Semiconductor ETFs have provided attractive returns for investors in 2023.

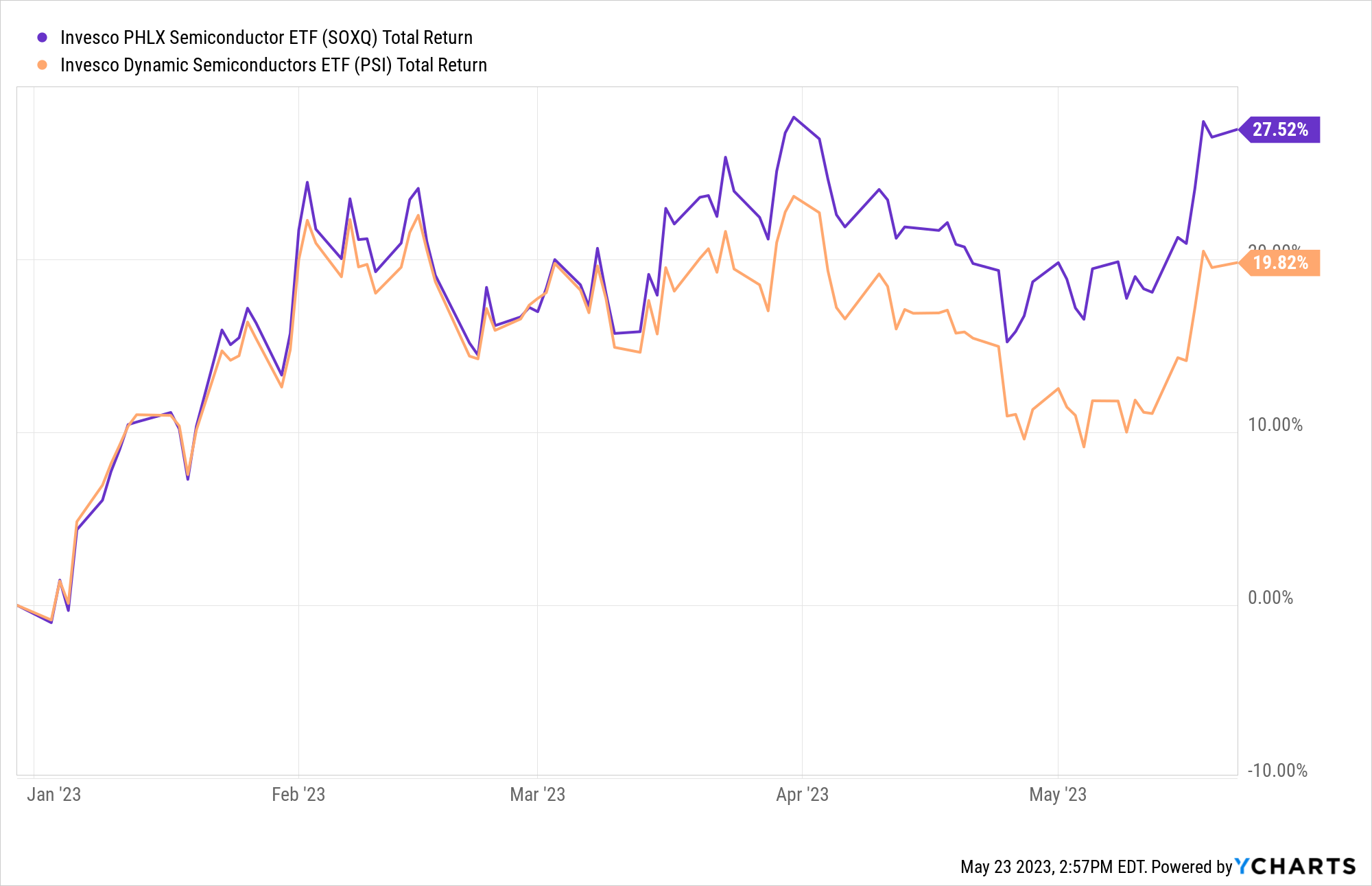

The Invesco PHLX Semiconductor ETF (SOXQ) and the Invesco Dynamic Semiconductors ETF (PSI) have climbed 27.5% and 19.8% year to date, respectively. Over one month, SOXQ has climbed 6.5% and PSI has increased 3.8%.

Semiconductor stocks are an essential part of electronic devices, positioning them for long-term demand. Semiconductors are essential for advances in communications, computing, healthcare, military systems, transportation, and clean energy.

Semiconductor ETFs Performance YTD

See more: “PBE Offers Exposure to Surging Catalent Stock”

Despite near-term uncertainty in the technology sector, semiconductor ETFs are likely to continue to benefit from newer innovations in technology like electric vehicles and artificial intelligence — especially as AI like ChatGPT dominates headlines, VettaFi’s associate director of research Roxanna Islam wrote in March.

Comparing the 2 Semiconductor ETFs

SOXQ is based on the PHLX Semiconductor Sector Index. The index measures the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business. Semiconductors include products such as memory chips, microprocessors, integrated circuits, and related equipment that serve a wide variety of purposes in various types of electronics, including personal household products, automobiles, and computers, among others.

SOXQ charges 19 basis points and has $111 million in assets under management.

See more: “Multi-Factor ETF OMFL Outpaces Benchmarks YTD”

PSI is based on the Dynamic Semiconductor Intellidex℠ Index, The index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action, and value. The index comprises 30 U.S. semiconductors companies.

PSI has accreted $536 million in assets since its inception in 2005. The pricier of the two semiconductor ETFs, PSI charges 56 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.