The global economic recovery could be happening at a slower rate than anticipated, which puts low growth strategies and three exchange traded funds (ETFs) from Invesco in focus.

Investors who are skeptical about the recovery can opt for low growth ETF strategies from Invesco that focus on quality. This suite encompasses equities and bond exposure to help balance a portfolio in today’s market environment.

Per a Wall Street Journal article, “Widespread business reopenings, rising vaccination rates and a big infusion of government pandemic aid this spring helped propel rapid gains in consumer spending—the economy’s main driver. But that burst of economic growth is starting to slow, economists say.”

“We’ve moved into the more moderate phase of expansion,” said Ellen Zentner, chief U.S. economist at Morgan Stanley. “We’re past the peak for growth, but that doesn’t mean something more sinister is going on here and that we’re poised to then drop off sharply.”

Equities Exposure

For general equities exposure, there’s the Invesco S&P 500 Quality ETF (SPHQ). The fund seeks to track the investment results of the S&P 500 Quality Index. In selecting constituent securities for the underlying index, the index provider calculates the quality score of each security in the S&P 500 Index, then selects the 100 stocks with the highest quality score for inclusion in the underlying index.

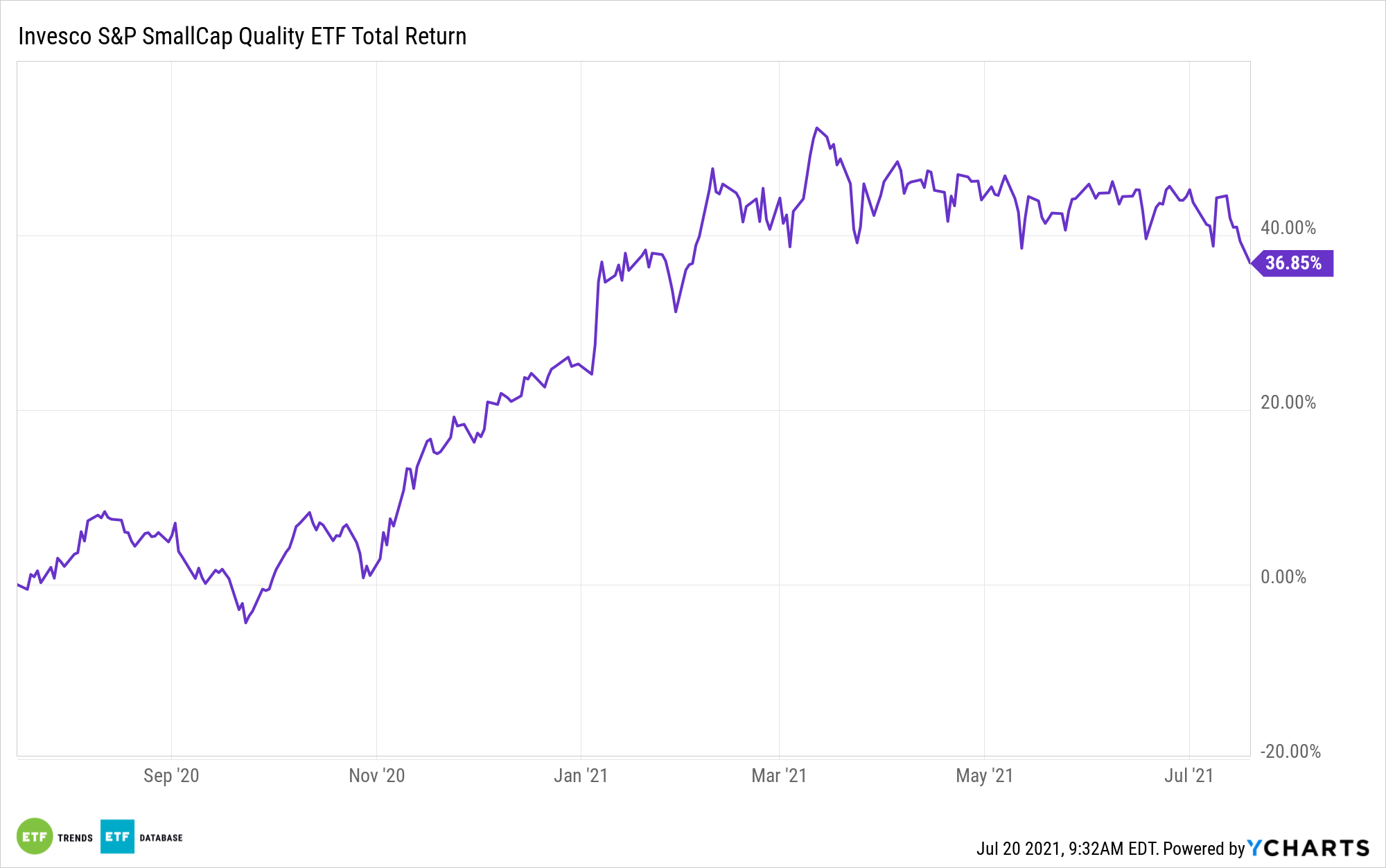

Additionally, small cap growth exposure is available with the Invesco S&P SmallCap Quality ETF (XSHQ). XSHQ seeks to track the investment results of the S&P SmallCap 600® Quality Index.

The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. S&P DJI weights each component stock of the underlying index by the total of its quality score multiplied by its market capitalization; stocks with higher scores receive relatively greater weights.

Bond Exposure

Investors can also add bond exposure with the Invesco Taxable Municipal Bond ETF (BAB). Getting taxable municipal bonds might seem counterintuitive given that one of the main reasons investors gravitate to munis is because of their tax advantages.

However, investors can also get higher yield in lieu of these tax benefits. BAB seeks to track the investment results of the ICE BofAML US Taxable Municipal Securities Plus Index. ICE Data Indices, LLC, oversees the underlying index, which is designed to measure the performance of U.S. dollar-denominated taxable municipal debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. market.

For more news and information, visit the Innovative ETFs Channel.