Aluminum prices have risen to more highs this week thanks to a confluence of factors, mainly related to China’s move to limit pollution. This bodes well for an Invesco base metals ETF.

“Aluminium prices climbed towards 13-year highs on Monday, boosted by strong demand and large shortages created by China imposing production curbs on high-polluting industries such as smelting to cut power use and emissions,” according to a Reuters report. “Benchmark aluminium on the London Metal Exchange (LME) traded 2.1% up at $2,917 a tonne by 1558 GMT. Prices of the metal used in the transport and packaging industries last month hit $3,000 a tonne for its highest since July 2008.”

Adding aluminum as a diversifying commodity to a portfolio could also serve as an inflation hedge. The Federal Reserve has already acknowledged that inflation is present as the economy starts to overheat from a pandemic recovery.

In the meantime, economic fundamentals of scarcity in China can continue to fuel the base metal’s rising prices. The more China demands aluminum — and the more it is difficult to find — translates to gains for aluminum traders.

“Headwinds to China’s demand have been pronounced year-to-date over car production, construction activity and more recently tight power markets,” said BoA Securities analyst Michael Widmer. “The fundamental backdrop may remain subdued until auto, property and power issues normalise, although this may not happen until 2022.”

A Base Metals ETF to Consider

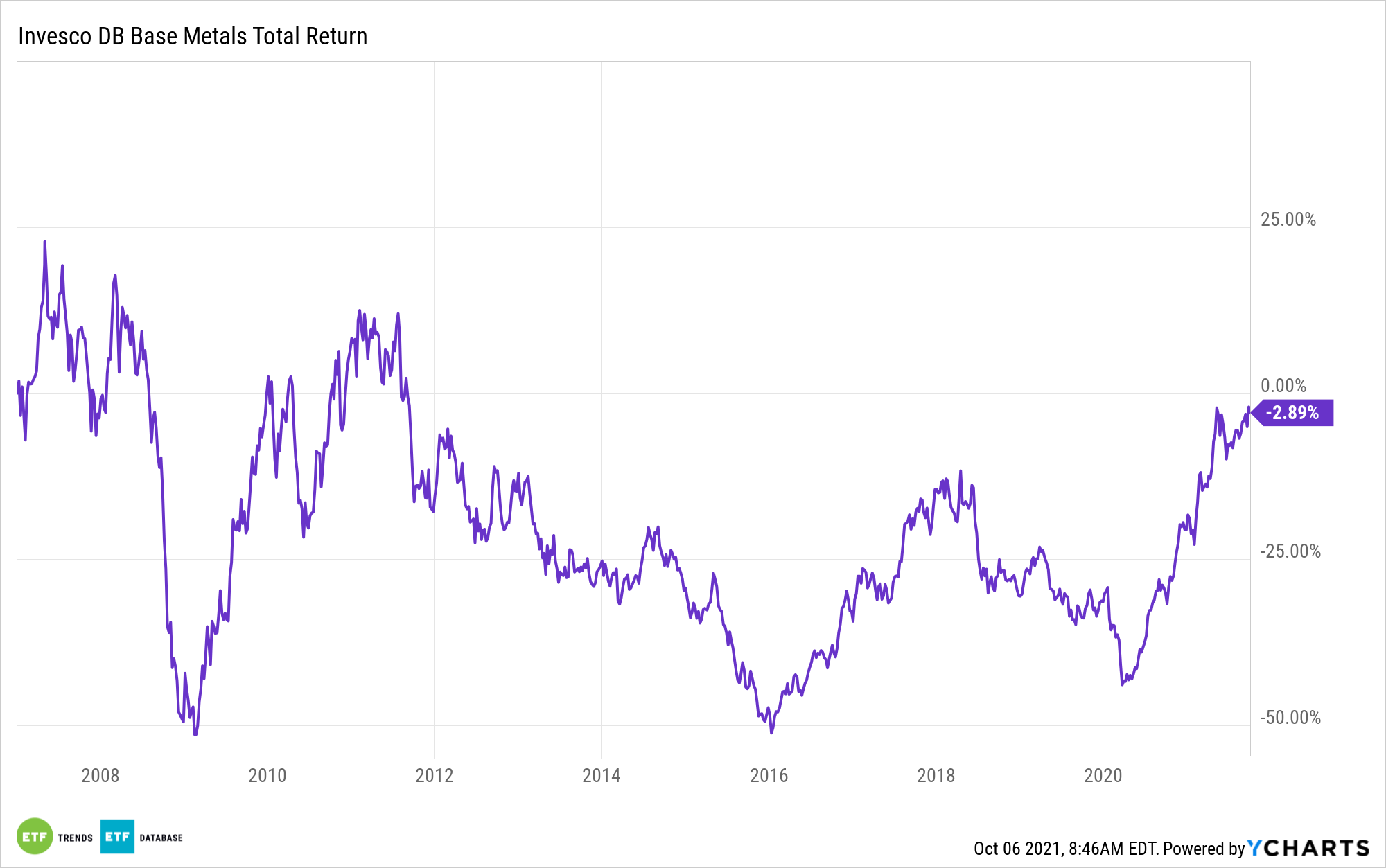

One ETF to get in on the action of rising aluminum prices is the Invesco DB Base Metals Fund (DBB). As of October 4, over 40% of the fund was comprised of aluminum futures.

The ETF seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return (DBIQ Opt Yield Industrial Metals Index ER) plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income less the fund’s expenses. According to Morningstar performance numbers, the ETF is up 22% for the year.

The fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The index is a rules-based index composed of futures contracts on some of the most liquid and widely used base metals — aluminum, zinc, and copper (grade A). You cannot invest directly in the index. The fund and the index are rebalanced and reconstituted annually in November.

For more news, information, and strategy, visit the Innovative ETFs Channel.