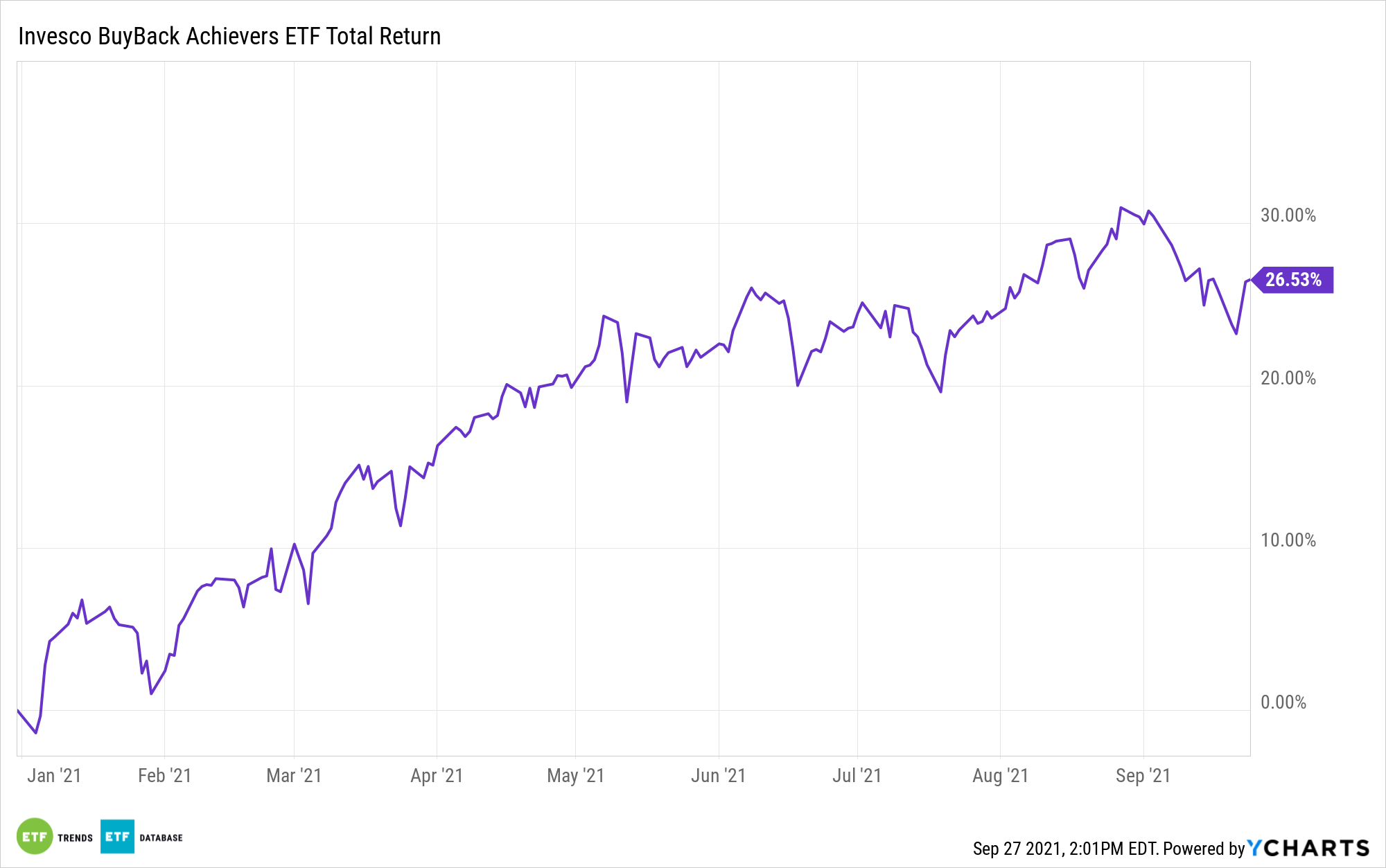

PKW, which tracks the NASDAQ US BuyBack Achievers™ Index, is up an impressive 26.53% year-to-date, beating the S&P 500 by more than 700 basis points. That’s a strong indication that PKW is responding to rebounding buyback activity.

“Q2 2021 share repurchases were $198.8 billion, increasing 11.6% from Q1 2021’s $178.1 billion expenditure, and up 124.3% from Q2 2020’s recent low of $88.7 billion,” according to S&P Dow Jones Indices. “294 companies reported buybacks of at least $5 million for the quarter, down from 335 in Q1 2021, and up from 170 in Q2 2020; 360 issues did some buybacks for the quarter, compared to 289 in Q2 2020.”

The NASDAQ US BuyBack Achievers Index rebalances in January, April, July, and October and mandates that member firms reduced shares outstanding counts by at least 5% over the trailing 12 months. Those are relevant requirements because buyback activity remains dominated by the largest repurchasers.

“Buybacks remained top heavy with the top 20 issues accounting for 55.7% of Q2 2021 buybacks, up from Q1 2021’s 53.3%, down from the dominating 87.2% in Q2 2020, and up from the pre-COVID historical average of 44.5%,” notes S&P Dow Jones.

In the second quarter, the top five companies in terms of buyback activity were Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOG), Facebook (NASDAQ:FB), Oracle (NYSE:ORCL), and Microsoft (NASDAQ:MSFT). Oracle accounts for 5.83% of PKW’s weight.

“Information Technology continued to lead and dominate in buybacks. In Q2 2021, IT’s share was flat at 31.6% of all S&P 500 buybacks compared to Q1 2021, and was down from Q2 2020’s 41.6%, as expenditures increased (11.4%) to $62.8 billion from the prior quarter’s $56.4 billion and was 70.1% higher than the Q2 2020 expenditure of $36.9 billion,” adds S&P Dow Jones.

Financial services has been another hotbed of buyback activity with that sector spending $41.8 billion on repurchases in the June quarter, up 18.1% from the first quarter while accounting for 21% of all buybacks. Financial services and technology stocks combine for over 55% of PKW’s weight. Healthcare and consumer discretionary names combine for almost 24%.

For more news, information, and strategy, visit the Innovative ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.