Global rates are starting to rise, making short-term bond exposure a necessity with ETFs like the Invesco Global Short Term High Yield Bond ETF (PGHY).

While global inflation remains a threat, there’s also the ongoing pandemic. The Omicron variant continues to introduce a wild card to the capital markets.

“I think it is also important to keep in mind that that omicron-related risk is probably two-sided, at least as it is reflected in our core objective, our ambition in terms of the inflation outlook over the medium term,” said Bank of England’s chief economist Huw Pill. “We have some homework to do in seeing how the omicron variant impacts both public health and the developments in the U.K. economy, but also cautiously interpreting how those things influence what has to be the thing that we focus on, and the thing that we can best influence, which is the medium-term inflation outlook.”

Central banks are having to contend with the rising COVID cases while still raising rates through improving economies. It’s a fine line for central banks to walk, given the current economic environment.

“While the Bank still expects inflation to get back to target in the medium term, action now maximises their chances of meeting their mandate in two to three years’ time,” writes Jim Reid, global head of fundamental credit strategy and thematic research at Deutsche Bank, in a note.

“Indeed, inflation risks are mounting. Pay awards are already drifting up. Inflation expectations are also slowly moving. And the risk of further disruptions to global supply chains is on the rise, with the spread of Omicron threatening to temporarily derail the global recovery.”

Counteracting Inflation With More Yield

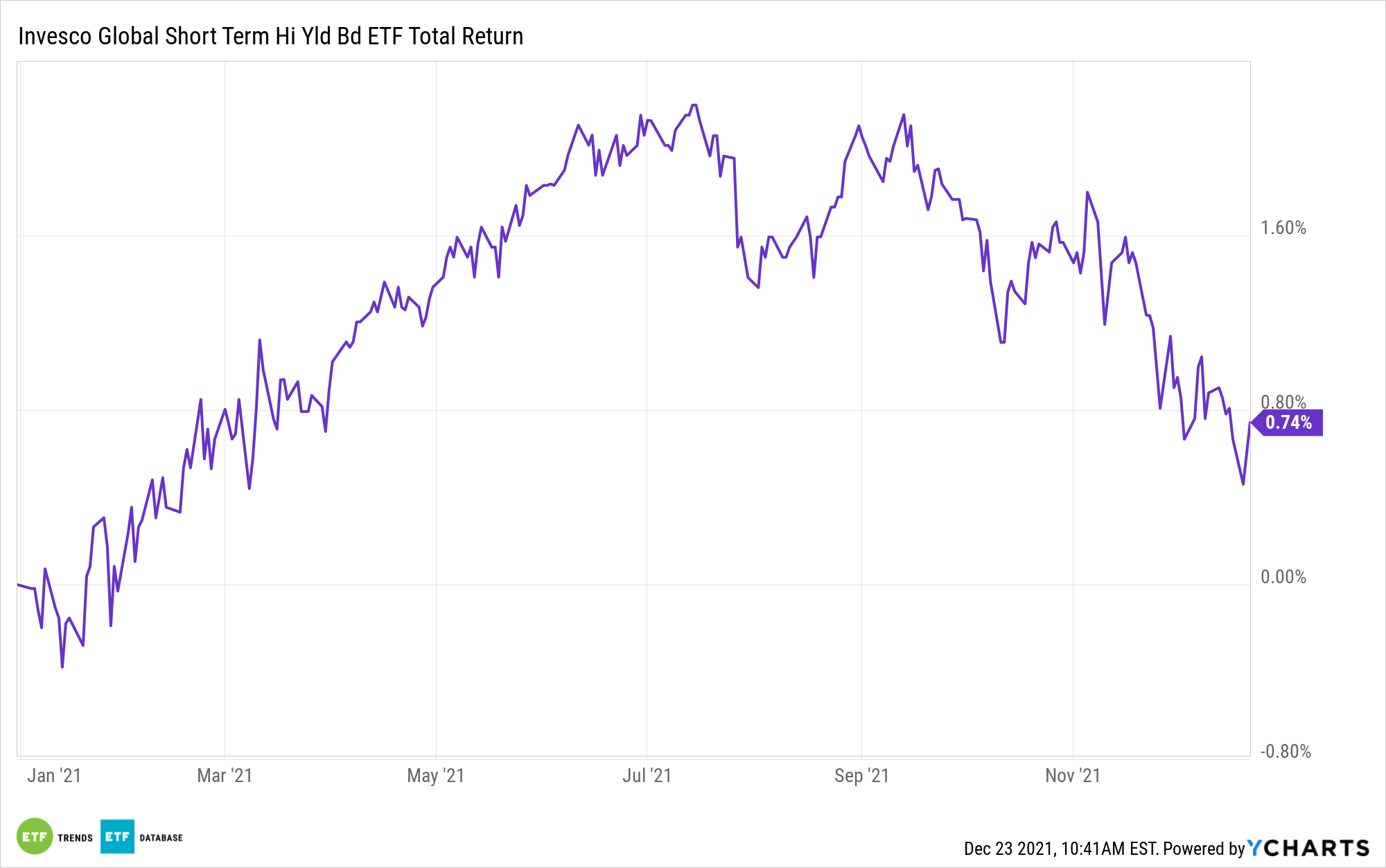

PGHY offers investors the yield they desire in this current fixed income environment. With global yields still relatively low despite central banks around the world looking to raise rates in 2022, PGHY provides that yield to counteract inflation.

As per the fund description, PGHY seeks to track the investment results (before fees and expenses) of the DB Global Short Maturity High Yield Bond Index. The fund invests at least 80% of its total assets in securities that comprise the underlying index.

The underlying index is composed of bonds issued by corporations, as well as sovereign, sub-sovereign, or quasi-government entities that are denominated in U.S. dollars, are rated below investment-grade, have not been marked as defaulted by any rating agency, have three years or less to maturity, have a minimum amount outstanding of at least $250 million, and have a fixed coupon.

For more news, information, and strategy, visit the Innovative ETFs Channel.