Safe haven government debt yields have been on the rise. In order to extract maximum yield, fixed income investors can look at longer duration debt via ETFs like the Invesco BulletShares 2030 Corporate Bond ETF (BSCU).

“The sensitivity of US corporate bonds to a rise in interest rates is near record levels, just as higher growth and inflation are expected to return in coming months as the nation’s coronavirus-hit economy recovers,” a Financial Times article noted. “Duration, which captures the expected time it will take for the price of the debt to be repaid in total cash flow, has been on an upward march for a couple of years. The rise has been driven by a rush of companies issuing longer-maturity debt at a time when borrowing costs are low.”

BSCU seeks to track the investment results of the Nasdaq BulletShares® USD Corporate Bond 2030 Index, which seeks to measure the performance of a portfolio of U.S. dollar-denominated investment grade corporate bonds with maturities or, in some cases, ‘effective maturities’ in the year 2030. It does not purchase all of the securities in the index; instead, the fund utilizes a ‘sampling’ methodology to seek to achieve its investment objective.

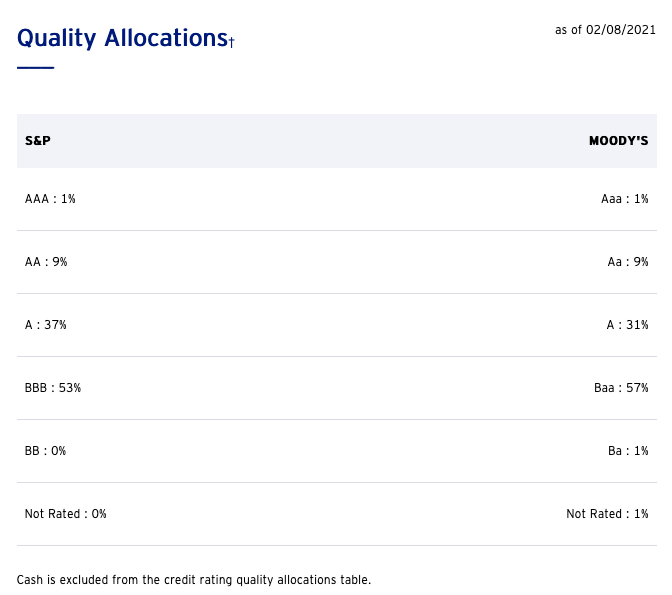

At a 0.10% expense ratio, BSCU is seven basis points below the category average. The fund invests in a variety of investment-grade bonds with most debt issues rated at A and BBB.

Go Long For Higher Yields

BSCU can be used as part of a bond laddering strategy through Invesco’s Bulletshares suite of ETFs with various maturity dates. Or, the fund can be used for standalone exposure to long duration corporate bonds, which have been the go-to for fixed income investors in recent times.

“The average duration for investment-grade corporate bonds now stands at 8.3 years, according to data from ICE Data Services, up from 7.7 years at the start of 2020 and just 6.5 years a decade ago,” the FT article said. “The shift heightens the risk that a rise in Treasury yields — a more pressing possibility in an economic recovery — will prompt a sell-off in corporate debt markets.”

“Nonetheless, yield-starved investors continue to lap up longer-dated bonds that are most in danger if rates do start to climb,” the FT article continued. The longer the exposure, the more susceptible bond investors will be to interest rate changes.

“It’s kinda wacky,” said Jim Shepard, who runs investment-grade bond issuance at Mizuho in New York. “At a time when you would want greater insurance against a rise in interest rates, you are buying something more exposed to it.”

For more news and information, visit the Innovative ETFs Channel.