When volatility is blaring in investors’ ears, it can be difficult to ignore. Low volatility ETF like the Invesco S&P 500 Low Volatility ETF (SPLV) can help.

Growth-fueled investments have been basking in the sun of a decade-long bull run. Now, low volatility factors like value are making a comeback, which is ideal in an economy that’s undergoing the healing process.

“But value and cyclical stocks tend to shine in economic recovery environments,” an article in The Street said. “That’s what the markets have been anticipating over the past few months as these three groups have transformed from laggards into leaders. If the post-COVID rebound can continue throughout the rest of 2021, low volatility ETFs may be poised to shine again.”

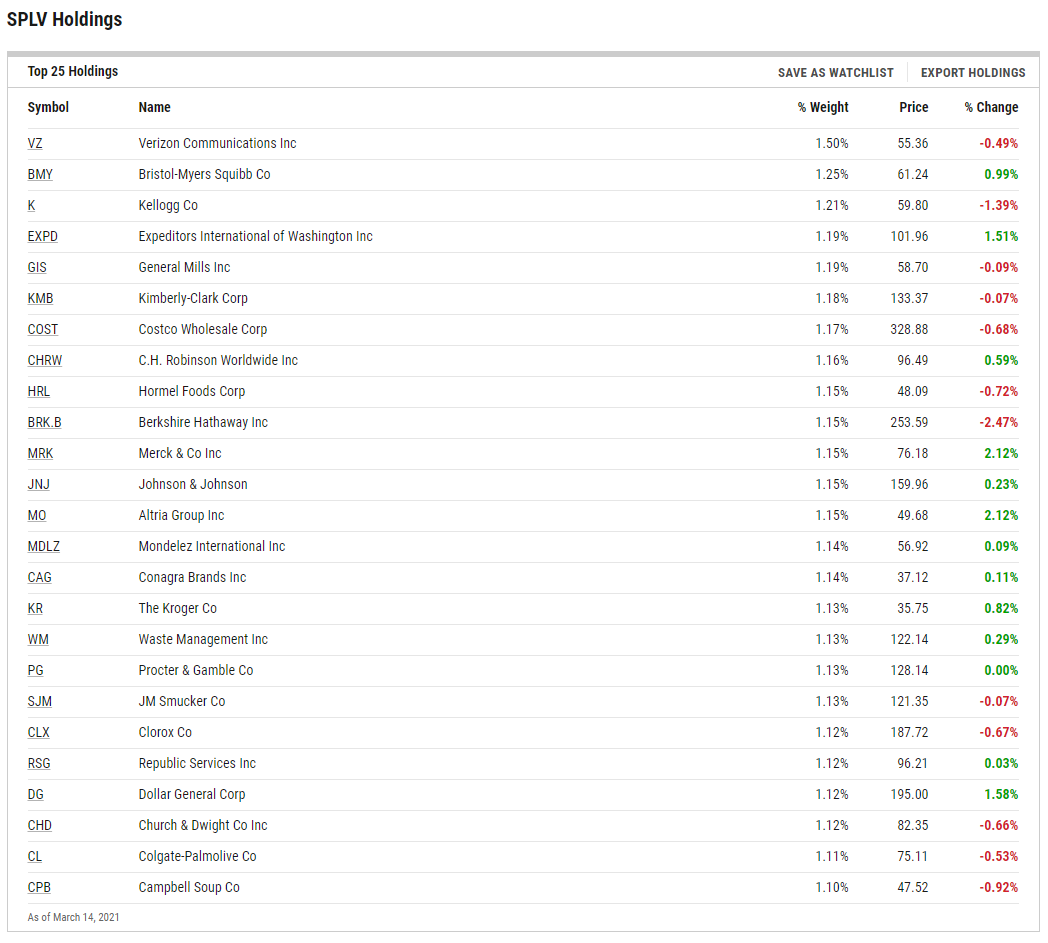

SPLV seeks to invest at least 90% of its total assets in common stocks that comprise the Index. The index is compiled, maintained, and calculated by Standard and Poor’s and consists of the 100 stocks from the SP 500 Index with the lowest realized volatility over the past 12 months.

Volatility is a statistical measurement of the magnitude of up-and-down asset price fluctuations over time. The fund and the index are re-balanced and reconstituted quarterly in February, May, August, and November.

Low Volatility for the Win

While SPLV may not capture as much upside compared to some other high beta funds, it’s still ideal for investors who don’t have the stomach for major market moves. Allocations in SPLV’s portfolio don’t exceed 1.5%, so it’s never overweight in one stock.

“The fund is probably one of the safest in the equity world as the companies on this list are very unlikely to go under unless there is an apocalyptic event in the economy,” ETF Database analysis duly noted. “However, these securities are unlikely to grow very much either as they are already pretty large and have probably seen their quickest growing days in years past, but most do pay out solid dividends which should help to ease the pain of this realization. Thanks to this, the fund could be a better choice for those looking for more stability in their portfolio without such big daily moves.”

For more news and information, visit the Innovative ETFs Channel.